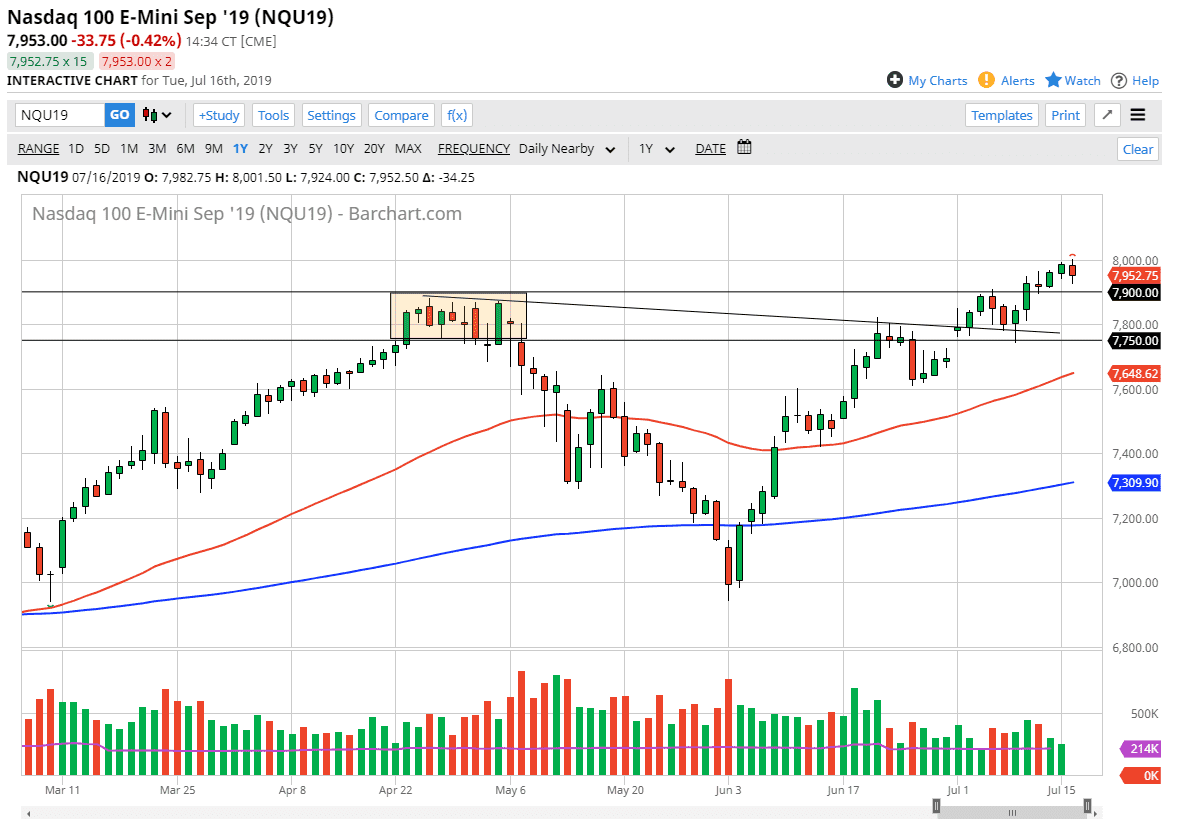

The NASDAQ 100 has initially tried to rally during the trading session but found the 8000 level to be a bit too much to overcome. By doing so, we broke down towards the 7900 level before bouncing late in the day. This is a market that has been quite bullish for some time, so I think at this point a pullback makes quite a bit of sense. Beyond that, the 8000 level is very difficult to break above as it is a psychologically and significant round figure. If we can break above there, the market is free to go much higher as it will break through a lot of psychological resistance more than anything else. However, if we were to turn around and break down below the 7900 level, then it’s likely that we could go down to the 7800 level underneath.

This market of course is rallying right along with other risk assets as the Federal Reserve is looking to cut interest rates, and that of course should continue to give a bit of a boost to risk assets such as this one. Ultimately, I believe that the market is trying to break out again but obviously we have some work to do. When you look at the longer-term chart, we are continuing to see a bit of an uptrend and perhaps even a bit of a channel. That’s channel of course is bullish, but possibly also a bit overextended.

Keep in mind that the NASDAQ 100 is highly sensitive to the US/China trade talks which are somewhat up in the air but recently we’ve seen a few more conciliatory comments coming out of Washington. Overall, this is a market that should continue to move right along with the social barometer of what’s going on between the Americans and the Chinese, but the one thing I think you can read on the chart more than anything else is how you shouldn’t be a seller.

There is a gap underneath the 7750 level, and that area should offer significant support. If we were to break through that support level, then the market probably breaks down rather significantly and starts reaching towards the 7400 level. Overall though, I do think that the buyers will continue to lift this market, because as long as we have lower interest rates, nobody will care about earnings and the long run as stock markets in America are about low interest rates.