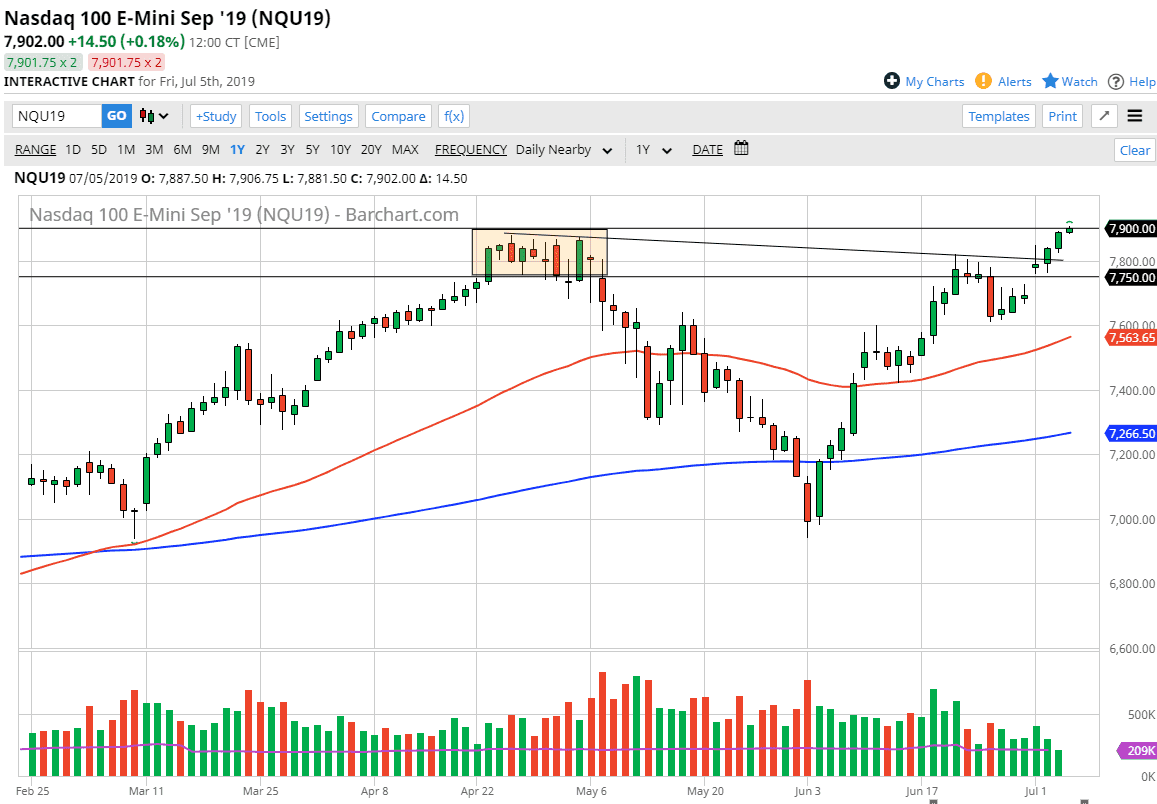

The NASDAQ 100 has rallied slightly in the futures market during the day on Thursday, in what would have been limited electronic trading. We are at the highs again at 7900 and the S&P 500 is doing the same thing. With that in mind I believe that stock markets in America will continue to go higher given enough time.

You should keep in mind that Friday is jobs day, and therefore the announcement will cause quite a bit of volatility. That being said, the market is very strong and has recently gapped higher and then shot towards the highs again. At this point, I believe there is enough support underneath to keep buyers jumping into this market on dips. There are a couple of different scenarios playing out before our very eyes on Friday, considering how people can read the jobs figure.

The initial reaction could be that the number is awfully soft, and that should have people thinking about the major likelihood of an interest rate cut coming. That is good for stocks, and therefore money will flow into the markets in New York. We could get an initial reaction that’s a very negative, due to a strong jobs number but the Federal Reserve is going to be cutting rates because the last time they disappointed the market crashed. That being the case, that initial pullback will probably be bought into, perhaps around the 7800 level as the downtrend line sits there.

Another added factor to this market is going to be that the US/China trade talks have chilled out a bit and got a little less cantankerous. That of course helps, as the NASDAQ 100 is full of technologically driven stocks, and those are highly susceptible to the US/China situation. Ultimately, I do like buying pullbacks anyway so therefore I look at this as an opportunity to pick up value when we see them. I don’t have any interest in shorting the NASDAQ 100, as there is an obvious bullish slant to the US stock markets. In fact, it’s not until we break down below the 7600 level that I would be a seller as we would crash through the 50 day EMA at that point. The NASDAQ 100 is playing a bit of catch-up to the S&P 500 from what I can see, and I think that will continue to be the case over the next several sessions.