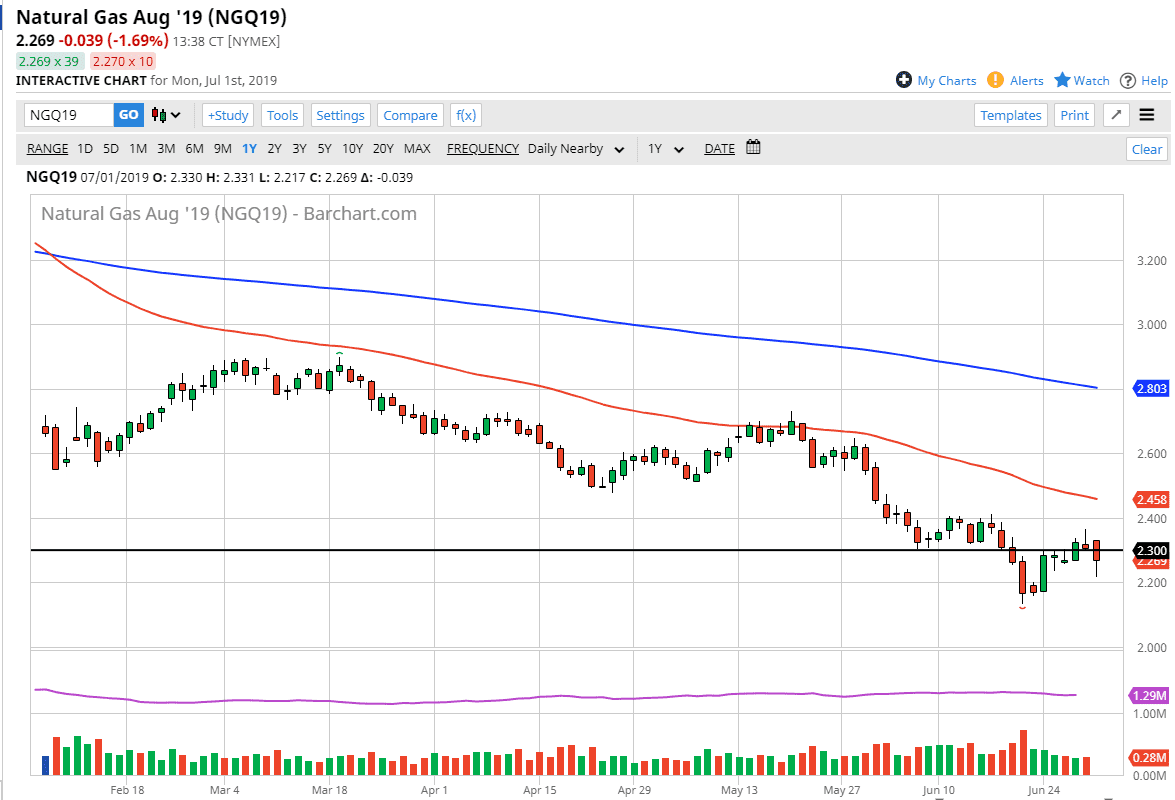

Natural gas markets broke down significantly during the trading session on Monday again, after initially trying to rally. This is a market that has been bearish for quite some time so it seems almost impossible to start buying at this point. The $2.30 being broken to the downside is of course a very negative sign, but we did get a bit of a bounce later in the day. I think this is more or less a function of the fact that we are so low in price right now. Short-term rallies continue to attract a lot of selling pressure, but I don’t think that it’s going to be very easy to hang onto the longer term short trades.

Looking at this chart, I believe that the $2.40 level above is resistance as well, and this is a market that is over supplied. The fact that we formed a shooting star on Friday was of course telling also, so I think at this point fading these short-term rallies will continue to work. Whether or not we are looking for some type of bigger move is a completely different question, but I do think that short-term traders will of course continue to be attracted to this marketplace.

Keep in mind that the market is very bearish this time a year typically anyway, so it’s a bit difficult to imagine a scenario where I’d be a buyer. Even if we did get above the $2.40 level, it’s very unlikely that we can break above the $2.45 level. That is the scene of the 50 day EMA, which has been quite reliable for some time. However, later in the year, most notably somewhere in the neighborhood of November, we will get a bullish move in this market that is absolutely brutal. I’ll be more than willing to buy natural gas then, but in the meantime I think we just simply continue to fade rallies. Yes, we’ve had a nice little pop late in the day on Monday but it’s hardly something to get overly excited about. Natural gas production continues to be extraordinarily strong, and demand lights. Beyond that, if we start to see a bit of a global slowdown, that will also work against the demand when it comes to natural gas markets. This market tends to move and $0.10 increments, which is exactly what we have seen during the trading session on Monday.