The NASDAQ 100 will be very thin and reduced to short-term electronic trading during the Thursday session as it is the Independence Day holiday in the United States. However, the Wednesday session was very interesting as we rallied right away and shot up in the air. As we are closing at the absolute highs, that shows that the market does want to go higher. What makes things even more curious is that the Friday session is of course the jobs figure and that will attract a lot of attention. Ultimately, the stock markets will continue to rally based upon the idea of the Federal Reserve injecting liquidity through interest rate cuts. Ultimately, they should also force money into the stock markets due to the fact that there is almost no return on bonds at this point.

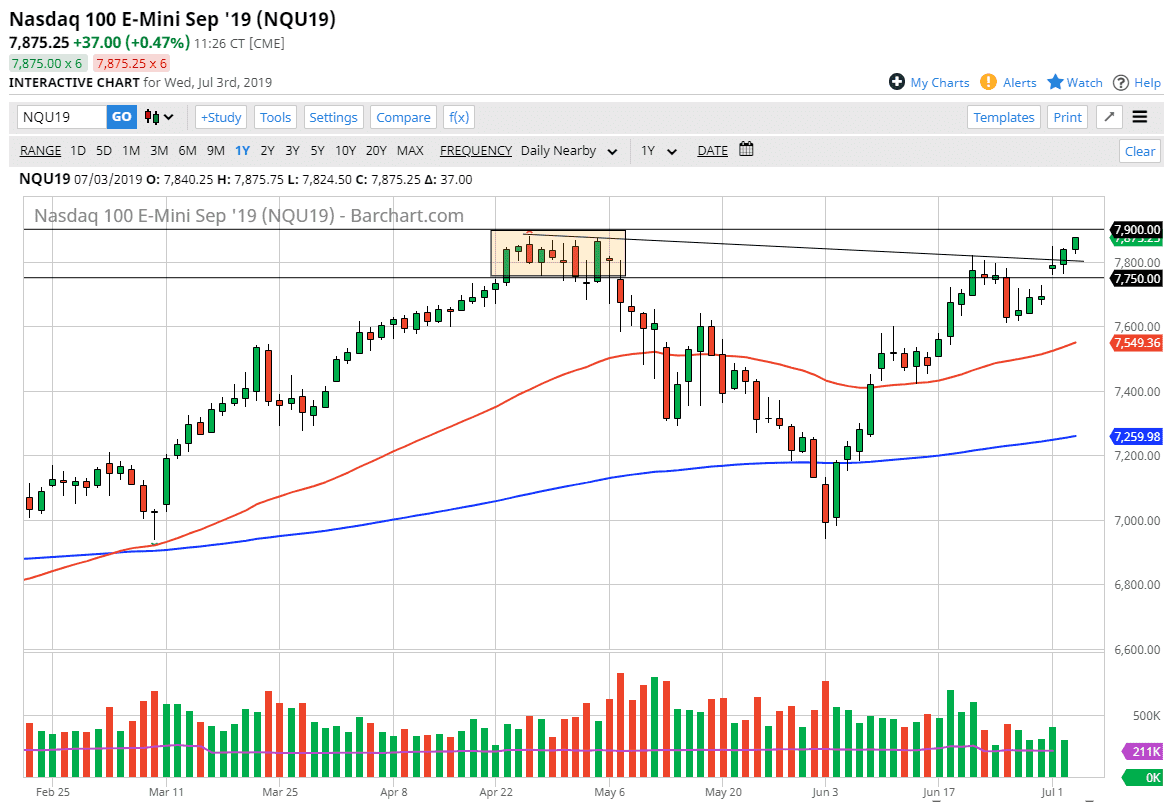

The NASDAQ 100 is a little bit different in the sense that it also reacts to the US/China trade relations a little bit more sensitively than some of the other indices, as so many of the technological companies are so highly influenced. That being the case, the market is very likely to pay attention to headlines coming out of both Beijing in Washington, and as we have had a recent truce between the two when it comes to the trade wars, it makes sense that we have broken higher. The 7900 level above is significant resistance, so if we break above there it’s very likely that the market continues to go higher.

Ultimately, the previous downtrend line should now be supported which is focusing on the 7800 level. I like buying short-term pullbacks, and I recognize that the Thursday candle stick should probably be thrown out, and that the true measure of where we are going next is probably going to be measured on Friday. Jobs numbers do tend to make markets a bit crazy, but it does give us a little bit more direction and catalyst to go somewhere. Obviously, the markets in and uptrend so dips should be thought of as buying opportunities in a market that is prone to go much, much higher. In fact, it’s not until we break down below the 7600 level that I would be concerned about the overall uptrend at this point in time. If we do break the 7900 level, it’s very likely that we go looking towards the 8000 level next as it is a large, round, psychologically and significant big figure.