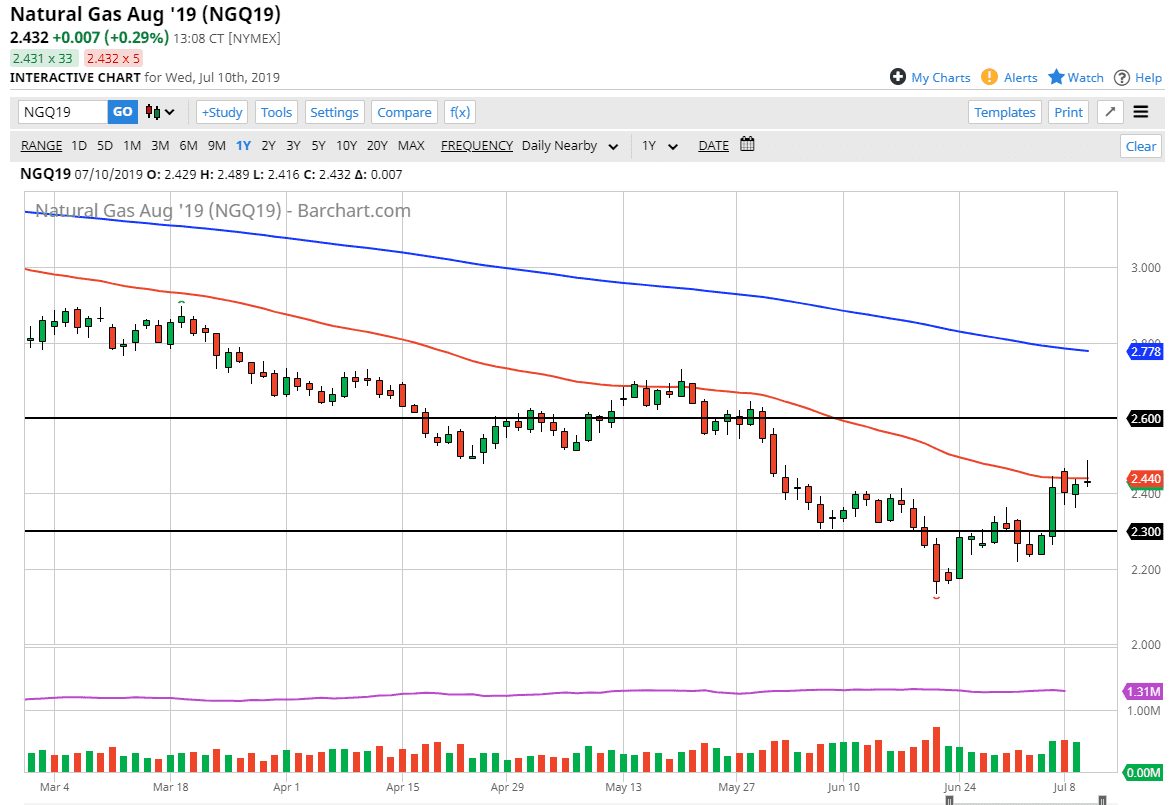

Natural gas markets ran into significant resistance later in the day on Wednesday, as the $2.50 level has caused selling pressure. Ultimately, this is a market that’s in a downtrend anyway so there’s no reason you should be buying it. The daily candle stick does look like it’s going to end up being a shooting star, which of course is a technically negative candle stick.

The 50 day EMA slices through the candlestick, so that will attract a certain amount of technical trading anyway. Beyond that though, the market is suffering at the hands of an oversupply situation that isn’t going to get any better. Even though natural gas markets are flooded with supply, fracking companies in the United States continue to pound out tremendous amounts of natural gas supply.

Recently, we have seen a bit of a rally but that rally is predicated upon the idea of warmer temperatures in August. The futures market is currently trading at mild, so it makes sense that we would see some buying pressure. Overall, I believe that the rallies are short-lived at best as these heat waves in the United States tend only last for a week or two, so it will be but a short blip on the radar.

This is quite a contrast from the seasonal bullish time of year during the cold months, which can last three months and be much more reliable. Cyclically speaking, August could cause a bit of a blip but it’s the wrong time of year to get overly bullish of a commodity that is so overdone that they literally run out of storage space at times. Beyond that, global demand for natural gas may be slowing down from an industrial side as the global economy seems to be cooling off.

A move below the $2.40 level opens up the door to the $2.30 level underneath. Breaking above the top of the candle stick from the trading session on Wednesday would be bullish, but only so much as to allow you to short this market at higher levels. The $2.60 level above is significantly important, so I don’t think that the market can get above there as we have seen so much in the way of previous selling in that area. While a pop above the highs of the trading session on Wednesday would be a good sign, it still is somewhat limited in what can be done.