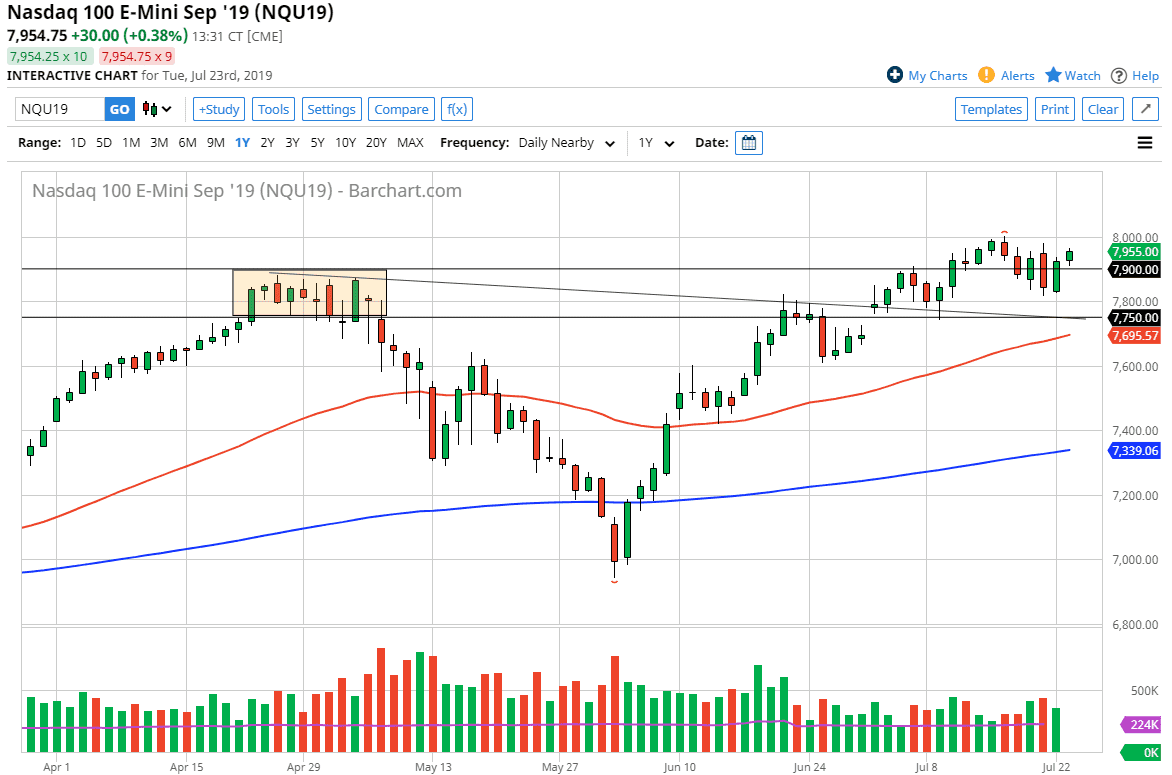

The NASDAQ 100 has pulled back a bit during the trading session on Tuesday, seeing some type of support at the 7900 level, which of course is a large come around, psychologically significant figure and an area that was resistance in the past. Now that it has offered support after a very bullish candle on Monday, it suggests that we are going to go higher. The next obvious level to pay attention to will be the 8000 handle as it is a “Century level.”

I believe that this market is likely to continue to go through there, but it could cause a little bit of resistance. Though, as long as the Federal Reserve is willing to cut interest rates and keep the market liquefied, it will go higher. It’s very likely that they will continue to serve their masters on Wall Street to push markets higher. Short-term pullbacks should continue to attract a lot of attention as the market has not only support at the 7900 level, but also the 7800 and the 7750 level.

All things being equal, I think that the strongest of support levels is found near the 7750 level, as it is not only the scene of a gap, a downtrend line that has slice through there, and then the 50 day EMA. This is a market that is most certainly going to stay in a bullish trend, but I think it takes quite a bit to excite the market at this point as we have already priced in at least one interest rate cut from the Federal Reserve. Beyond that, it is also earnings season so that of course will throw markets around occasionally, but at the end of the day it doesn’t really truly matter.

All things being equal I do think that we eventually break out and go looking towards the 8500 level, but it’s going to take some time to get there. At this point, it is a market that I look for value in, meaning pullbacks that show signs of a bounce on short-term charts. I have no interest in shorting until we break down below the 50 day EMA decisively on a daily close at the very least. Looking at the chart though, it seems very unlikely to happen and I do think that the basing pattern that we are trying to form over the last couple of days is winding the market up for a move to the upside.