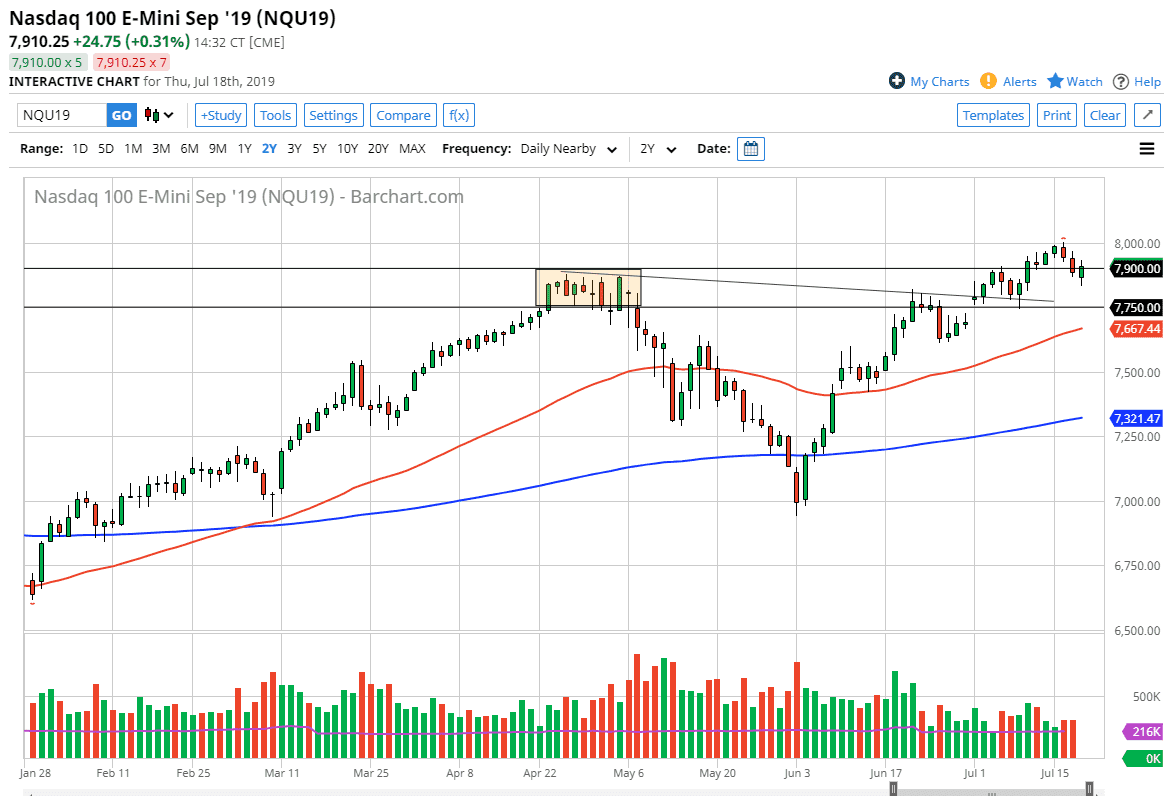

The NASDAQ 100 rallied rather significantly during the trading session on Thursday after word got out that the Iranians were willing to talk about the nuclear arrangement. By rallying above the 7900 level, this is a sign that we should continue to go higher. By breaking above the 7900 level again, it’s likely that we could go towards the 8000 level again which was the most recent high. If we were to break above there, then the NASDAQ 100 could really take off to the upside.

Looking at short-term pullbacks would be the way to go forward, based upon short-term charts. If we were to break down below the lows of the Thursday session, it’s likely that we could go down to the 7750 level. That’s an area that is massive support, and I think that we could continue to find value hunters underneath there. If we break above the 8000 level, the market could go much higher, as it is such a large, round, psychologically significant number. Remember, stock markets like these large figures, and there is going to be a certain amount of interest in the thousand point levels.

If we were to break down below the 7750 level, then we will test the 50 day EMA underneath, which is painted in red on the chart. That being said, I think it’s only a matter time before the buyers come back to take over and take advantage of value. This is a market that continues to be in an uptrend, regardless of what we have seen the last couple of days.

All things being equal I do think that value hunters come back into the market, and of course the NASDAQ 100 is sensitive to the US/China trade relations going better. If we get some type of good news out of Beijing or Washington, then we could go much higher. That I think would be the “one-two punch” along with the trend that could send the NASDAQ 100 to higher levels. The 50 day EMA is reaching towards the gap underneath, so by breaking that we could have a massive collapse, reaching down to the 7500 level, and then perhaps even the 200 day EMA underneath. Remember, stock markets are being driven by one major thing right now: cheap money coming from the Federal Reserve.