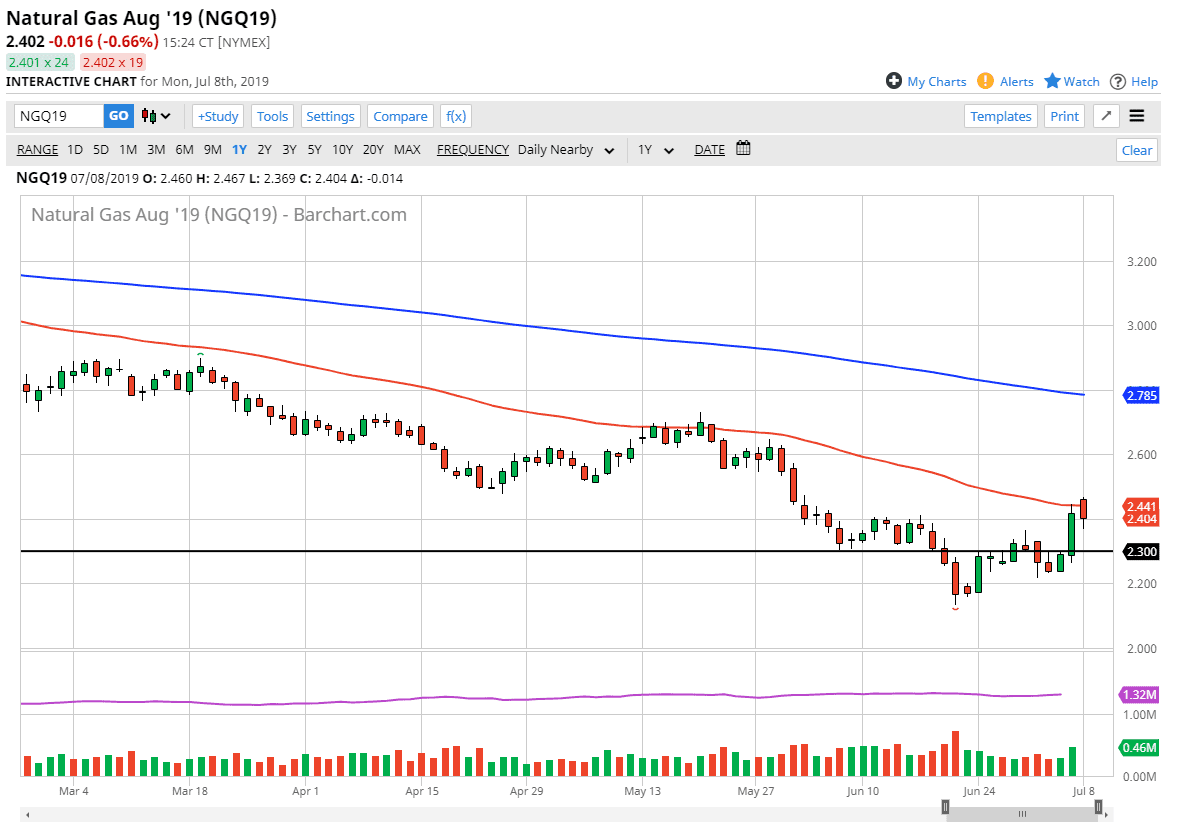

Natural gas markets gapped higher to kick off the week on Monday, and even managed to clear the 50 day EMA. That’s a very bullish sign but we have seen a turnaround since then, breaking well below the 50 day EMA and closing the gap, but did not bounce as one would expect. In fact, we broke down through that level and close near the $2.40 level.

Because of this, it’s likely that the market will continue to show the downward momentum, as the 50 day EMA certainly is pointy lower. On the other side of the equation we have broken above the $2.40 level which was resistance, so it does show some bullishness. I think at this point the market is probably best traded from a standpoint of looking for exhaustive candles too short, as we have been in a downtrend.

I do recognize that the market rallying from here only offers more value for sellers. I believe that the $2.60 level will be massive resistance and I think it’s only a matter of time before the sellers would jump all over this move. Any candlestick along the lines of a shooting star gets me short of this market. I also believe that the $2.30 level will be the initial target, followed by the $2.20 level. Quite frankly, there’s no reason to think that this market is going to go higher for the longer-term.

The pop over the last couple of days makes sense considering that the heatwave in the United States should drive up demand, and of course we are seeing higher temperature forecasts for the month of August. Nonetheless, this is a short-term phenomenon so by being patient you can simply trade with the trend, which is something you should be doing anyway. This market is typically bearish as oversupply is a consistent problem, with perhaps the exception of winter months in the United States. If something changes I will let you know, but I welcome rallies as they give me an opportunity to start selling again.

In fact, as a general rule I don’t like buying this market until we hit November or so. We are currently trading the August contract, so the rally that we have seen reflects that potential of higher temperatures to cool down homes, but that is a very short term thing, and people don’t necessarily run cooling 24 hours a day, unlike heat.