The natural gas markets initially tried to rally on Monday and then broke down quite a bit. At this point, it’s very likely that the market will continue to see a lot of negative pressure, and that makes quite a bit of sense considering that the oversupply of natural gas continues to be a major issue. Beyond that, we also have the fact that there is a bit of cyclicality when it comes to this market, as the market tends to drift lower most of the year, only finding enough of demand to pick the market up for a few months in the cold months of winter.

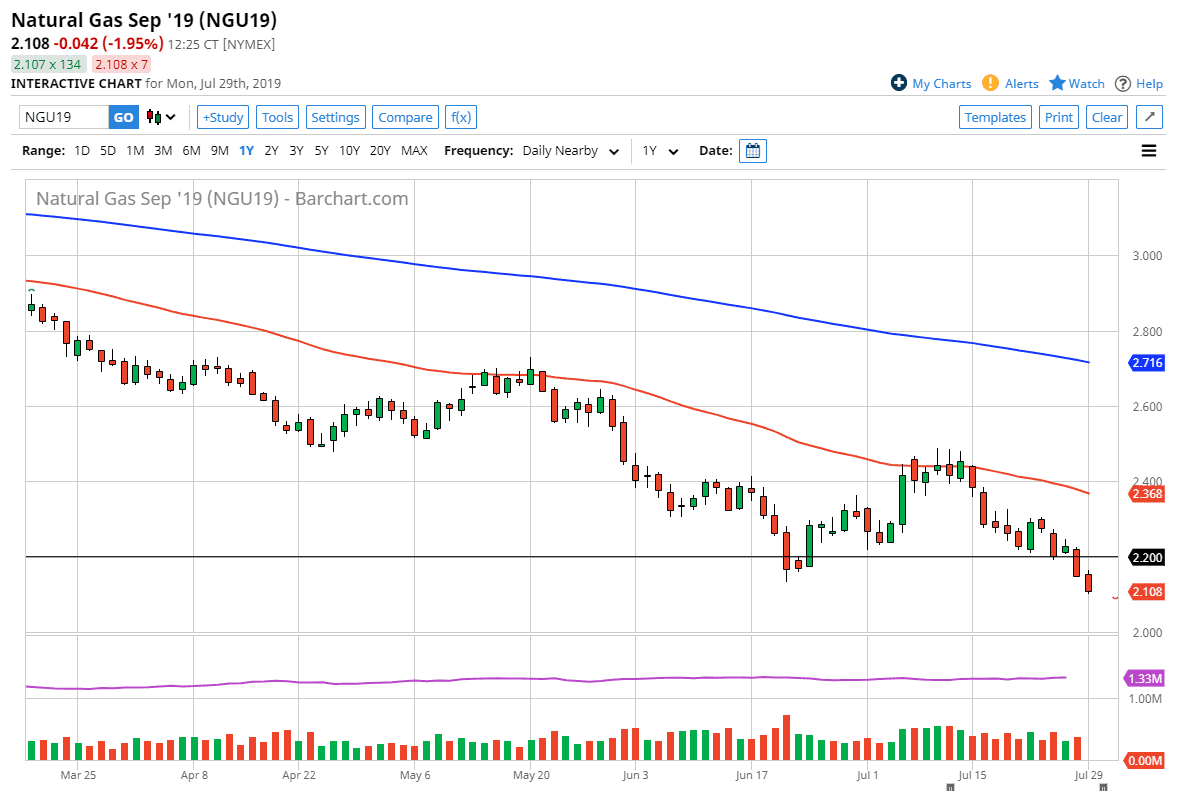

Looking at this chart, it’s very likely that we will go looking towards the $2 level underneath, which of course is a large, round, psychologically significant figure that will attract a lot of attention. At this point, the market looks very likely to try to bounce from there, but I think now that we continue to break lower, the market is hell-bent on trying to test that major level as these large round numbers always do tend to attract a lot of attention.

Rallies at this point will more than likely continue to attract a lot of selling, especially near the $2.20 level, which is an area that was previous support as well as resistance. Above there, we also have the $2.25 level, and then the 50 day EMA which is red on the chart. The EMA of course is very negative looking, and of course an area that has played quite a bit of attention to longer-term sellers. Overall, I think that short-term rallies will continue to show opportunity for sellers to get involved, and therefore it’s likely that we will find plenty of reasons to short this market.

If we were to break down below the $2.00 level, that would be a very negative turn of events and could send a flood of money into this market. I don’t expect that to happen though, but if it did, that will cause quite a bit of attention in the marketplace, and that of course will attract a lot of money. All things being equal though, we are getting closer to the bottom than the top, and therefore I think it’s only a matter of time before we reach value and perhaps a turning point, probably in another month or two.