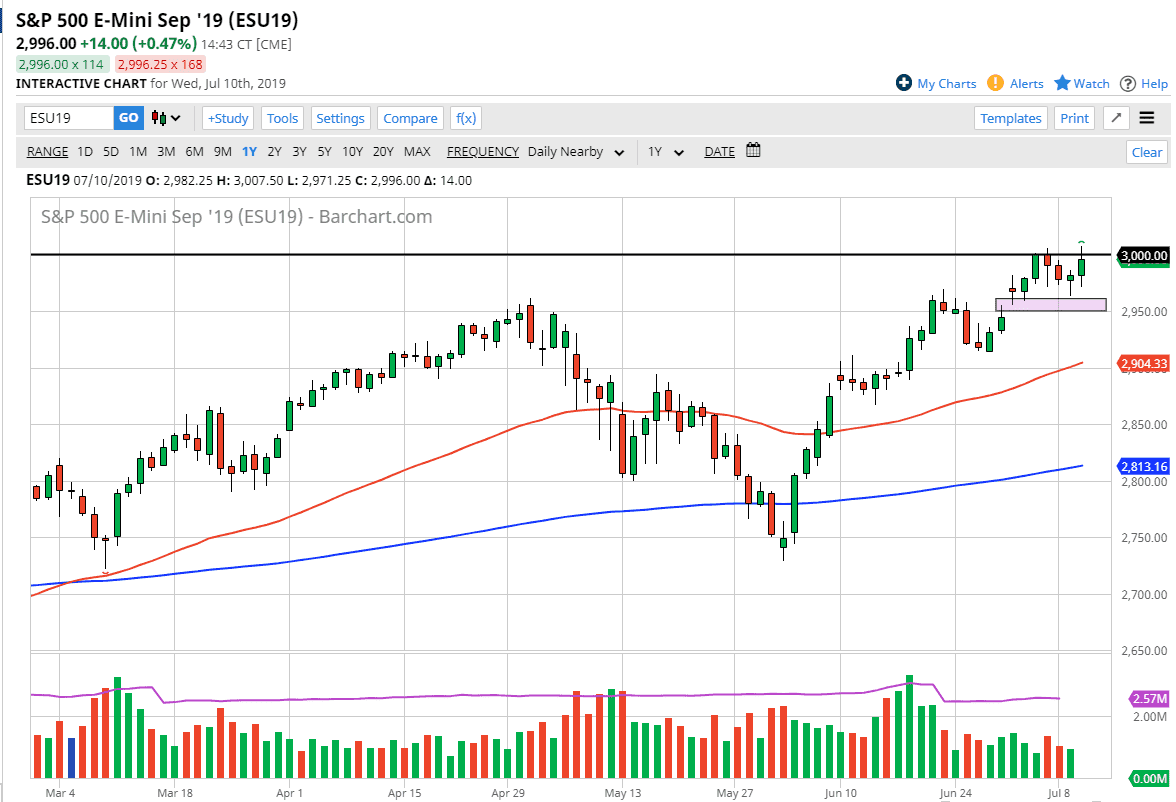

The S&P 500 initially tried to pull back during the trading session on Wednesday but gained quite a bit of pressure to the upside after the opening statement from the Humphrey Hawkins testimony was released. After that, it looks as if the stock markets is scratch that are ready to continue to go higher and break above the 3000 resistance barrier. The large, round, psychologically important level at the 3000 level will of course cause a certain amount of noise, but it makes sense that now that we have pierced that level couple of times, it’s only a matter of time before it gives way and we start to see real momentum come into this market plays.

Looking at the chart, you can see that the 2950 level has offered support in the past, and if you have it marked by a pink box. This box represents a small gap, and perhaps more importantly the previous highs that we have seen. At that, the market looks likely to consider this level the “floor” in the longer-term market, allowing for a bit of a barrier of protection. If we pull back from here, I’d be looking for short-term supportive candles to take advantage of the overall attitude of the market. Ultimately, this is a market that will be very noisy, but at this point it’s very unlikely that the barrier can hold under the pressure of anymore attempts.

Simply put, once we get a daily close above the 3000 handle this market is primed to take off to the upside. The alternate scenario of course is that we break down below that gap I mentioned at the 2950 level, and if we get a daily close below there the market probably goes down to the 50 day EMA. Overall, this is a market that is bullish but it is also focusing on only one thing at this point in time: easy monetary policy out of the Federal Reserve. As long as money monetary policy is easy, this is a market that should continue to go higher. Dips will be bought, unless of course something changes drastically out of the Federal Reserve. I doubt that happens, because we have seen more than one scene where the Federal Reserve buckles and acquiesces to what Wall Street wants overall. Wall Street wants low interest rates and interest rate cuts, and that we getting them.