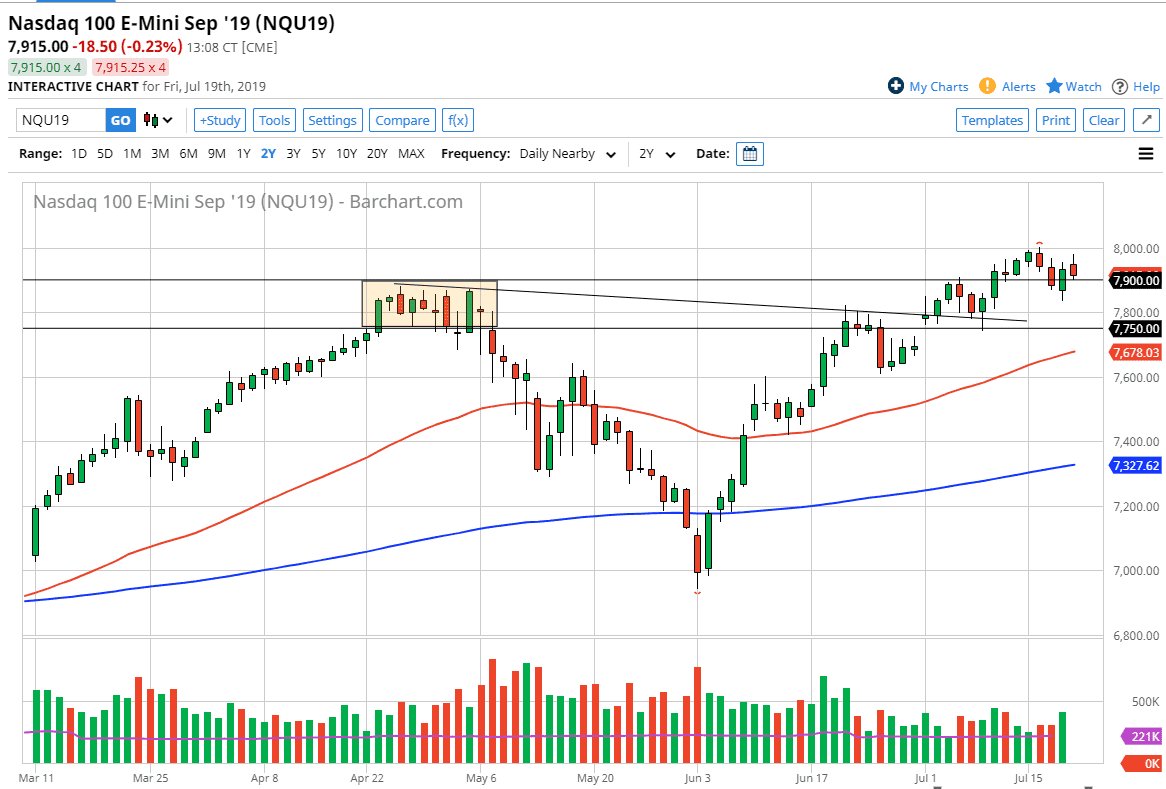

The NASDAQ hundred initially tried to rally during the trading session on Friday, but then turned around to fall towards the large, round, psychologically significant figure of the 7900 level. That’s an area that should of course cause a bit of support. I think at this point even if we break down through there, we could probably have plenty of support down at the 7800 level. At this point, the market has been strong, but ultimately we are in an upward channel more than anything else. I like the idea of buying pullbacks that show signs of resiliency.

The NASDAQ 100 is of course very sensitive to the US/China trade situation, as there are so many large tech companies attached to it. I think at this point though the one thing you should pay attention to is the overall trend, which of course is very bullish. The 50 day EMA is curling higher and should continue to offer support as well. That moving average is starting to curl towards the 7750 handle, so I think at this point that’s probably going to be a short-term “floor.” I do think that it’s only a matter time before the buyers return and try to push this market higher.

In fact, one of the major reasons we have not broken out to the upside is that we did not clear the 8000 handle. The large, round, psychologically significant figure is of course something that’s difficult to overcome. If we can break above that level, it would free more money into the market and send plenty of buyers to the upside. I think that breaking above the 8000 handle will be one of those situations where buyers come in and celebrate a bit. The alternate scenario of course is that we break down below the 50 day EMA, and that could open this market to reach down towards the 7600 level. That’s an area where I expect to see support, but I think it would be somewhat short-lived. Below there, the next move would be to the 7400 level as the 200 day EMA is an area that should offer support as well. Ultimately, the market looks as if it is ~to the upside and there’s no reason to fight that overall attitude. I buy dips and breakouts above that crucial level of 8000 above.