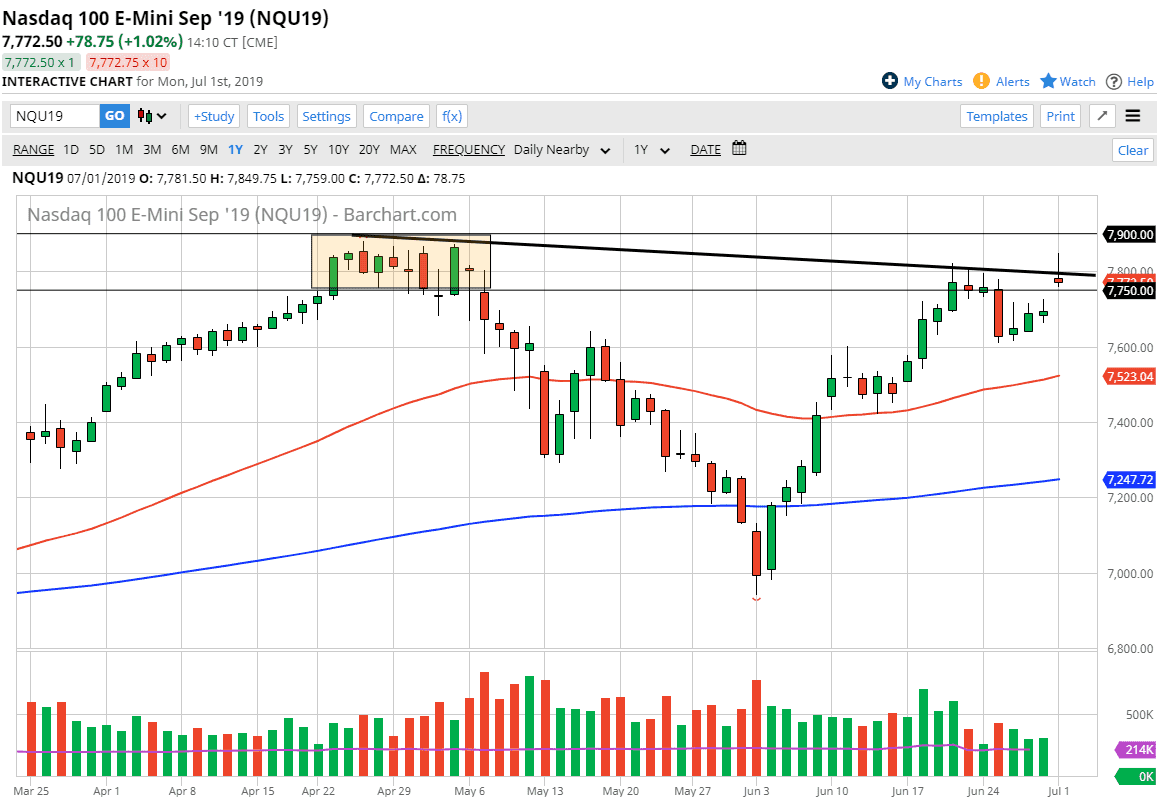

The NASDAQ 100 gapped higher right along with the other indices in the United States on Monday, but unlike the S&P 500, the other index that I follow here at Daily Forex, we did not make a fresh new high and in fact have formed a very bearish candle stick. The daily candle stick looks very much like a shooting star and I suspect that we are probably going to try to find a bit of selling pressure so that we can fill the gap underneath.

Looking at the chart, you can see that I have a downtrend line drawn that has offered enough resistance to turn the market around. The 7750 level underneath could cause a little bit of support but quite frankly I think it’s the gap that most traders will be paying attention to. Yes, the NASDAQ 100 is full of technology stocks that are very sensitive to the US/China trade situation, and of course the idea that the Americans are starting to loosen up on Huawei helps that scenario, but ultimately the market has been priced so bullish that it’s difficult to imagine a scenario where we get the ability to go much higher without some type of additional catalyst. At this point, it could be the jobs figure but I think it comes down to the US/China trade situation which of course hasn’t really gotten any better. Granted, it didn’t get worse of the weekend and that’s a good sign but the way this has gone it’s only a matter of time before negativity creeps back in.

Although the S&P 500 does look rather bullish, it’s not lost on me that both the Russell 2000 and the NASDAQ 100 dome. The question now is which one leads the way? I think we are going to have a lot of questions that need to be answered, and after this last weekend, I don’t know that much is changed in the markets. I believe that the S&P 500 will probably lead the NASDAQ 100, because if it doesn’t and the NASDAQ 100 leave the S&P 500, it’s likely lower. We are at a very precarious position right now, as we are starting to see divergence and a lot of the indices that I follow. To the downside, if we were to break down below the 7600 level and the NASDAQ 100, we could go much lower. If we can break above 7900, then we could start to talk about the possibility of 8000, probably accompanied with good news.