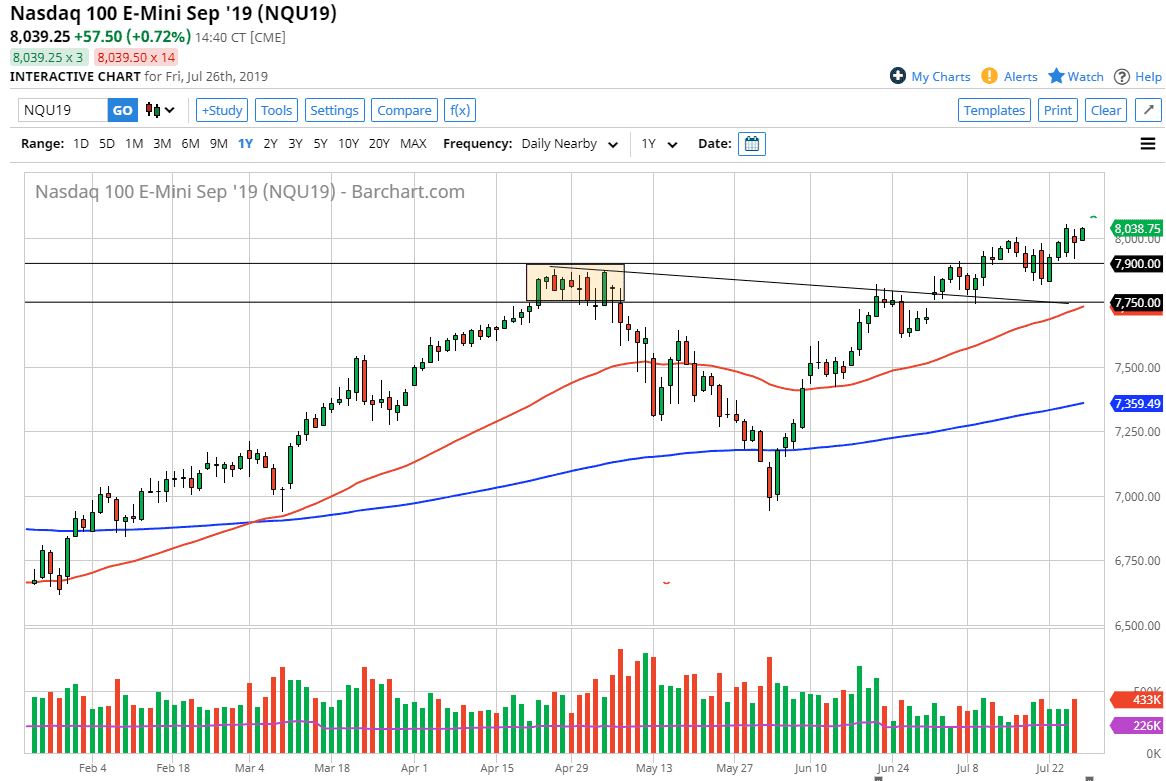

The NASDAQ 100 has rallied a bit during the trading session on Friday, closing towards the highs yet again. This is a market that has been extraordinarily bullish for some time, and now that we are through the biggest bulk of technology companies in the earnings season, the market will probably breathe a sigh of relief. The market continues to be one that you want to buy on dips, as there is a massive amount of support underneath.

The initial support is probably at the 8000 level, and the fact that we have stayed above there is a very bullish sign. The psychology of the round figure of course attracts a lot of attention but I do think that it’s only a matter time before we forget about it. After all, the more time we spend either above or around the large, round, psychologically significant figure, the less likely it is to be important.

The 50 day EMA reaching towards the gap underneath has this forming a “floor in the market” and it’s likely that people will continue to see this market as one that can be bought as long as we stay above that area. We have the gap, the 50 day EMA, and the downtrend line slicing through that level.

To the downside though, if we break down below the 50 day EMA, it’s likely that we go much lower. If that happens, I would expect a move towards the 7500 level. That’s an area that should attract a lot of attention, and therefore I think we could see a bounce from there if we did break down. All things being equal though, the Federal Reserve is very likely to cut interest rates and then put out some type of dovish statement. Both of those should continue to push stock markets higher, and that of course means indices such as the NASDAQ 100. The US/China trade situation being worked out could be a major driver of prices going higher as well. That could be a very good sign for a longer-term run, but right now I think every time we pull back you should to simply look for some type of short-term bounce to take advantage of. We are in an uptrend, and there’s no reason to fight it whatsoever. I think that ultimately this is just another blip on the radar in the long run higher.