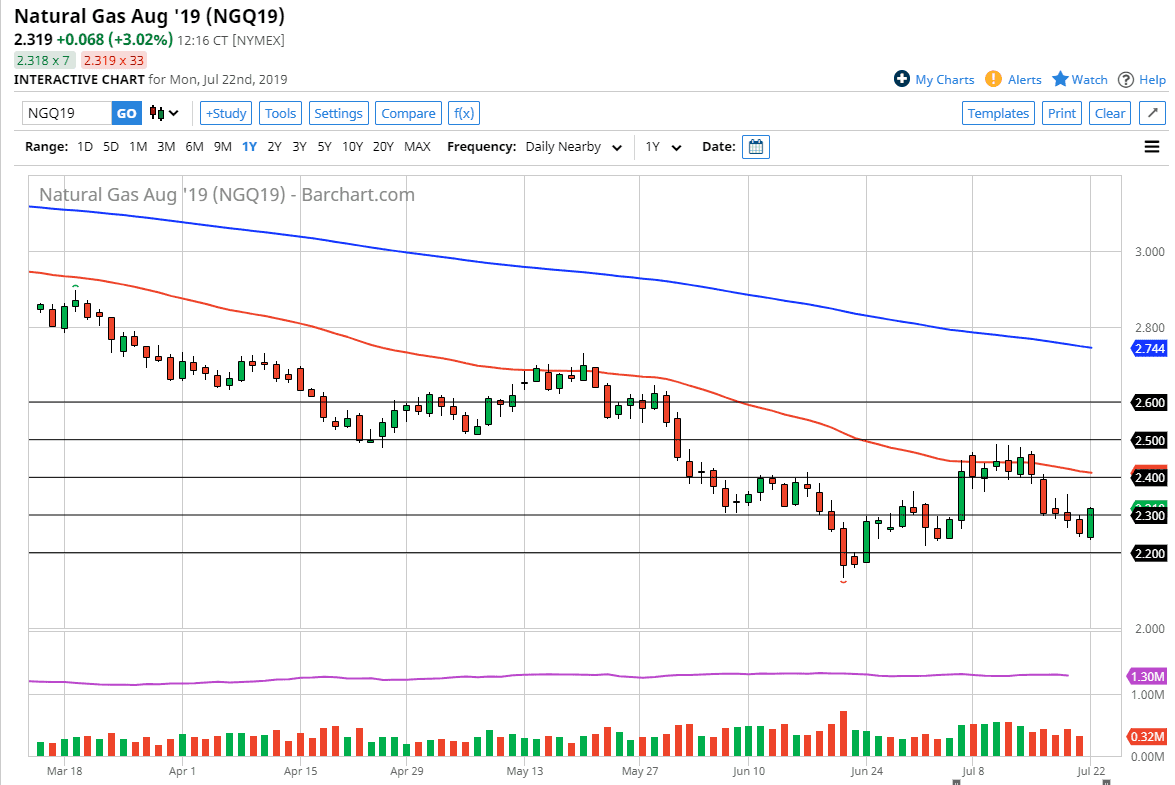

The natural gas markets have rallied a bit during the trading session on Monday, forming a bullish engulfing candlestick. That being the case, it’s very likely that we are going to see a continuation of this rally based upon the fact that this candlestick was formed, and quite often it does signify a bit of a trend reversal. Don’t get me wrong though, I don’t think it’s a complete trend reversal rather a nice bounce setting up.

I look at any bounce as a gift

I look at any bounce as a potential gift in this market, because we are in a longer-term bearish trend. The bearish candlestick probably brings more traders in but I also recognize that we have a couple of long wicks from Wednesday and Thursday of last week, and that should show selling pressure. Beyond that, the $2.40 level is an area that was previous support and should now be resistance. The 50 day EMA is also traveling right around that level, so I think that we could get a little bit of a bounce towards that area, but I think it would be a nice selling opportunity and what has been a longer-term downtrend.

The fact that we closed at the very top of the candle stick normally means that we do get a little bit of follow-through, but I think counter trend rallies will continue to be sold mainly because of the massive amount of oversupply when it comes to natural gas. Many blip on the radar when it comes to supply is going to be a short-term situation, considering that the couple of reasons that we have had recently have been the tropical storm in the Gulf of Mexico, and the heatwave in the United States which is currently breaking. Both of these are short-term situations, in what is a long-term market.

Technical analysis

Looking at the natural gas markets it’s obvious that we may have a day or two of bullish pressure ahead of us, but it’s not worth trying to take advantage of. I believe at this point it’s very likely that we continue to short signs of exhaustion, as the market seems to show a lot of price action and trading between the $2.40 level and the $2.50 level above. I think that is a major barrier that is going to be difficult to overcome, and therefore it’s likely that we are going to continue to see a lot of noise in that area, and at the first signs of exhaustion I think you become short. Beyond that, if we get closer to the $2.40 level, and form something like a shooting star, then I become aggressively short. As far as buying is concerned, I’m not interested in doing so until we start trading colder months in the futures market. It’s a cyclical phenomenon that I’m willing to take advantage of, but we aren’t quite there yet.