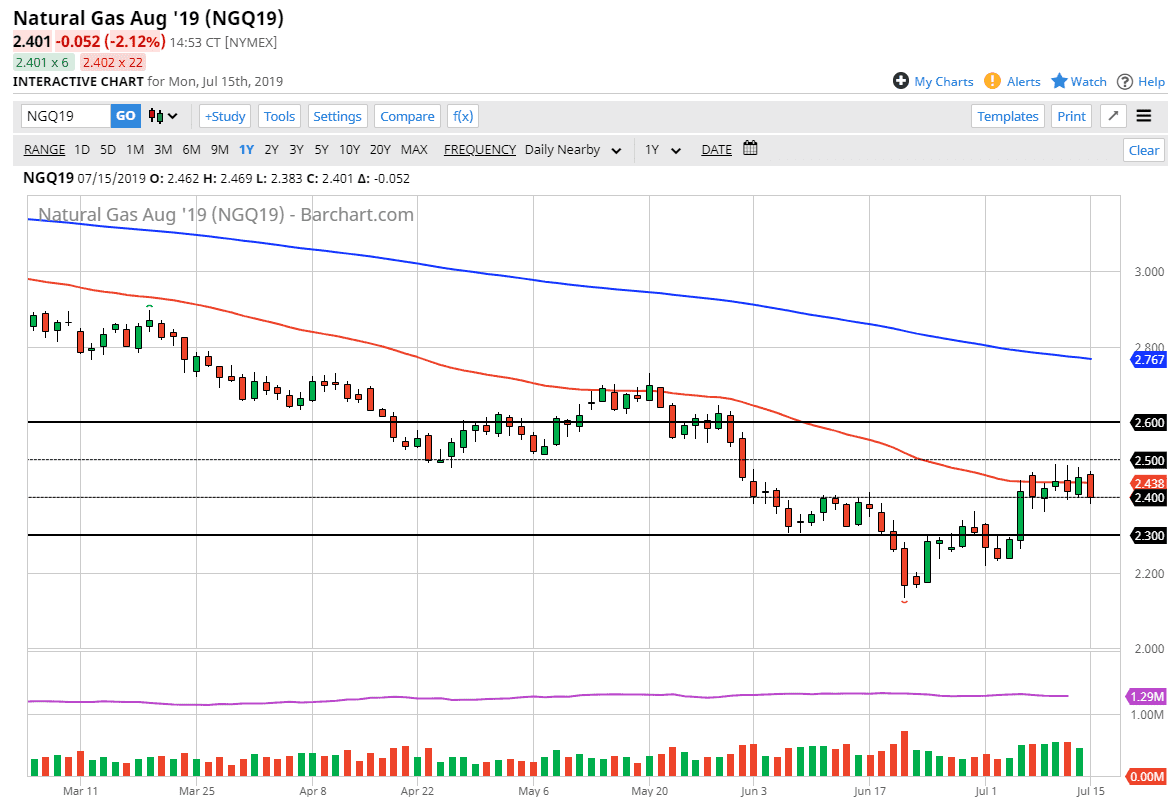

The natural gas markets fell during the trading session on Monday as we kick off the week yet again. The 50 day EMA is flat and we are testing the $2.40 level for support. This level has caused a significant amount of support over the last week or so, just as it has been significant resistance in the past. With that, it makes quite a bit of sense that we have paused at this area. Overall though, we have been in a downtrend so I am still very suspicious of any rallies.

One of the biggest factors recently for a rally in the price of natural gas has been the idea of the tropical storms slamming into the Gulf of Mexico and disrupting natural gas distribution. This is a short-lived phenomenon though, and quite frankly it is only a matter time before that is no longer an issue. Beyond that, we also have to worry about high temperatures in the United States expected to show up, and that of course will drive up demand for natural gas to cool homes and offices. That being said, the heat waves that we get in the US are short-lived most of the time, so this is a temporary driver of price.

All things being equal, we will eventually return to the major imbalance of supply. Natural gas is overly abundant in the United States and Canada, as well as many other nations around the world. Simply put, with the advent of fracking, a shortage of natural gas just isn’t going to be in the cards, with the exception of the occasional disruption. It will never be due to a lack of the actual commodity.

The market seems to be divvying up into $0.10 increments, so this point I’m willing to pay attention to the $2.50 level as resistance and short the first signs of exhaustion in that area. Even if we break above there, I think that there is even more resistance to be found at the $2.60 level. The alternate scenario of course is that we break down below the $2.40 level, freeing the market to go much lower, with the initial target being $2.30. Overall, I prefer to fade rallies as they offer an opportunity to get short of a market that is decidedly bearish. That being the case, this is a market that I have a hard time buying because of the longer-term outlook.