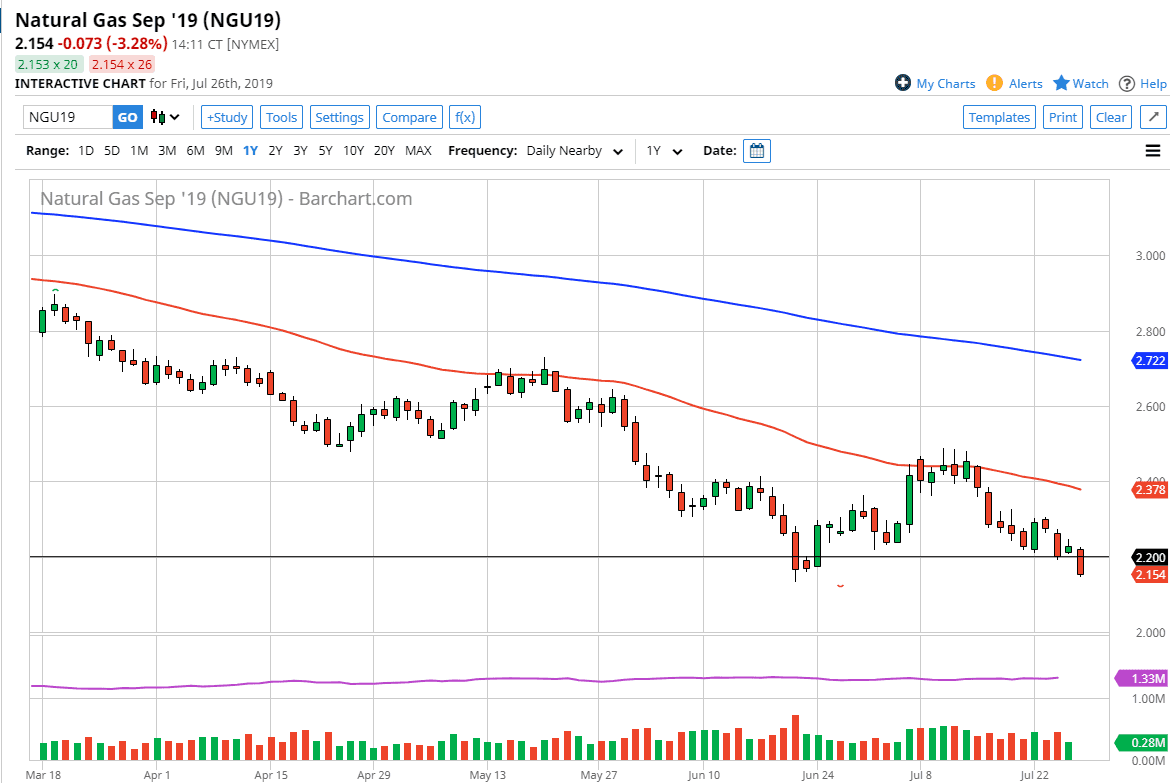

Natural gas markets continue to show signs of weakness, as we have broken below the $2.20 level significantly on Friday. In fact, we are closing at the very bottom of the range which of course is a very negative sign as well. Natural gas is oversupplied, and the easiest way to see just how bearish this market is would be to notice that we are at the lows again, reaching towards much lower levels. I think rallies at this point will continue to be faded, and that there are a whole multitude of areas above that could cause issues.

With the United States having over 14,000,000,000,000 ft.³ of natural gas in the ground, it’s difficult to imagine a scenario where we suddenly ran out of it. Because of this, I like the idea of selling rallies every time they occur, which should be thought of as gifts going into the market. I think the $2.20 level will be resistance, just as the $2.25 level will be and of course the $2.30 level. It’s not until we break above the $2.50 level that I think anything’s changed.

This market seems hell-bent on trying to test the $2.00 level underneath, which is a large number that will attract a lot of attention. The question now is when do we start the winter rally? We are currently trading the September contract, so we aren’t necessarily talking about wintertime yet. Given enough time though, we will see a massive spike in this commodity like we do every year. That being said, it’s not happening in the short term so I continue to fade rallies until something tells me otherwise. I suspect that the $2.00 level will attract a ton of attention though, and that could be close to the bottom as a lot of people will make a big deal about the big figure.

This is probably a market that’s best day traded on hourly charts that show signs of exhaustion after short-term rally. It’s difficult to imagine a scenario where you could get overly aggressive in one direction or the other this late in the trend, but clearly there is money to be made if you are quick and nimble at this point. Beyond the heating and cooling issue, we also have a potential lack of demand due to industrial slowdown around the world. In general, things don’t look good for natural gas.