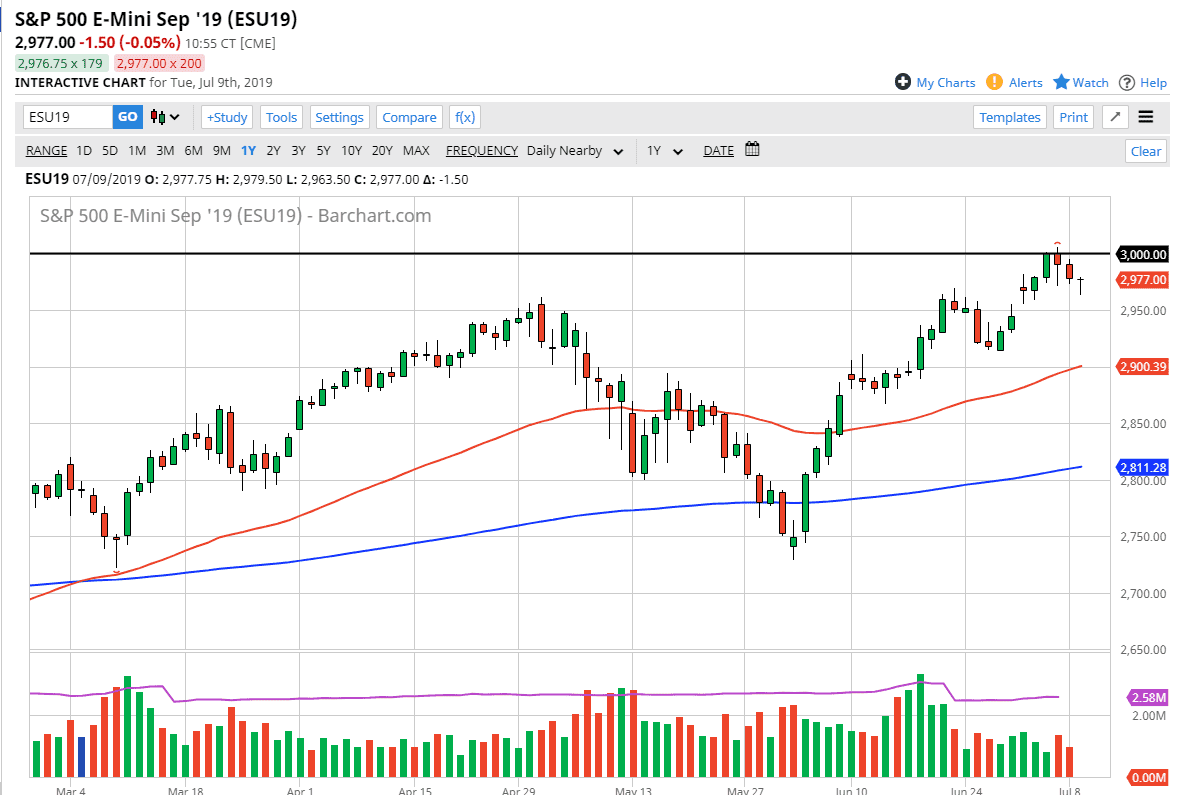

The S&P 500 initially fell during the trading session on Tuesday but did find enough buyers underneath at the 2965 level to turn things around. That does show quite a bit of bullishness, but we have a gap below that has yet to be filled. That Is closer to the 2950 level so I think that it’s only a matter of time before each down there and find plenty of buyers. Keep in mind that’s my thought, not an indisputable fact.

The fact that we do find buyers on dips tells me that the market wants to go higher over the longer-term. We have Jerome Powell testifying in front of the United States Congress for both Wednesday and Thursday, so that of course will cause a lot of volatility and not only the stock market, but also the US dollar. If he’s altered dovish, then Wall Street will celebrate by going long stocks. If he isn’t dovish enough that could be detrimental and could send the S&P 500 lower and a bit of a tantrum.

If we were to break down below the gap below, which has a bottom closer to the 2945 handle, then we probably go looking towards the 50 day EMA which is closer to the 2900 level. That’s an area that is massive support, both from a structural and psychological standpoint. If we were to give up the 2900 level, that would be extraordinarily negative. However, it’s obvious to me that this market is “leaning higher”, meaning that all we need is some type of catalyst to start buying and breaking above that crucial 3000 psychological barrier. Once we break above that level, then it’s very likely that we go looking towards the 3050 handle, possibly even the 3100 level.

Obviously, if we were to break down though, it would be a stunning reversal and could send a massive amount of order flow looking for the exits. That of course will exacerbate any negativity, and it could be a nasty flash crash. However, I do think that at this point it seems like the buyers have complete control so unless Chairman Powell says something incredibly stupid, it’s likely that the market will get what it wants, and at the very least hang around this general vicinity. Longer-term, this could be a different story but right now it looks like the market is trying to break out to the upside.