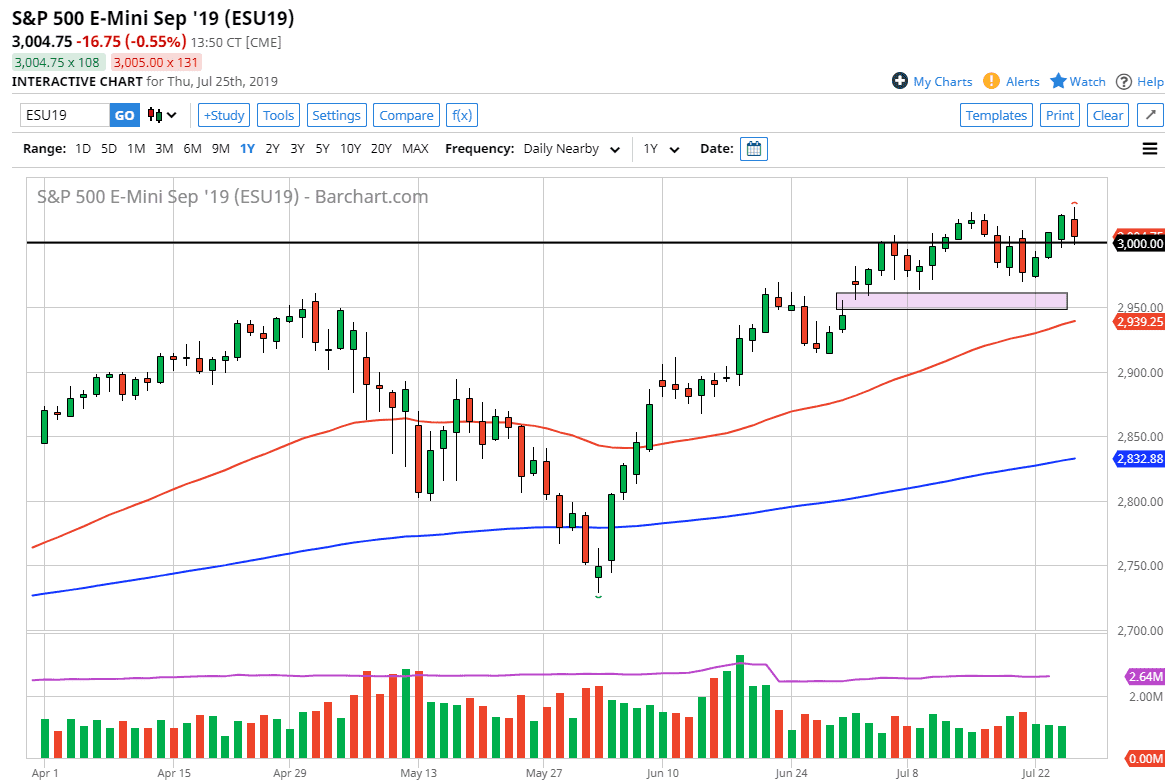

The S&P 500 initially tried to rally during the trading session on Thursday but could not hang onto gains. Because of this, it looks as if the market isn’t quite ready to go anywhere and there are a multitude of reasons to think that could happen. For example, the most important thing is that we are heading into the weekend and a lot of people do not like the idea of carrying risk into that weekend.

The gap below at the 2950 handle is massive support, and as long as we can stay above there I think that it is a very good sign. The 50 day EMA is starting to run toward that level so I think it’s likely that we will find buyers. Otherwise, if we break down below the 50 day EMA, then things could get a little bit soft and negative, perhaps reaching down to the 2900 level. To the upside, if we can make a fresh, new high it’s likely that we probably go looking towards the 3050 level. All things being equal though, there are a multitude of things that we need to keep in mind.

The earnings season of course will cause a lot of trouble, and a lot of volatility. However, I believe that the most important thing to pay attention to is the Federal Reserve and whether or not they are going to cut rates. At this juncture it’s almost impossible to imagine a scenario where the Federal Reserve won’t give the Wall Street group what they want, so it’s likely that the market has already priced in at least the 25 basis point cut. However, that biggest question is going to be what the statement is like after the interest rate cut. That will be what people pay attention to the most, so therefore I think it’s important to glean what the attitude is going to be.

If we did break down below the gap underneath, it would probably have something to do with a more hawkish than expected Federal Reserve, but quite frankly that would be a huge shock. Earnings don’t matter, it’s interest rate cuts that do and therefore even if we do get pullbacks you should probably think of them more as a potential buying opportunity at this point. We are in a trading range right now, so ultimately that is how this should be approached.