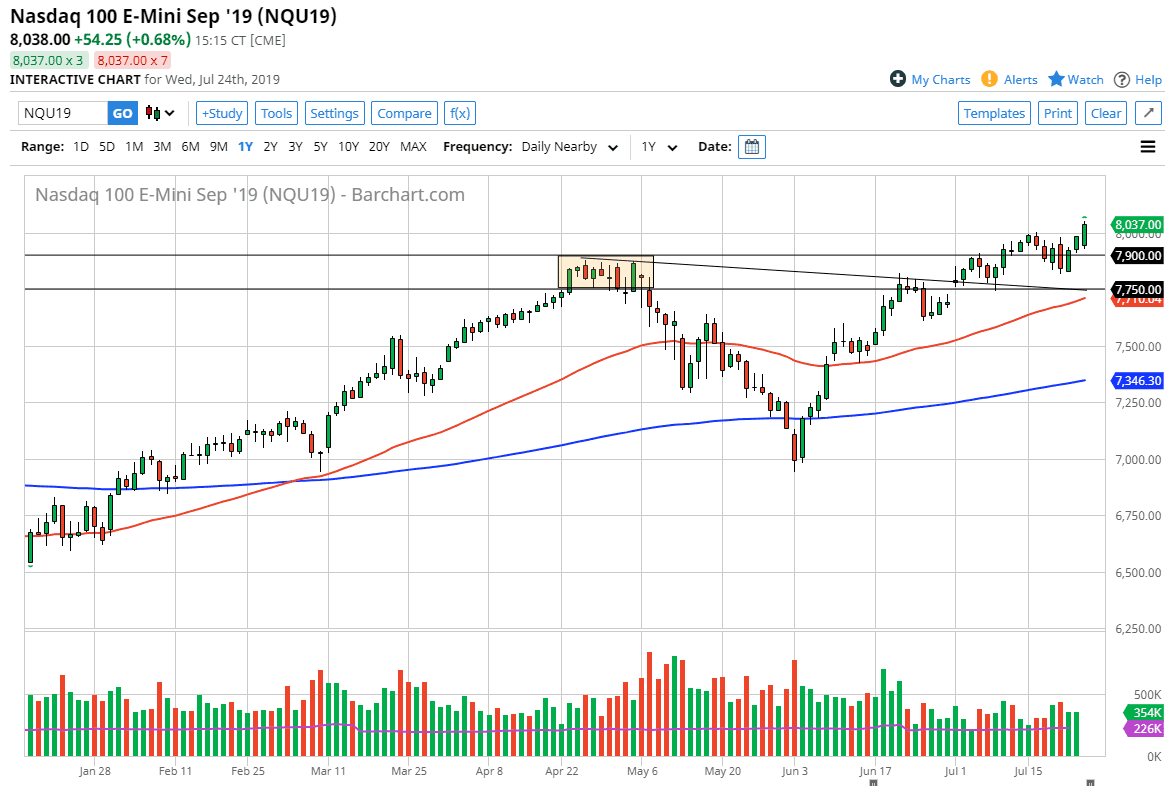

The NASDAQ 100 rallied significantly during the trading session on Wednesday, breaking above the 8000 level violently. This is an area that of course would attract a lot of attention due to the fact that it is a “Century figure”, and that of course always causes a lot of noise. The fact that we are at the all-time highs certainly doesn’t hurt anything so therefore after this bullish candle stick I think it’s obvious that the NASDAQ 100 continues to go much higher. That being said, I believe that we are looking at a scenario where buyers will come in to pick up dips, and I don’t have any interest in trying to short this market. The NASDAQ 100 obviously is highly susceptible to technology stocks, which have earnings all week.

Looking at this chart, I believe that the 7900 level underneath is going to be massive support, and it does look like the overall uptrend is very much intact. I think that if we can break above the range of the day we probably go looking towards the 8050 level, and then possibly even the 8100 level. I have no interest in shorting this market it is obviously very bullish.

The Federal Reserve is going to cut interest rates going forward, so it makes sense that the market continues to rally. After all, that’s what people care about on Wall Street: liquidity and small rates. Don’t get fooled: although earnings help they don’t necessarily drive where this market goes next. Regardless, the market looks very likely to be a scenario where value hunters come back in every time it drops, because bonds don’t pay anything worth owning as far as yield is concerned these days. The market has started to form a nice and reliable channel, and I think we probably stay in that going forward. Even if we did break down from here I think there is plenty of support not only at the 7900 level, but also the 7800 region. I am a buyer and not a seller. I do believe that occasionally there are pullbacks coming, but those are going to be opportunities as far as I see. Wall Street is back to its usual tricks, buying technology stocks as they believe growth is coming due to low interest rates again. There’s no point using logic, to simply follow the trend.