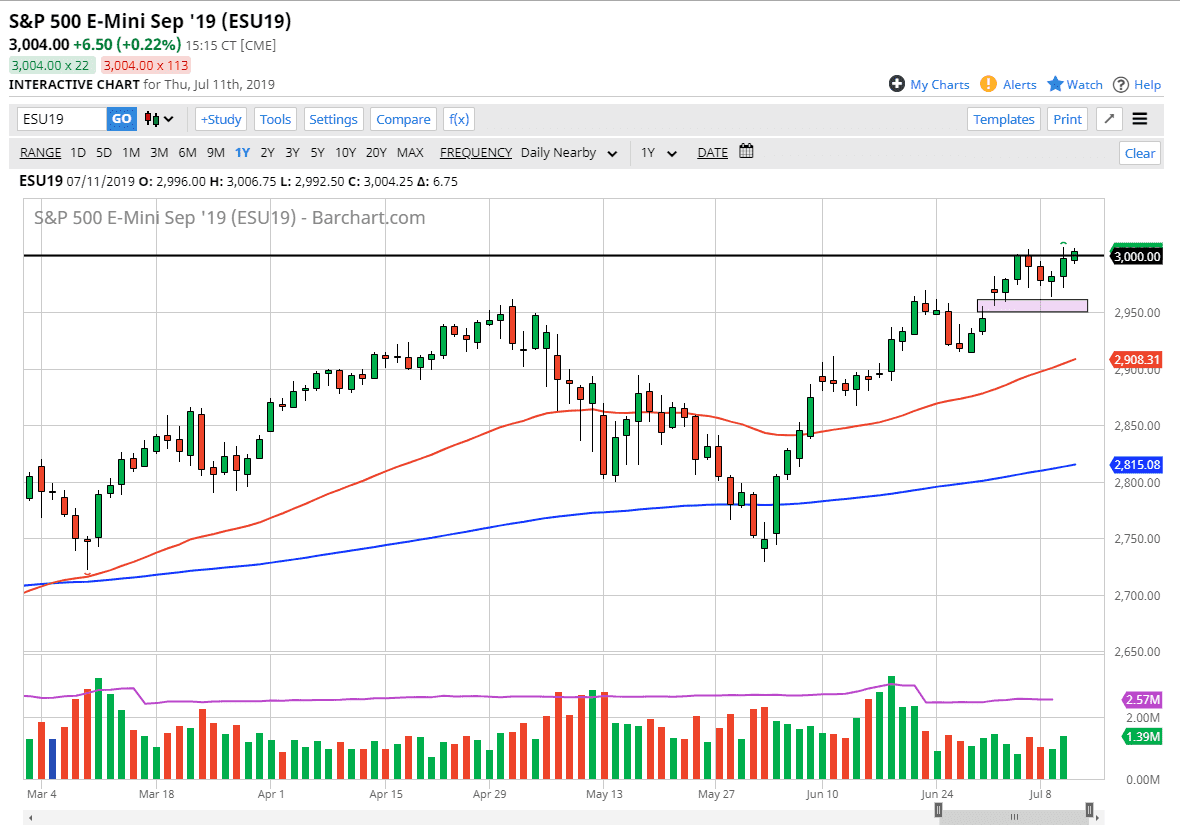

The S&P 500 rallied again during the day on Friday, reaching above the 3010 level to show even more strength. This is a market that continues to show signs of life and resiliency, as every time we pull back the buyers jump right back in. This isn’t necessarily due to any type of earnings; we have those coming in the future. The reality is that the market doesn’t care about those for the longer-term run though, they are paying attention to the Federal Reserve more than anything else. As long as they cut interest rates in July, and then perhaps show a proclivity to cut further in the future, it’s likely that the stock markets will continue to go much higher.

Short-term pullbacks continue to offer buying opportunities, as the 3000 level will offer a significant amount of support as it was previous resistance. Underneath, there is a massive gap at the 2950 level that should continue to help this market go higher. Ultimately, the dips are to be looked at as offering value, as the trend is most certainly higher, and there’s no reason to think that is going to change in the short term.

Longer-term, I believe that we are going to go looking towards the 3020 handle, and then eventually the 3050 handle. That being the case, it’s very likely that we will see volatility, but ultimately this is a situation that shows just how bullish the market is as we don’t really have any reason to think that the attitude is going to change. Recently, we have seen a major change in the attitude of the Federal Reserve and I think that over the next couple of months we should continue to see a lot of support for the stock market.

Ultimately though, the market will continue to show signs of nervousness, as the stability of this market is lacking. The bond market is signaling recession, while the stock market is showing signs of economic strength. Ultimately, this is a market that needs to be played from a technical standpoint, and not any hint of logic, this market should’ve fallen apart a long time ago but ultimately this is a strong move, and it isn’t showing any signs of letting up in the short term. The volatility seems to be muted, and as long as the VIX stays below 20, we should continue to show bullishness here.