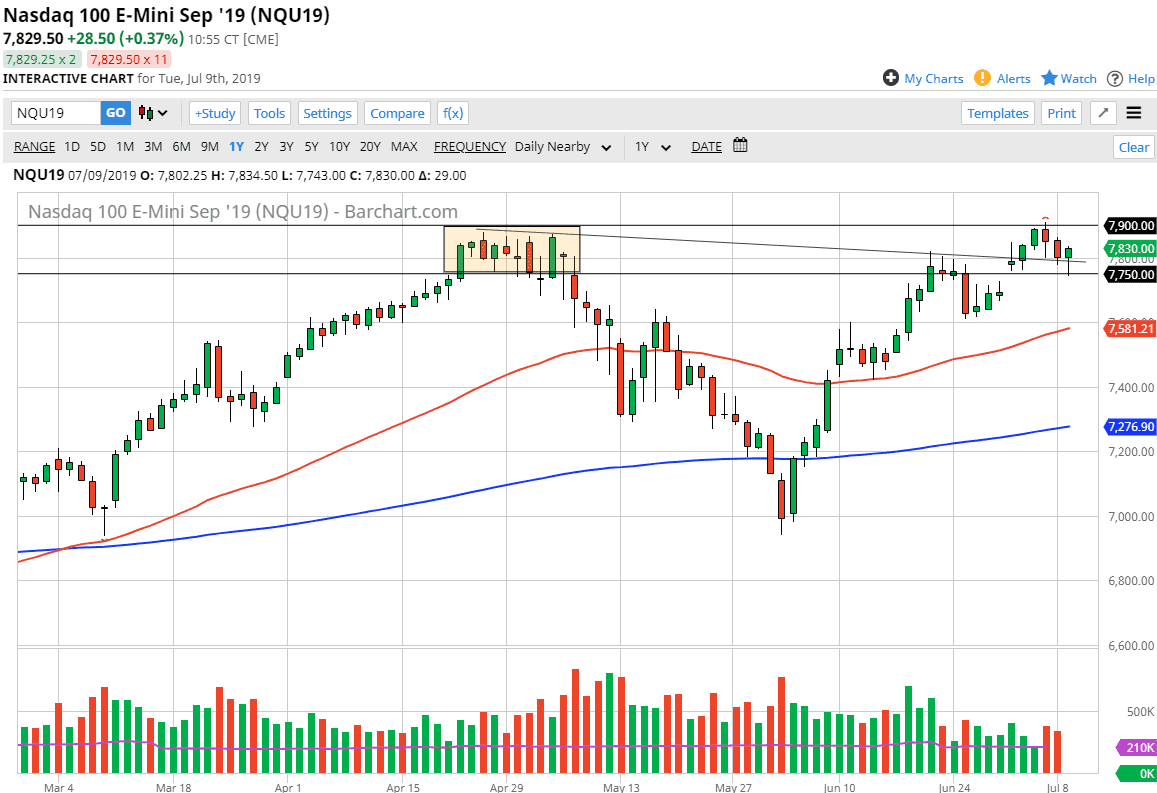

The NASDAQ 100 fell initially during trading on Tuesday, reaching down to the 7750 level before turning back around and rallying quite nicely. This of course is an area that featured a gap lately, and of course a downtrend line that I have marked on the chart. With that being the case it’s likely that the NASDAQ 100 is going to try to lead the way higher but we have a minefield of potential trouble just ahead.

During the Wednesday and the Thursday session, we have the Federal Reserve Chairman Jerome Powell testifying in front of Congress. That of course will move markets quite drastically as it gives you an idea as to whether or not the Federal Reserve is going to be dovish, altered dovish, or completely disappoint the market. The more dovish Jerome Powell is, the higher stock markets will go, it’s quite that simple at this point as all Wall Street cares about as cheap money. Don’t get fooled: stock markets have nothing to do with the economy anymore and haven’t for 12 years.

That being the case, we look for support underneath that places like the gap, and if we were to break down below that gap it could be a rather negative side. Keep in mind that we only tested the top of the gap, so that would be below 7700. All things being equal though, this does look like a very bullish candle stick, and we will probably eventually go looking towards the 7900 level. A break above there opens the door to the 8000 handle, which would of course be a fresh new high.

If we were to break down below the gap though, we will probably go looking for support at the 50 day EMA which is currently trading just below the 7600 level. That seems less likely, because quite frankly stock markets have been extraordinarily bullish, and even as we await what could be major news, the reality is that we are still comfortably bullish in general. Buying dips has worked for quite some time, and probably will continue to be the case in this marketplace. I have no interest in shorting, at least not until we break down below the 50 day EMA which of course would change the longer-term outlook for the market as well. Keep in mind that this market is also a bit sensitive to the US/China trade relations.