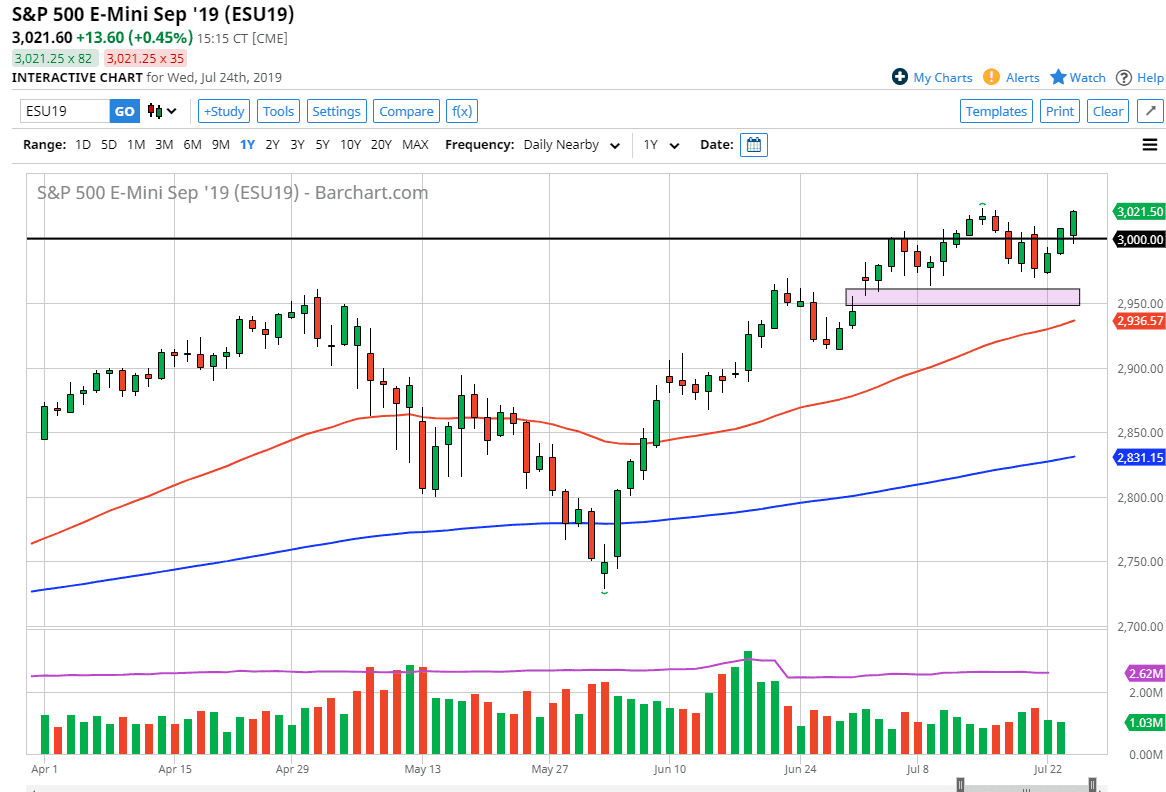

The S&P 500 has pulled back a bit during the trading session on Wednesday but found support underneath the psychologically and structurally important 3000 handle. At this point, it’s obvious that the stock market is ready to go much higher, and it should be noted that the NASDAQ 100 is already at fresh all-time highs. The S&P 500 will almost certainly follow, and the fact that we are closing at the top of the range certainly does nothing to hurt that assertion. I think that the market probably finds plenty of reasons to break out, perhaps none more prevalent than the Federal Reserve looking to cut interest rates. At this point, we are at the very top of the most recent consolidation area and banging on the door of much higher levels.

The gap underneath at the 2950 level should also be paid close attention to, because it is a major support level that should continue to drive this market higher as well. That is an area that if we broke down below would send this market into a tirade, but I don’t see that happening after what we see on the chart. We do have earnings after the bell obviously, but nobody cares about that because we get those low interest rates the drive stocks higher.

I suspect that the next major level that we are going to go looking towards is the 3050 handle, and then possibly the 3100 handle. The S&P 500 has been very strong all year, and it looks like we are ready to go much higher, not only based upon the price action but also based upon the order flow that I had been witnessing all day. We had seen major blocks of orders and the magnitude of 850, 1000, and even at 1200 contracts being flaunted and jumping on the offers. That’s an extraordinarily bullish sign, and most certainly somebody out there has a lot of conviction.

If for some reason we were to turn around and break down below the 2950 handle, it’s likely that we could break down to the 2900 level, but that seems to be all but impossible after the action that we have seen over the last couple of days. I for one will be long of this market just above the 3020 handle and aiming for 30 points.