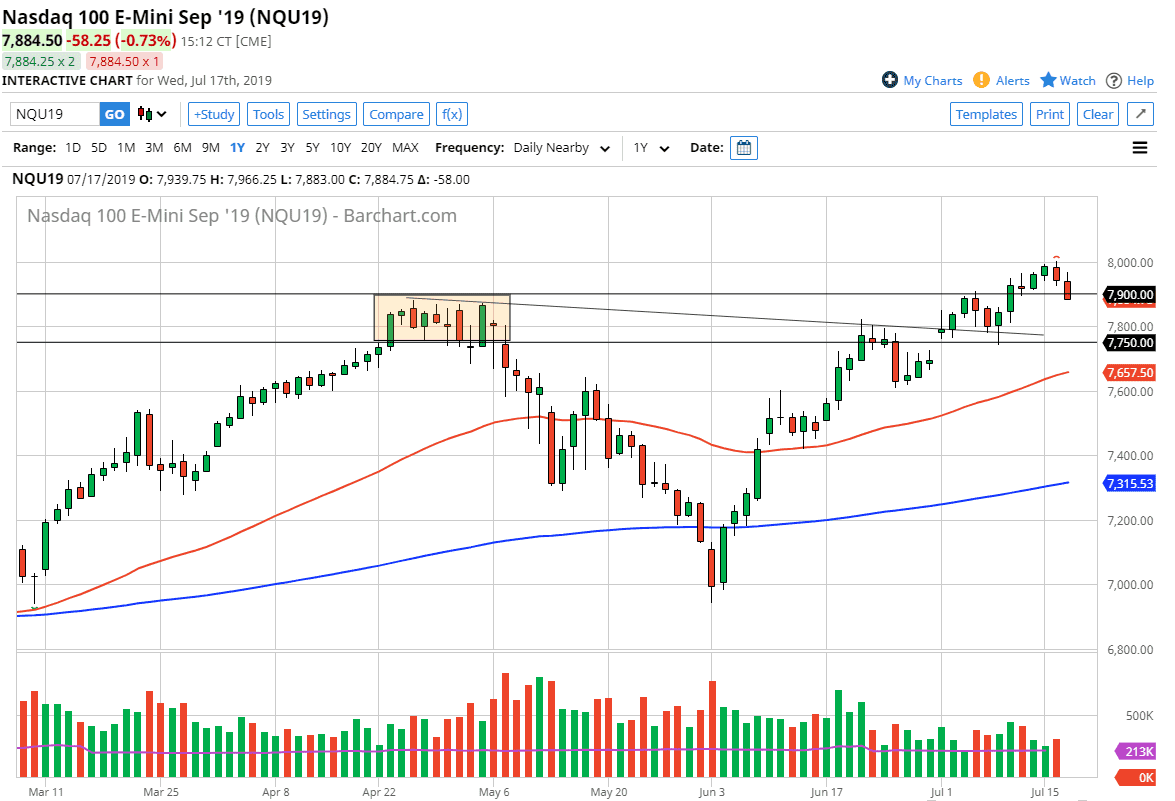

The NASDAQ 100 initially tried to rally during the trading session on Wednesday but gave up the gains as we broke down through the 7900 level. Perhaps people are starting to collect profits, perhaps it is something going on with the overall earnings season, but at this point we are obviously in and uptrend. At the end of the day, that’s all that truly matters as trying to figure out where we are going to go next is much easier when we use the trend to our advantage. Ultimately, short-term pullbacks should offer buying opportunities, especially near the 7800 level which should offer support. This is an area that extends down to at least the 7750 level.

I believe it’s only a matter of time before the buyers return, because the only thing that has mattered to the stock markets for over a decade is whether or not the Federal Reserve is going to continue to pump out that cheap money. If that’s going to be the case, we will continue to find buyers and push to the upside. I like the idea of looking for value in a market that has been strong for quite some time, and will continue to see buyers come in. I think that if we break down below the gap at the 7750 level, then we could run into serious trouble. Currently, the 50 day EMA is racing towards that area, so that could be another reason why the area holds.

I am going to wait for some type of supportive candle stick on a daily time frame to take advantage of, as it would show that the buyers are coming back in. They are looking for value in a market that has reached all the way to the psychologically important 8000 handle but failed. That’s not a huge surprise though, because these large thousand point levels tend to attract a lot of attention. With this, eventually we will be comfortable above there, and then continue to go higher. Keep in mind that the NASDAQ 100 is highly sensitive to the US/China trade situation, so pay attention to that as the headlines will have a major effect here. I don’t think you should be selling this market though; I think at this point you should be looking at opportunities of buyers coming back into the market to take advantage of the longer-term situation.