Natural gas markets have fallen a bit during the trading session on Friday, which makes perfect sense considering that we had a couple of possibilities to push the market higher than both failed. Initially, people had worried about the possibility of a tropical storm disrupting supply in the United States. The tropical storm came and went, with minimal damage and disruption.

Beyond that, we have the heatwave coming into the picture as well, so having said that it’s very likely that the demand for natural gas could pick up. However, this is a short-term move, and has already started to fade away. With that being the case, it’s very likely that the longer-term trend will continue and that’s what we saw on Friday.

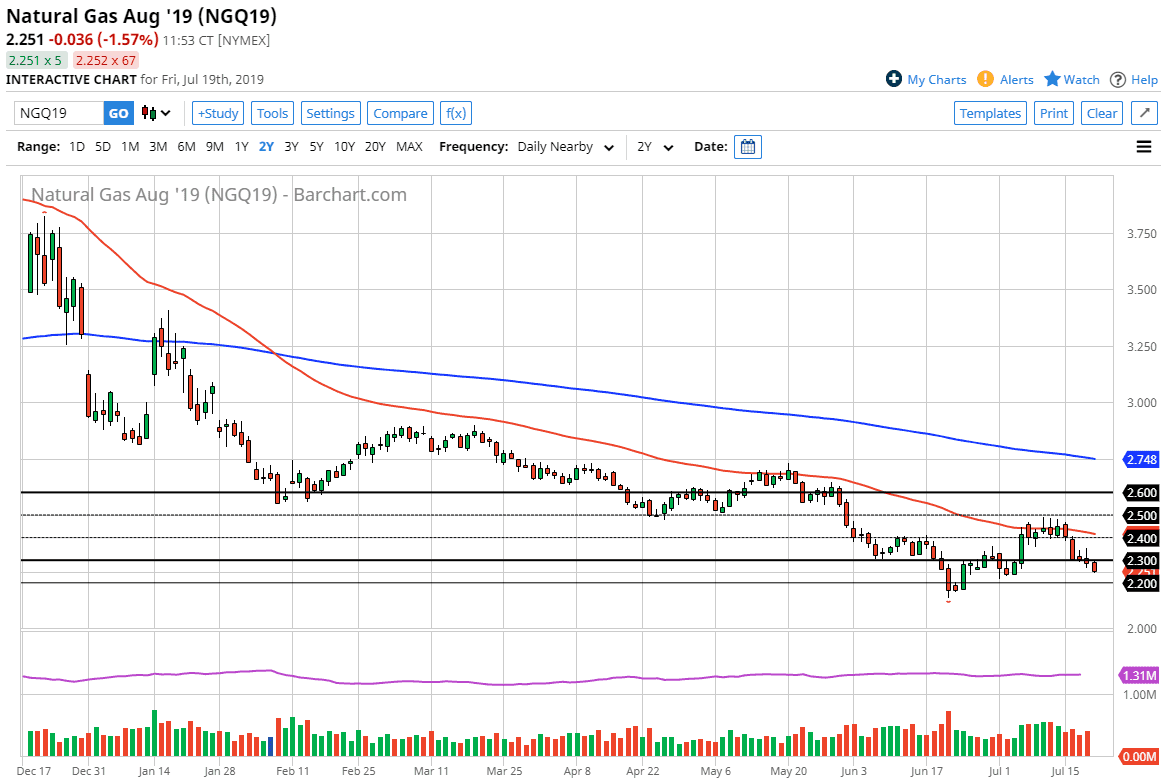

Natural gas markets have broken down significantly during the Friday session, slicing through the $2.30 level without too many issues. We closed towards the bottom of the candle stick, and therefore it shows that we are more than likely going to have a bit of follow-through as this market will figure to continue the longer-term destruction, and a run down to the $2.20 level is very likely to be the next move. I believe at this point it’s likely that level will also give way and that we should then go to the lows again, perhaps down to the $2.00 level. Rallies at this point are to be faded, because there just isn’t enough demand for natural gas out there to take care of the massive amounts of supply that we have.

Never forget, the United States alone has 14,000,000,000,000 ft.³ of proven natural gas in the ground and that number has been climbing. Canada has even more. In that type of scenario you are never going to get enough demand to wipe out the global supply. In fact, recently I have seen studies that suggest the United States could power the entire planet for 300 years on its natural gas alone. This being the case I like fading any signs of exhaustion or fresh lows. However, this isn’t to say that we go down forever. In fact, there is a seasonal effect coming near the fall when we start to see natural gas pop higher due to increased demand in the winter. We are currently trading the August contract though, so obviously we are away from that move.