Natural gas markets will be very thin during the trading session on Thursday, as we are going to see people celebrating the Independence Day holiday in the United States. This leads to limited electronic trading, but nonetheless there will be some movement, especially in the CFD markets. That being the case, I will look at the natural gas markets but issue this warning ahead of time: natural gas markets, as well as many other commodity markets, will be very thin and therefore susceptible to erratic movement.

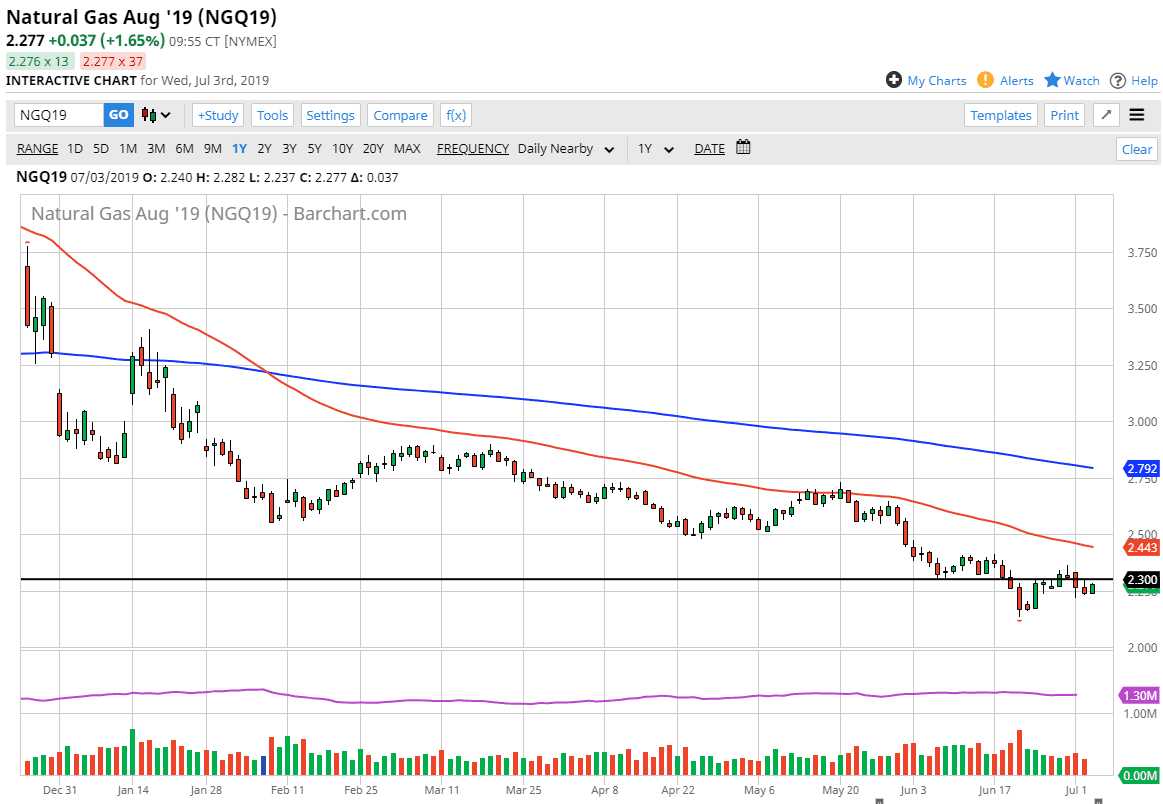

Natural gas markets will continue to show negative pressure longer-term, and the $2.30 level should offer quite a bit of resistance as we have seen it do so in the past. Ultimately, if we rally from here it’s likely that the $2.40 level will also be resistive as well. Overall, this is a market that continues to fade on rallies, and therefore signs of exhaustion on short-term charts will probably be the best opportunities. At this point, the market looks as if it will continue to be more of a short-term traders type of situation, as we are close to the bottom of the overall downtrend from what I can tell.

The $2.00 level underneath is massive support, as it is a large, round, psychologically and historically significant number. Ultimately, this is a market that has a lot of resistance above, and the form of the 50 day EMA, and every $0.10. The oversupply of natural gas should continue to weigh upon the market, at least until we get to the colder temperatures later this year. Typically, this time of year is very bearish for natural gas as the demand simply is a going to be there. Beyond that, we are starting to see concerns about a global slowdown and that could come into effect as well.

Now, going into the session on Thursday: slippage could be a major situation, especially in the electronic trading. Natural gas markets do tend to be somewhat erratic anyways, so you can’t necessarily count on getting filled at the exact price you place. If you have the ability to trade the CFD market, that might be the best way to go, because if nothing else you can trade in a relatively small position size. All things being equal though, you are probably better off waiting until the jobs number comes out on Friday, as we should have more volume in the market at that point.