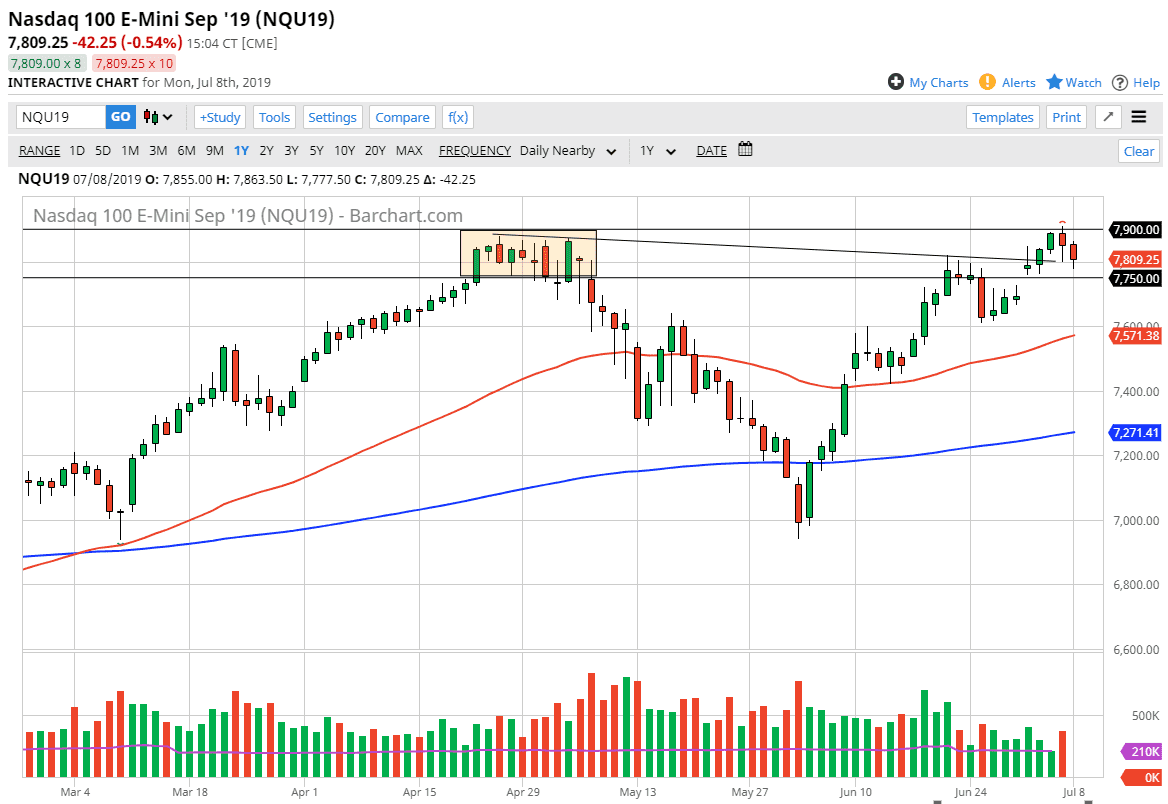

The NASDAQ 100 has fallen a bit during the trading session on Monday to kick off the week, reaching down towards the 7800 level which is an area that coincides nicely with the downtrend line that I have drawn on the chart. Beyond that, there is a lot of support underneath at the 7750 level as well. Overall, a breakdown below that level could send this market looking for the gap just underneath. This is a market that has been bullish so I think that there will be plenty of buying just waiting to happen.

Keep in mind that the NASDAQ 100 is highly sensitive to the US/China trade relations as so many technology companies do go back and forth. I think at this point it is a market that has been trying to press to the upside, breaking above the 7900 level, and going all the way to the 8000 handle. This is a marketplace that has shown a lot of bullish pressure as of late and I think that probably continues. However, it is a bit of a laggard in comparison to the S&P 500, so pay attention to that index as well, as it could give us a bit of a “heads up” as to where we are going next.

Dips at this point should be thought of as buying opportunities, but I think you will need to be very cautious about jumping “all in.” After all, the markets have been struggling with a lot of different troubles around the world, not the least of which will be the US/China trade situation, but we also have slowing global growth. Beyond that, we have the Federal Reserve and whether or not it’s going to cut interest rates in July, which I think it will. However, some people are banking on the 0.5% cut, while others are banking on the 0.25% cut. There’s a huge difference between the two, so it’s likely that there will be significant changes depending on which one of the cuts happen. All things being equal though, the only thing Wall Street seems to care about these days is whether or not there are interest rate cuts, so ultimately I believe that the buyers will return sooner or later. However, a break down below the 50 day EMA which is pictured in red could show an entire trend change. That looks to be very unlikely at this point.