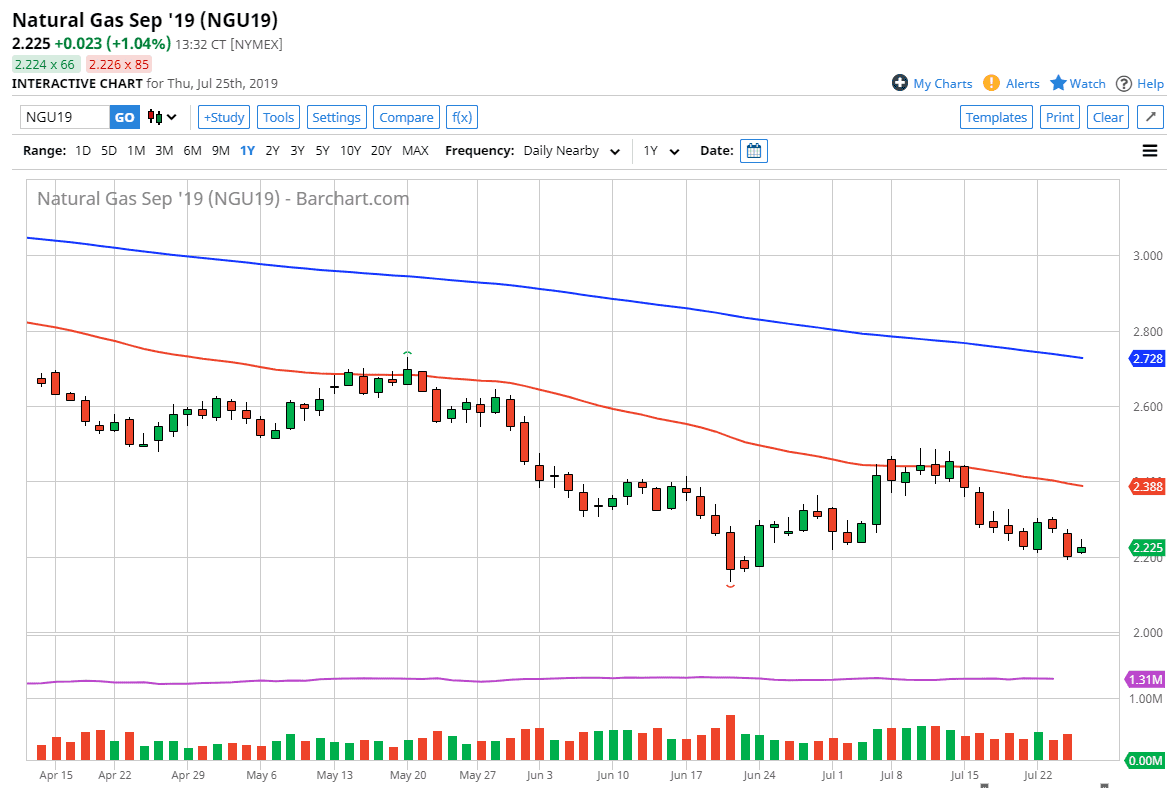

The natural gas markets initially tried to rally during the trading session on Thursday but rolled over during the day to show even further weakness. Quite frankly, this is a market that can’t get out of its own way and I think that it’s only a matter of time before we break down below the $2.20 level that has been holding the market up. If we drive lower than that, the $2.15 level will be targeted, and then I think that the market will go looking towards the $2.00 level, an area that I think will cause a massive interest in this market. At this point, it’s very likely that rallies will continue to be sold off, because quite frankly this is a market that has a huge bearish overhang when it comes to this pricing situation.

The demand for natural gas will continue to struggle, and I think that overall this is a market that you need to look at from the prism of being extraordinarily negative, and as a result every time this market rallies you should be looking to sell. After all, the natural gas market is extraordinarily oversupplied, and that’s not going to change anytime soon. The futures market is currently trading the September contract, and therefore you should be looking at this market as one that is in between the hot weather and cold weather. Meaning that there is in a massive amount of supply out there that will be able to be taken care of. Granted, there is an extraordinarily bullish trade just waiting to happen, but that’s not going to be until we get to the cold months, something that we will be trading for a moment as we just flipped over to the September contract.

If we rally from here, it’s likely that the $2.40 level will cause massive resistance, because quite frankly it was massive support and massive resistance in the past. The 50 day EMA is slicing just below there, so that probably causes a bit of resistance as well. At that point, I would not only be short of this market but I would be aggressively short. If we did break above the $2.50 level that could change a lot of things but I don’t see that happening anytime soon. We are in the longer-term downtrend, and that shouldn’t be fought against here.