Strong signs from the Federal Reserve of a near interest rate cut for the first time in a decade have strongly weakened the US dollar, and were an opportunity for the yellow metal to go upwards towards the $1427 resistance, and therefore, it went back to the range of highest levels in 6 years. The recent bearish correction sessions for gold had pushed the prices towards the $1386 support level during Tuesday’s session. With this announcement, we recommended buying gold.

The comments of the Fed’s Chair Jerome Powell at his testimony before the congress reflected what was in the Fed’s last minutes of meeting that many members believe the motives for lowering interest rates have strengthen. The minutes of meeting suggested that all almost all members reviewed their evaluation to the correct path for the rates based on the global developments which led to more doubts around the economic expectations.

"Many considered that an additional policy of adjustment in monetary policy would be adopted in the near term if these recent developments and the impact on the economic outlook were confirmed," the Fed said. Thus, market expectations increased to 100% that the bank will cut the US interest rate during its meeting this month.

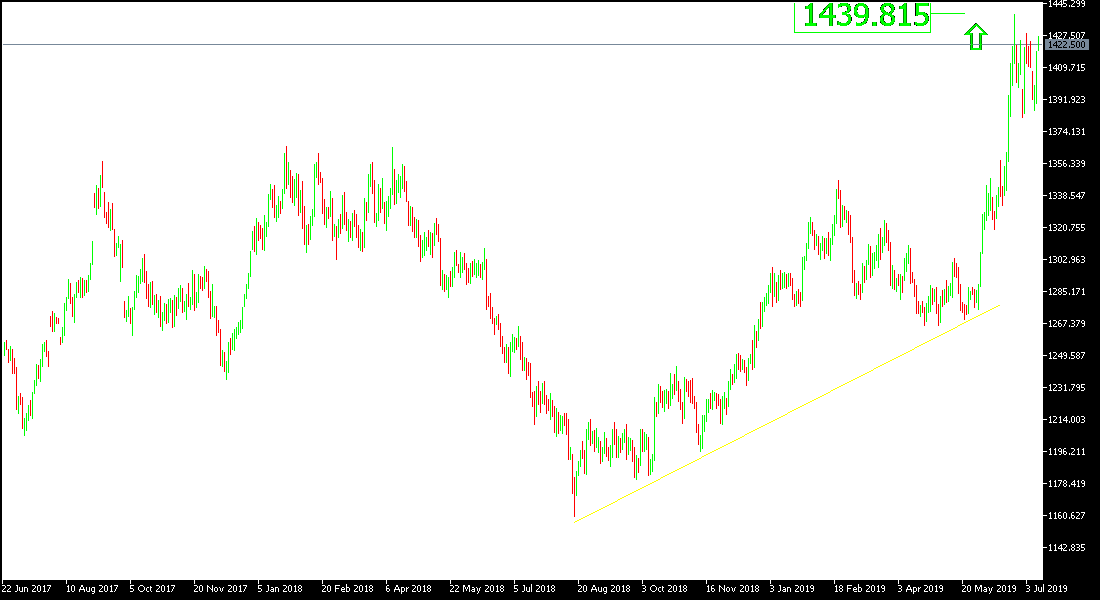

The price of gold is stable within its bullish channel as shown on the daily chart below. Stability around and above the $ 1400 psychological resistance still supports the strategy of buying from each bearish level. The factors supporting gold gains remain standing, topped by rising global geopolitical and trade tensions, even after optimism of renewed US-China negotiations to end the world's biggest trade dispute that threatens global economic growth.

In recent technical analysis, we have confirmed that US interest rate signals will support the decline of the US dollar and hence further gains in gold.

Technically: Gold prices today are still trying to hold the $1400 psychological summit, which supports the strength of the uptrend. Stability above that peak will make the nearest resistance levels at 1415, 1428 and 1440 respectively, which supports the strength of the upward trend. On the downside, the nearest support levels for gold today are 1410, 1395 and 1375, respectively. We still prefer to buy gold from every bearish level.

On the economic data front, gold will monitor the performance of the US dollar after the announcement of the US consumer price index and what will be seen in the testimony of Federal Reserve Chair Jerome Powell before the US Senate.