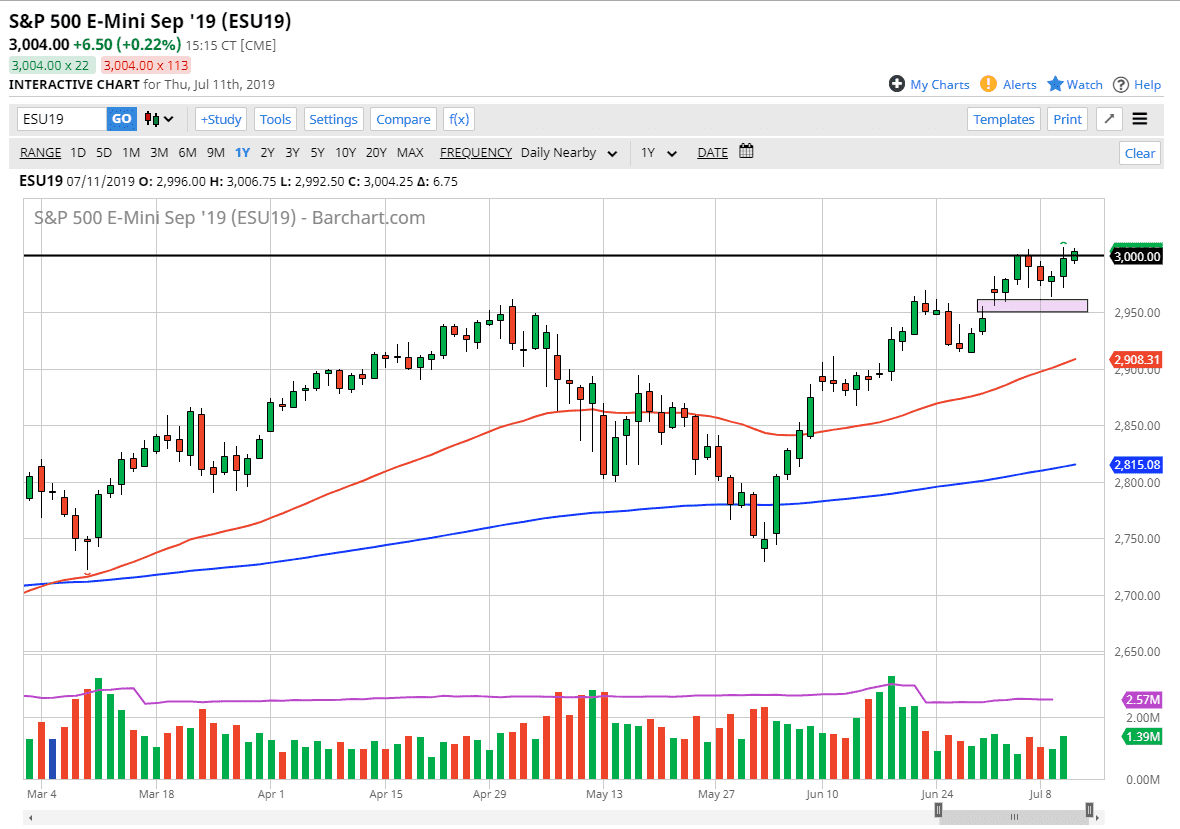

The S&P 500 has broken above the 3000 level yet again, closing above the level for the first time. That being the case, the market looks as if it is ready to go higher but we may get the occasional short-term pullback. The occasional short-term pullback should be thought of as value that we can take advantage of, as the reserve is going to cut interest rates. That is the jet fuel needed for Wall Street, although this has already been priced in. The question at this point is whether or not they can continue this.

The 2950 level underneath is massive support based upon the gap, and of course the couple of attempts that we have made. As long as we can stay above the 2950 handle, the market is very likely to continue to go higher. Ultimately, if we can break above the Wednesday candle stick, then the market is ready to go much higher. I think at this point the market continues to show bullish pressure, and therefore you can’t fight what’s going on.

We are getting close to a larger earnings season, and there will be a lot of questions about individual stocks as to where they go. However, it has become a market that simply worries about the Federal Reserve and nothing else. The only thing they care about is whether or not there is liquidity being added by the Federal Reserve, and nothing else. Ultimately, that’s been the Wall Street game for quite some time, at least going back to the great recession.

If we were to break down below the 2950 level then we will probably find support at the 50 day EMA which is drawn as red on the chart. As long as we can stay above there it’s very likely that the uptrend continues. Expect a lot of choppiness and noise appear, but the fact that we close above the 3000 handle is yet another reason to think good things about the market. Friday’s tend to be a bit tricky but we could get traders trying to hold over the weekend for any potential gap up. I wouldn’t hold my breath on that, but it is a potential possibility as things go. Look at dips as value, and think about trying to find value in a market that has priced Federal Reserve easiness and perhaps even a bit of perfection.