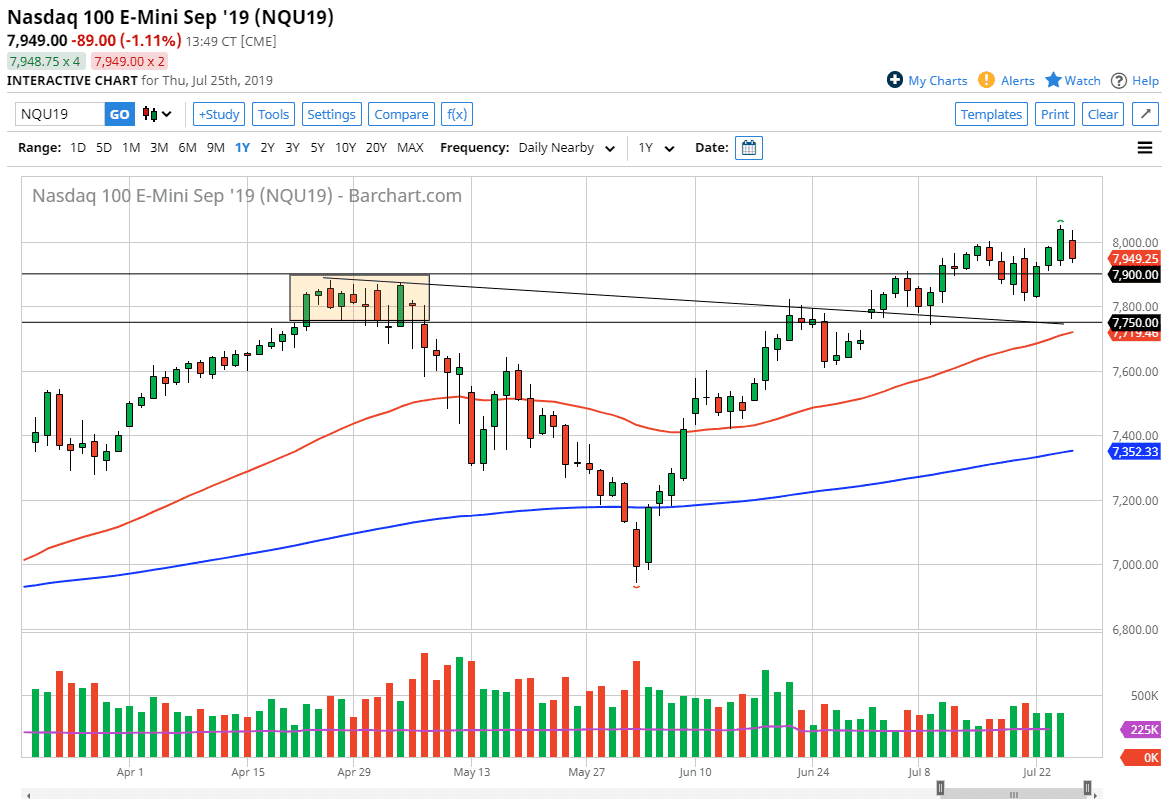

The NASDAQ 100 has tried to rally during the trading session on Thursday but then gave back quite a bit of the gains. Ultimately though, we are still in a range, and therefore I think we are going to continue to stay in that range. The 7900 level underneath is going to be massive support, so if we were to break down below there I think it opens up a little bit more selling down to the 7800 level. The downtrend line of course crosses in that area, and it’s also a scene of a gap at the 7750 handle.

Ultimately, I think that short-term pullbacks will be buying opportunities based upon value but I don’t think we should be putting too much money into the market ahead of the weekend as a lot of traders will be looking to get rid of risk. Ultimately, this is a market that is in the midst of her earnings season for some of the biggest technology giants, and of course is the recent Department of Justice investigation into several of the main players, so expect trouble.

I do believe that eventually we will get used to the 8000 handle, just as the S&P 500 is testing the 3000 level. Eventually both of these markets find plenty of comfort in this area, and then leave them behind. This is, it just like any other stock market indices in the United States, a function of what the Federal Reserve is going to do.

As long as they look likely to cut rates and continue to do so, it’s very likely that the NASDAQ 100 will roll right along with the S&P 500 to the upside. Obviously, we are in a massive long-term uptrend, so there’s no need to think about selling and I do look at dips as value. That being said, we probably have more grinding to do over the next several days before we can get past earnings season and perhaps begin a larger move. If we were to break down below the 7750 handle, and the 50 day EMA, then it could flesh this market lower, perhaps ending the uptrend. At this point, this is a “long only market”, and therefore I’m not looking to fight the momentum as the market has been littered with the bodies of people who got cute and tried to short this market.