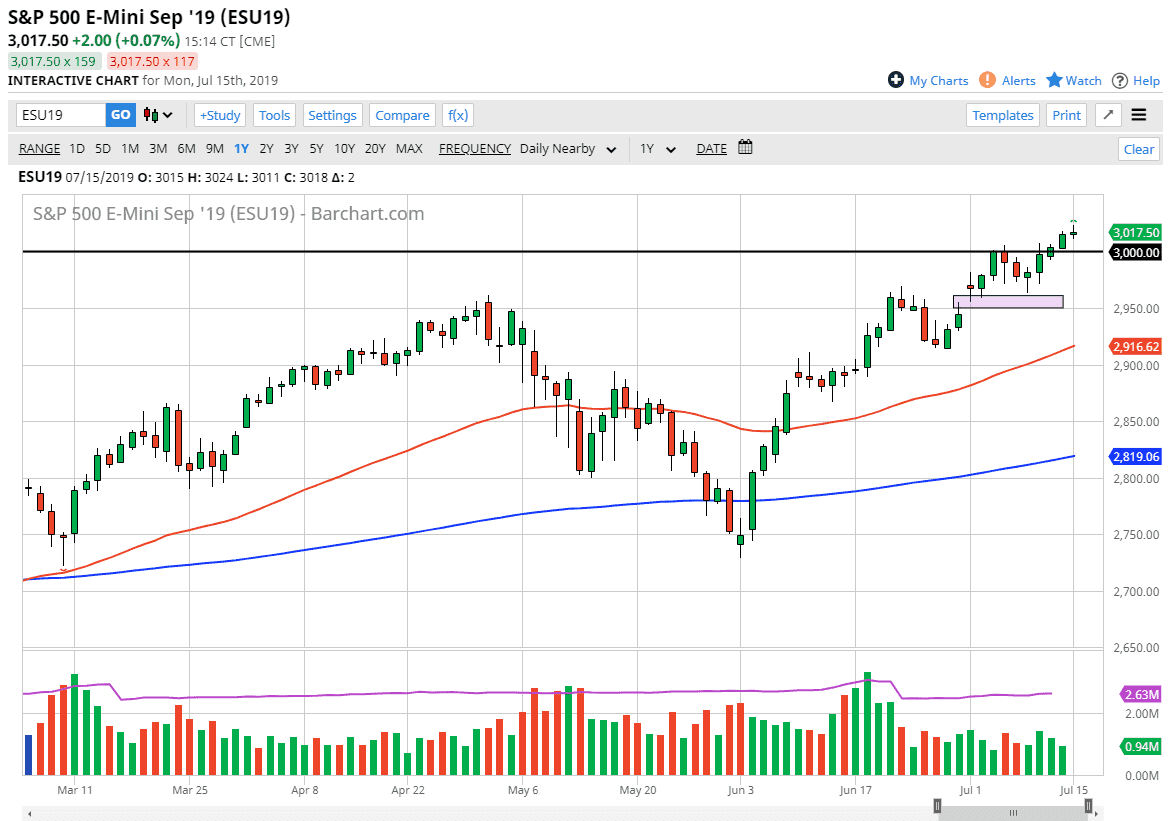

The S&P 500 went back and forth during trading on Monday, granting slightly higher during the trading session on Monday. We are at all-time highs, so it’s not a huge surprise to see that we are struggling a bit to continue to the upside. I think at this point now that we are well above the 3000 handle, it’s likely that we are going to see buyers in that area on any type of pullback, which might be what we are about to see.

As you can see on the chart, I have a box drawn near the 2950 level that should offer significant support. After all, it’s a “midcentury number”, and the scene of a gap. We had formed a hammer there last week, so it’s already shown itself to be an area where buyers are willing to step in. At this point I like the idea of picking up value as we are most decidedly in an uptrend, but that doesn’t necessarily mean that we just jump in whenever.

At this point in time it appears equity markets continue to rise based upon Federal Reserve softness, and that’s going to continue to be the case. In fact, you can make an argument that the S&P 500 has had nothing to do with the economy for the last 11 years or so, and simply everything to do with the Federal Reserve cutting rates or adding liquidity. Although we are getting ready to enter earnings season, any effect that announcements will have will be short-lived based upon profitability. Profitability doesn’t matter, it’s liquidity that drives this market.

If we were to break down below the 50 day EMA, which is pictured in red on the chart, then I would consider the trend over with and more than likely this market should continue to break down rather drastically from that point. Short-term pullbacks should continue to offer the value the people are looking for, because there have been a lot of people out there very skeptical of this rally, not understanding that the fundamentals have been disjointed for years. Ultimately, this is a market that should continue to see quite a bit of noise, but we have levels to watch in case of a significant break down. That breakdown could of course facilitate much lower prices, but right now it seems a bit unlikely unless of course the Federal Reserve fails to cut rates.