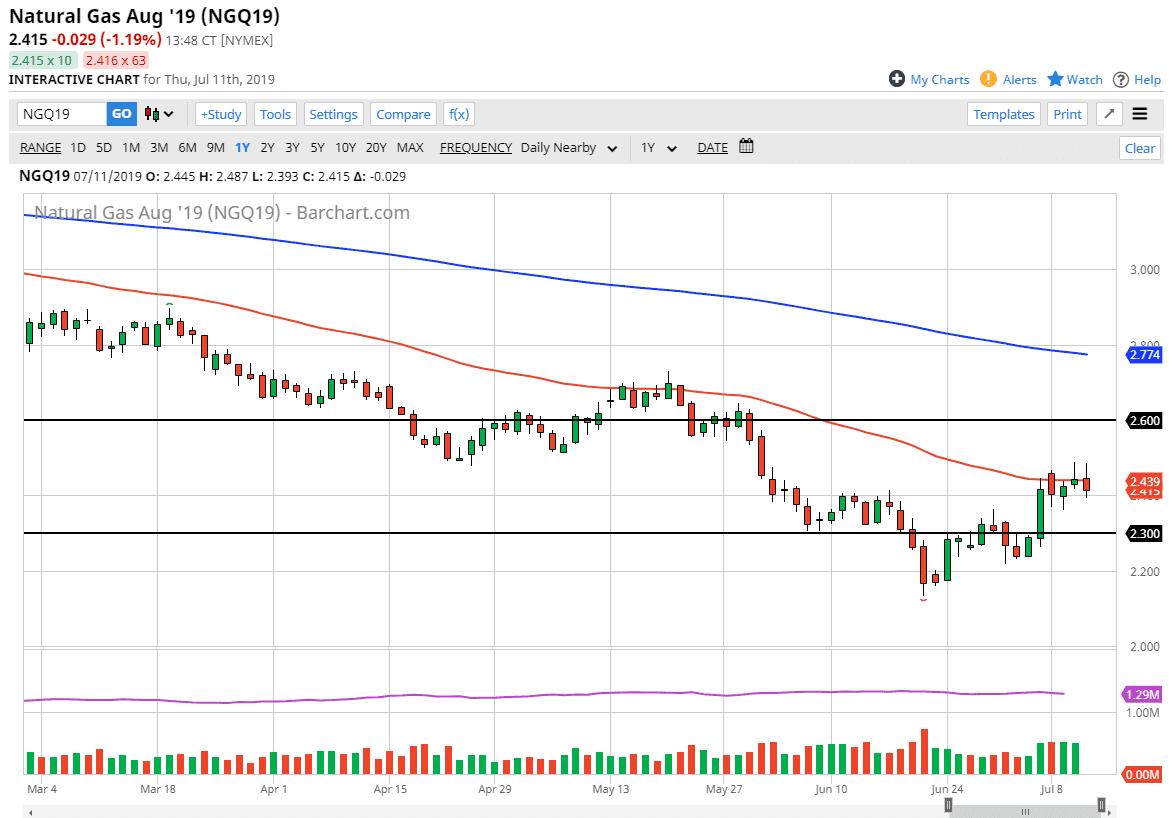

Natural gas markets rallied a bit during the trading session on Friday, dancing around the 50 day EMA. The $2.40 level underneath is support, just as the $2.50 level is significant resistance. At this point, the market is looking to try to make some type of decision, but at this point the markets are probably moving on the most recent headlines out there, the most important of which is the tropical storm heading into Louisiana. There are a lot of natural gas facilities in that region, so of course it can affect distribution.

That being said, the natural gas markets have also been rallying as of late due to the idea of hotter than expected temperatures coming in August, and that of course drives up demand for natural gas to cool off homes. However, both of these are minor blips on the longer-term radar, and therefore it’s likely that we will eventually see the sellers come back as the longer-term outlook for this commodity is most certainly bearish. After all, we have over 14,000,000,000,000 ft.³ of natural gas in the ground within the borders the United States alone, and they keep finding more. In other words, there’s always going to be natural gas in all of our lifetimes to continue to fuel the world.

That being said, demand does pick up at certain times of the year. August can be slightly bullish, but at the end of the day, it’s a slight blip on the radar. When I look at this chart I recognize that there is going to be a nice selling opportunity above, probably closer to the $2.60 level. At that point, I would jump all over any type of exhaustive candle that I can take advantage of, perhaps aiming for the $2.40 level and then after that the $2.30 level. Natural gas is not a market that I like in general, and therefore I think it’s only a matter time before we can take advantage of an overpriced situation.

If we do break above the $2.60 level, then the 200 day EMA will come into play near the $2.75 level, so therefore I think there are plenty of opportunities above to take advantage of exhaustion. Ultimately, this is a market that is bearish, but even in the most bearish market you will occasionally get a pop like we are seeing here.