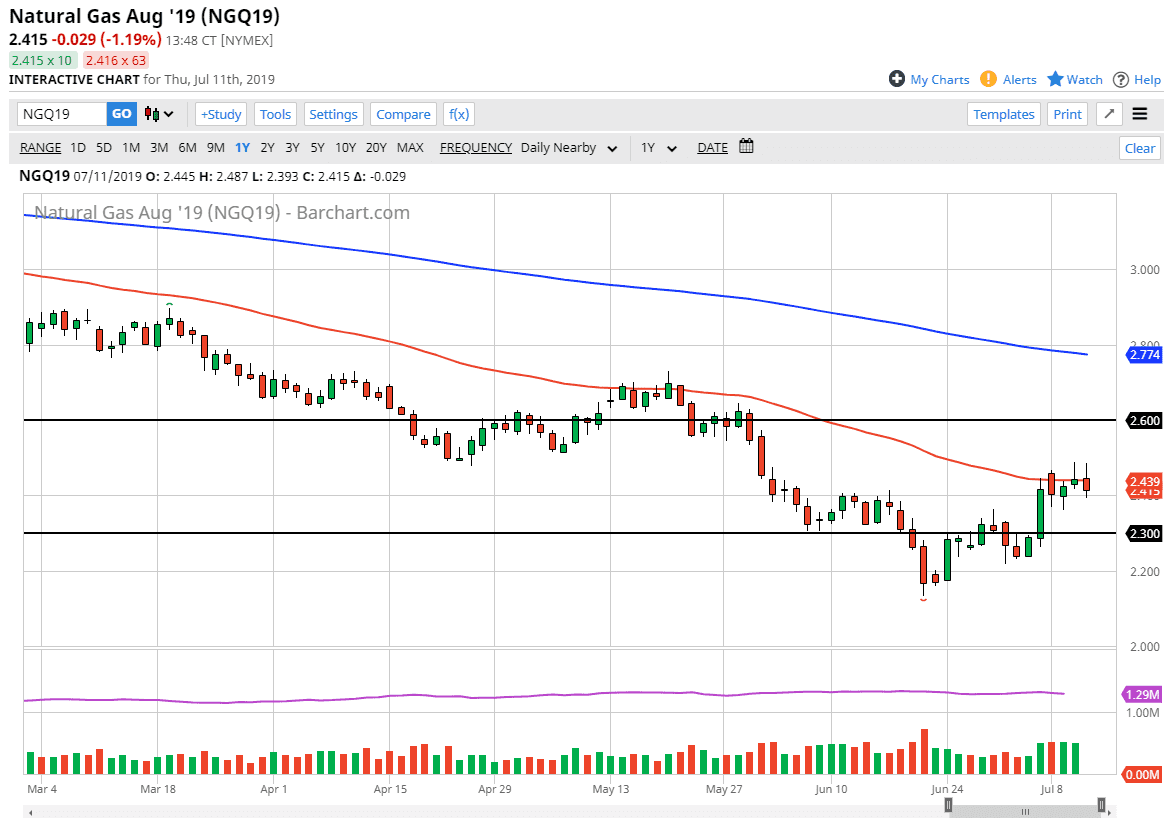

The natural gas markets initially rallied during trading on Thursday but have failed again at the first signs of trouble above the 50 day EMA. What’s interesting is that we did the exact same thing during the Wednesday session to form a shooting star, and now we have repeated this action on Thursday. This tells me that there is a lot of interest in this area so it wouldn’t be much of a surprise to see this market roll right back over. The $2.40 level should be somewhat supportive, but I think only from a psychological standpoint more than anything else. There is the aspect of “market memory” that you can take into account at this level as it was major resistance, but I think ultimately we are in a downtrend and that’s really all that matters.

Looking at this chart, we could very easily find this market down at the $2.30 level in the blink of an eye, because the oversupply of natural gas will continue to be an issue going forward, and I don’t see how that changes anytime soon. With that being the case, it’s very likely that what we are going to see is rallies sold into like we have over the last couple of days. That being said, the alternate signal would be that if we were able to break above both the Wednesday and Thursday high prices, that would show a significant break out to the upside and a complete reversal of momentum. By breaking through that level, it’s likely that the market probably goes looking towards the $2.60 level, an area that has been important more than once. Ultimately, this is a market that I do think will give us plenty of opportunities to short, as the natural gas markets have only been rallying due to the idea of a hotter than anticipated August in the United States. However, this is a short-term phenomenon, and therefore it’s very likely that we are going to get plenty of opportunities to short this market going forward. I do not have any interest in trying to buy this market, I think it’s simply a matter of waiting for the right exhaustion to take advantage of. To the downside, if we can break down below the $2.30 level we will revisit the lows yet again. Natural gas remains very bearish from a longer-term standpoint.