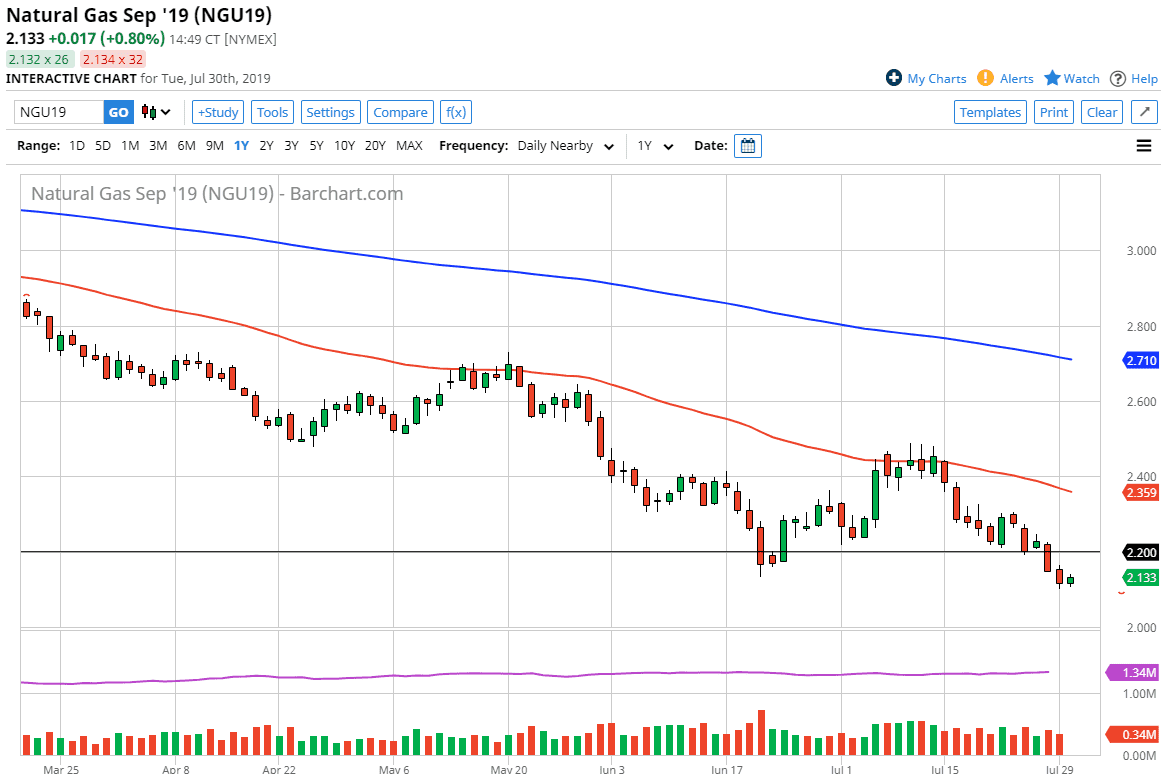

Natural gas markets have been trying to rally a bit during the trading session on Tuesday, but it’s only a matter time before the overall trend continues. After all, this is a market that has been in a negative trend for what seems like ages, and of course there is nothing changing anytime soon to keep this model of bearishness to continue.

There is a major issue with the fact that we continue to see far too much in the way of natural gas supply to be taken out by demand. Ultimately, I think that the market has plenty of resistance barriers above that continue to keep this market negative from a technical standpoint as well. When I look at the $2.20 level, I recognize that there is a lot of potential for selling pressure there. After that, then we have the obvious $2.25 level for resistance from a psychologically important standpoint.

Ultimately, the market has the $2.00 level in its focus, and I do think that eventually where we try to get to. It’s going to take some time to get there, but there’s no reason to think that we won’t. Yes, there does come a point where it’s far too cheap, but we don’t have that right now. I believe that this market will continue to see rally sold off, at least in the short term. Longer-term, we will eventually see a bounce but we aren’t anywhere near that point in time.

One of the main reasons that we should get a bit of a bounce is that we are going to continue to pay attention to the cyclicality of the market. After all, it’s only a matter of time before cold temperatures come back towards North America and Europe, and that should send the natural gas markets higher once we start trading this cold months contracts. However, we are doing that right now and therefore I think we will continue to pay attention to those levels mentioned previously, and of course the 50 day EMA which is pictured in red on the chart. It has been reliable resistance previously, so think it is going to continue to be the “ceiling” in this market. I expect a massive bounce from the $2.00 level, even if we do reach that before we switch over the cold months. If we were to break down below there, that would be an extraordinarily negative sign to say the least.