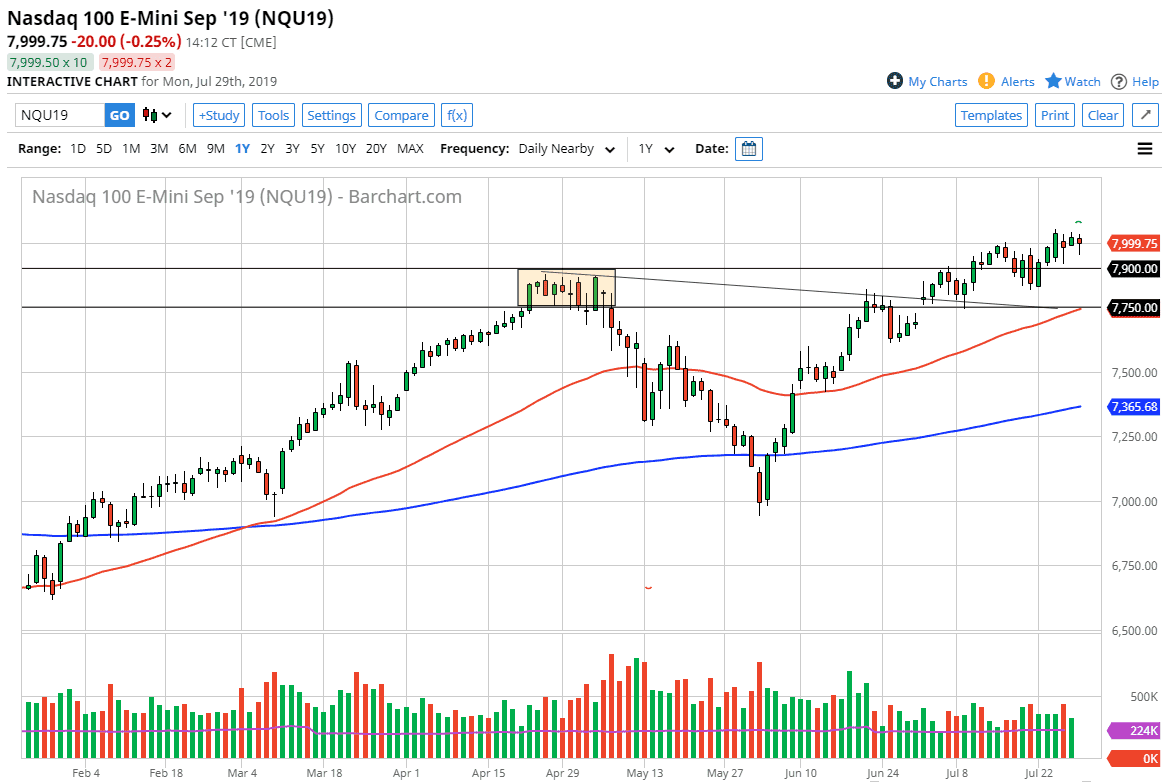

The NASDAQ 100 fell during the trading session on Monday, as we continue to see a lot of noise near the 8000 handle. At this point, we have bounced enough to form a bit of a hammer though, so that is a good sign that we continue to find plenty of buyers. Underneath, I see the 7900 level also offer a support so there is plenty of reasons to think that we are going to continue to go higher, as we wait for the Federal Reserve to make its decision on Wednesday. We do believe that the market is going to react very strongly to what happens next, and I believe that personally the Federal Reserve is going to cut by 25 basis points.

Ultimately, the NASDAQ 100 will be waiting to see whether or not the Federal Reserve is not only going to cut rates, but if they insist on sounding dovish going into the future. If there are more rate cuts coming, that should help stock markets in general, and of course the NASDAQ 100 won’t be any different. The candlestick is of course a very bullish, and I think that the fact that we continue to bounce around the 8000 handle tells us that there is still plenty of fight left in this marketplace.

The 50 day EMA underneath is currently testing the 7750 handle. And that’s an area that coincides nicely with the downtrend line that I have marked on the chart. It’s basically where the gap is from previous trading, so I think that is a bogey for your “floor” in the marketplace. If we were to break down below that gap, then we could be in trouble. Between now and then though, I think any sign of support is a buying opportunity. If we can break to a fresh, new high again, then I believe that the market will continue to go towards the 8100 level.

Another thing that has me bullish is the fact that there are a couple of recent hammers, so I think at this point it’s obvious that there is plenty of wherewithal in the trading community, but between now and the end of the day on Wednesday, when we finally know exactly what the Federal Reserve is going to say or do. Ultimately, this should be a very quiet couple of days until we get all of those answers.