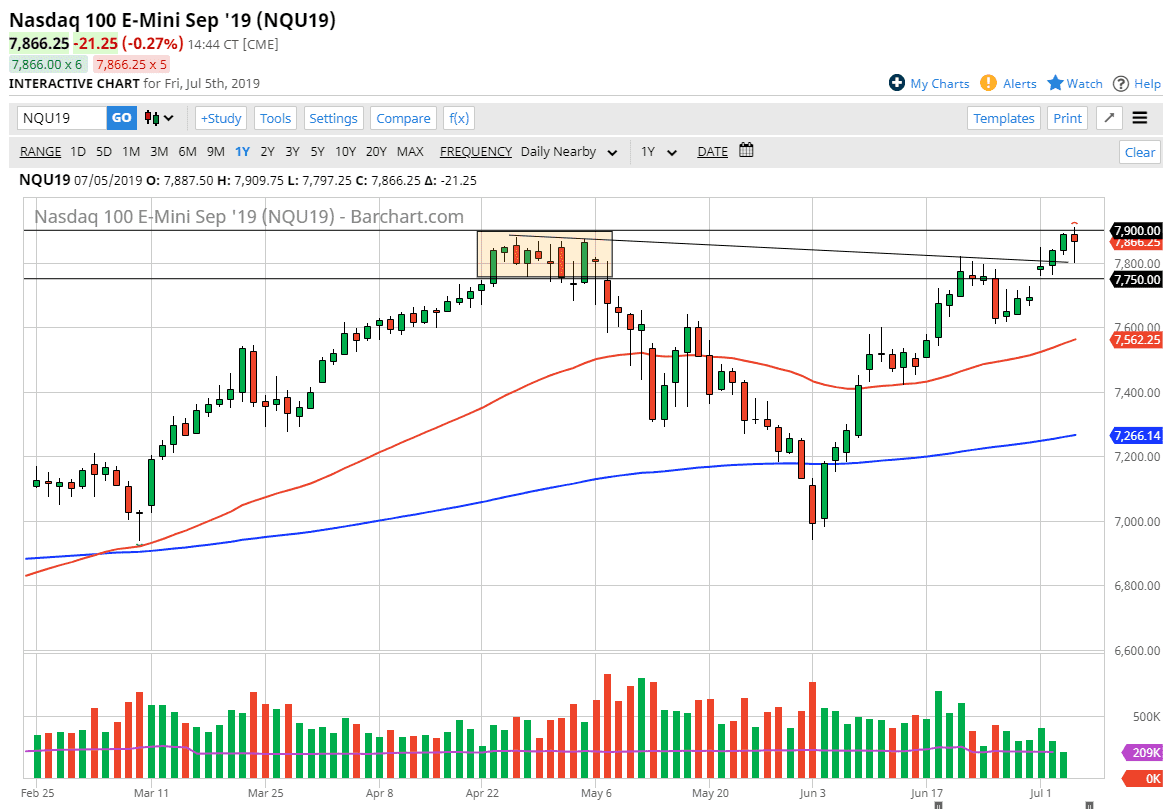

The NASDAQ 100 has been all over the place during the Friday session, initially trying to rally during the Asian session, but then broke down significantly to reach towards the 7800 level. However, we have rallied since then, as market participants initially were shaken by the idea of a strong jobs number. That led them to believe that perhaps the Federal Reserve wouldn’t be cutting interest rates anytime soon, which is something that they are hoping for.

The NASDAQ 100 is highly sensitive to the US/China trade relations as well, so it makes sense that the fact that the Americans and the Chinese have calmed the situation down suggests that we are probably going to go higher in technology related stocks, which of course means this index. The fact that we formed a hammer of course suggests bullish things as well, especially considering that the downtrend line has now offered support.

The 7900 level is a large, round, psychologically significant figure, and if we can break above that it’s very likely that we continue to go higher, perhaps reaching towards the 8000 handle, which will attract a lot of attention due to the fact that it is a big figure as well. Looking at this chart, it looks as if we have a ton of support at the downtrend line, and of course the gap that sits just below it marked at the 7750 handle. Ultimately, this market is in an uptrend and even though we are concerned about the potential Federal Reserve interest rate cuts happening or not, the reality is that the buyers are looking for any reason to go long that they can.

Lower interest rates mean that traders are going to be forced to jump into the stock market for returns. That being the case, it’s very likely that we not only show signs of bullishness, but we eventually break out and continue to reach towards fresh, new highs. The NASDAQ 100 has some catching up to do with the S&P 500 and I think it’s going to happen over the next couple of sessions. That being said, if we were to turn around and break down through the gap underneath, that could change some things but we need some type of catalyst for something that negative to happen. To the upside, you should start looking for every 100 points or so to be a fight.