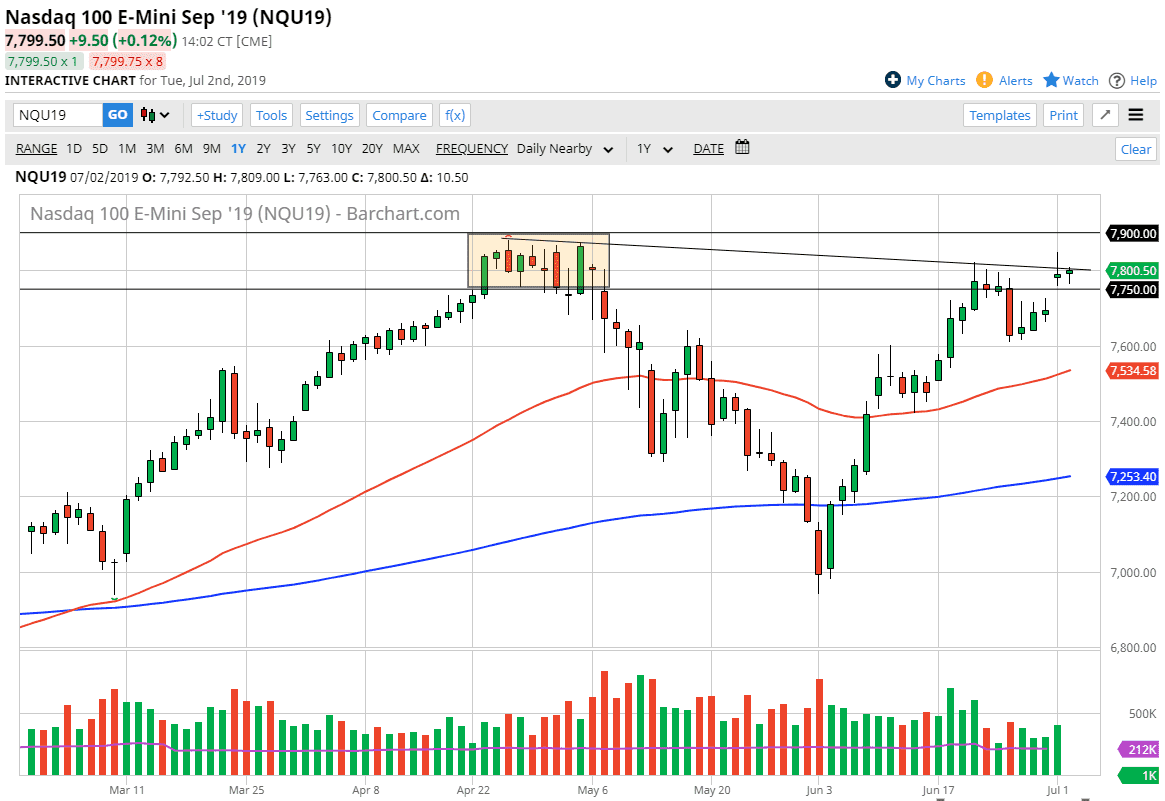

The Nasdaq market fell initially during the trading session on Tuesday but turned around to show signs of strength again. This is a market that needs to rally if stocks in America are going to do any better because of the massive underperformance that we have seen over here in relation to the S&P 500.

The shooting star that formed on Monday was something to worry about, because it formed a right at the downtrend line that I have marked on the chart. However, as we close in at the end of the day on Tuesday, it looks as if we are trying to break through that downtrend line. The 7800 level being broken is a good sign, and most certainly if we can break above the top of the candle stick for the Monday session, that would be a very bullish sign for the market, sending it towards the 7900 level.

The biggest problem we have now is that the liquidity will be an issue going into the July 4 holiday, and the jobs number coming out on Friday. Ultimately, this is a market that continues to grind its way higher, and of course it’s likely that there is still a lot of pent-up energy. That being said, it’s very unlikely that we let this gap go unfilled underneath, so there is the possibility of a break down. If we can go below the 7750 handle, then the market goes looking to fill the gap. At that point I would be a buyer, as the market would certainly have a lot of technical strength in that area.

To the upside, if we were to clear the 7900 level the market probably goes to the 8000 level after that. This is a market that will be very noisy in the short term, as the liquidity issues, problems with the US and China, geopolitical issues, perceived global slowdown, and of course a dovish central bank in the United States all throw things together to have competing forces.

Ultimately, if we were to turn on a break down below the gap underneath that would be a very negative sign, perhaps reaching down toward 7600, before breaking down even further. Ultimately, this is a market that is bullish so I do favor the upside, and therefore that’s what I’m looking to do, take advantage of value when we pull back.