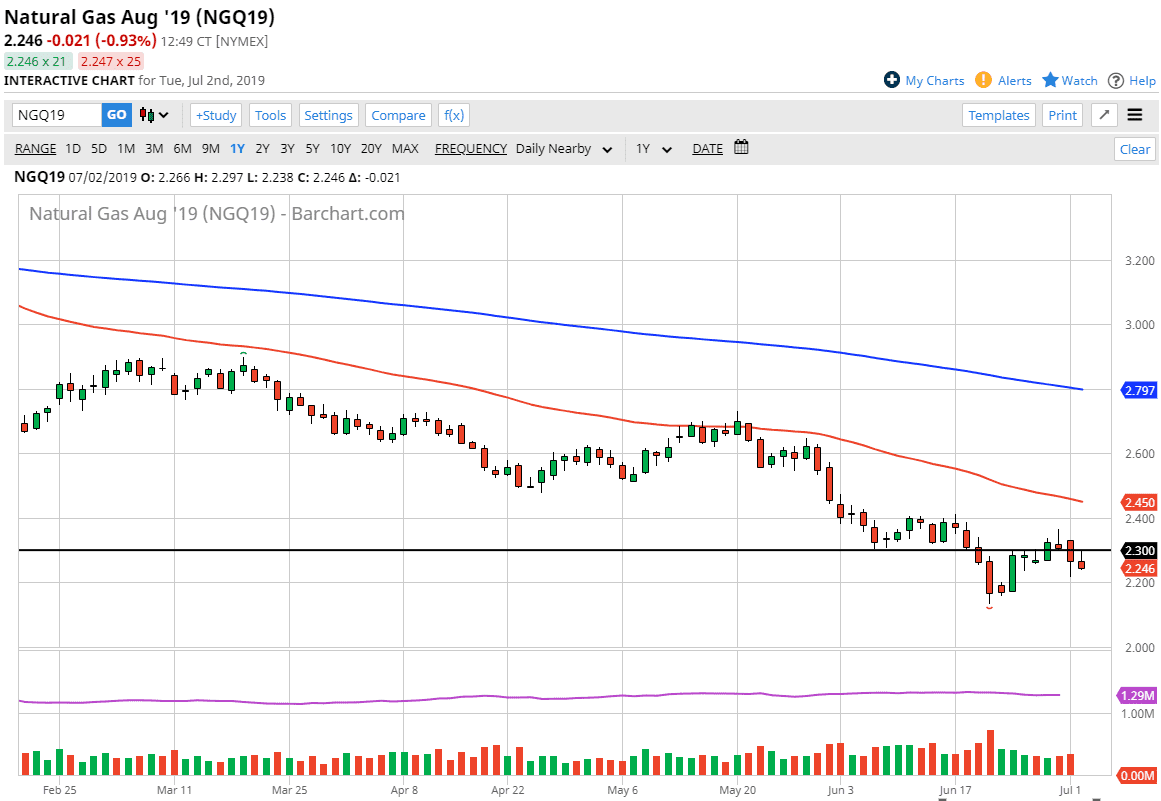

Natural gas markets tried to rally significantly during the trading session on Tuesday, but then pulled back to find selling pressure yet again. After all, the $2.30 level has been extraordinarily resistive, so therefore it’s likely that we will continue to see sellers in that region. At this point, it’s very likely that the market simply won’t be able to get out of its own way, as the massive amount of supply continues to be a major issue. Most natural gas is simply burned off as it isn’t worth harvesting.

In a situation where we have such an oversupply, anytime you get a bit of a rally is going to invite more selling. The shooting star shaped candle suggests that we are going to continue to go lower, and at this point I think you need to go to shorter-term charts such as 15 minute charts that show signs of exhaustion as the natural gas markets continue to be buried under a huge amount of bearish pressure. That being said, there is also a significant level above that being broken could throw this market into disarray, at least temporarily.

I believe that the $2.40 level is massive resistance, so if we were to break above there it’s very likely that the 50 day EMA would be targeted next. The 50 day EMA is one that quite often affect this market so I believe that this is one of the better markets to trade right now, if you can simply be patient enough to see a rally that you can take advantage of. We get there occasionally, but again they tend to be on short-term charts.

To the downside I believe that we are going to go looking towards the lows again, perhaps reaching towards the $2.15 level next, followed by the big figure at the $2.00 level. At this point, I believe that is a foregone conclusion, but it doesn’t necessarily mean we’re going to get there overnight. Whether or not we can break down below there is a completely different conversation, because it will of course attract a lot of attention due to the fact that it is such a significant round figure. Even if we were to rally from here I don’t see a situation where you should be buying natural gas, as we have so many different resistance barriers above.