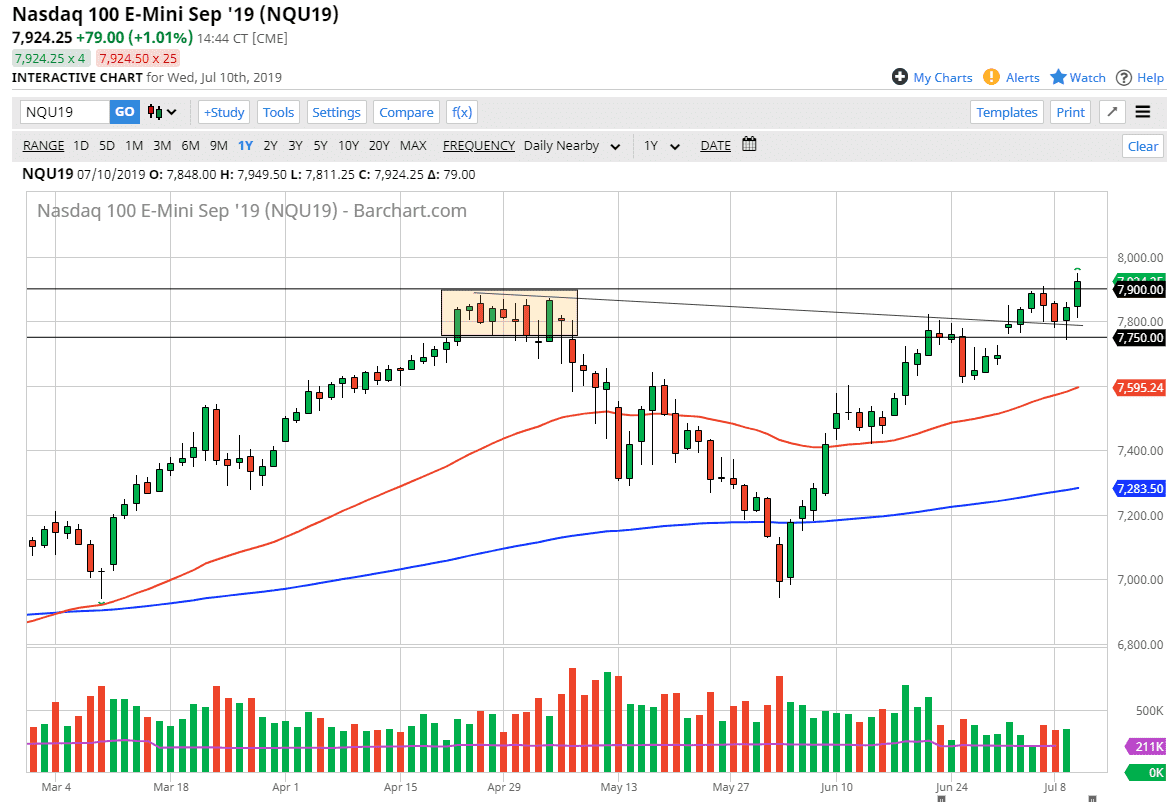

The NASDAQ 100 initially pulled back a bit during the Wednesday trading session, testing the 7800 level. The market then rallied significantly and reach above the 7900 level. Ultimately, we have broken to a fresh, new high, and therefore it’s likely that we are going to go to the 8000 level given enough time. This is a market that has been strong for a while now, and the fact that the market has broken out suggests to me that we have further real estate to cover.

Looking at the chart, you can look at the smaller time frames to figure out that the opening statement the Humphrey Hawkins testimony was crucial in turning stock markets higher. Short-term pullbacks should continue to be buying opportunities, and I think that it’s only a matter of time before we break out and reach towards higher levels. We have recently tested the downtrend line for support and found it, and that was reiterated during trading on Wednesday. Beyond that, there is a nice gap underneath that should continue to offer support as well so I think that the NASDAQ 100 is ready to go higher over the longer-term. Ultimately, short-term pullbacks will continue to be looked at as value.

If we were to break down below the gap underneath, the market could then break down to the 50 day EMA which is pictured in red. The 7600 level would obviously be the next target but I think at this point it’s obvious that equities in the United States are going to continue to rally based upon cheap money coming out of the Federal Reserve. With that in mind I am bullish on the occasional pullback and recognize that this is a market that simply cannot be sold anytime soon. It looks as if the Federal Reserve is going to make sure that it keeps equity markets rallying, so this brings to the old statement “you can’t fight the Fed.” The market seems like it’s on the verge of a huge move, the only question of course is which one of the indices moves first. Keep an eye on both the NASDAQ 100 and the S&P 500, as they will typically move in the same direction over the longer-term. Both indices look very bullish right now, so it’s very unlikely that we get a significant selloff of any stature. 8000 will cause a certain amount of psychological resistance, but in the end that’s all it is.