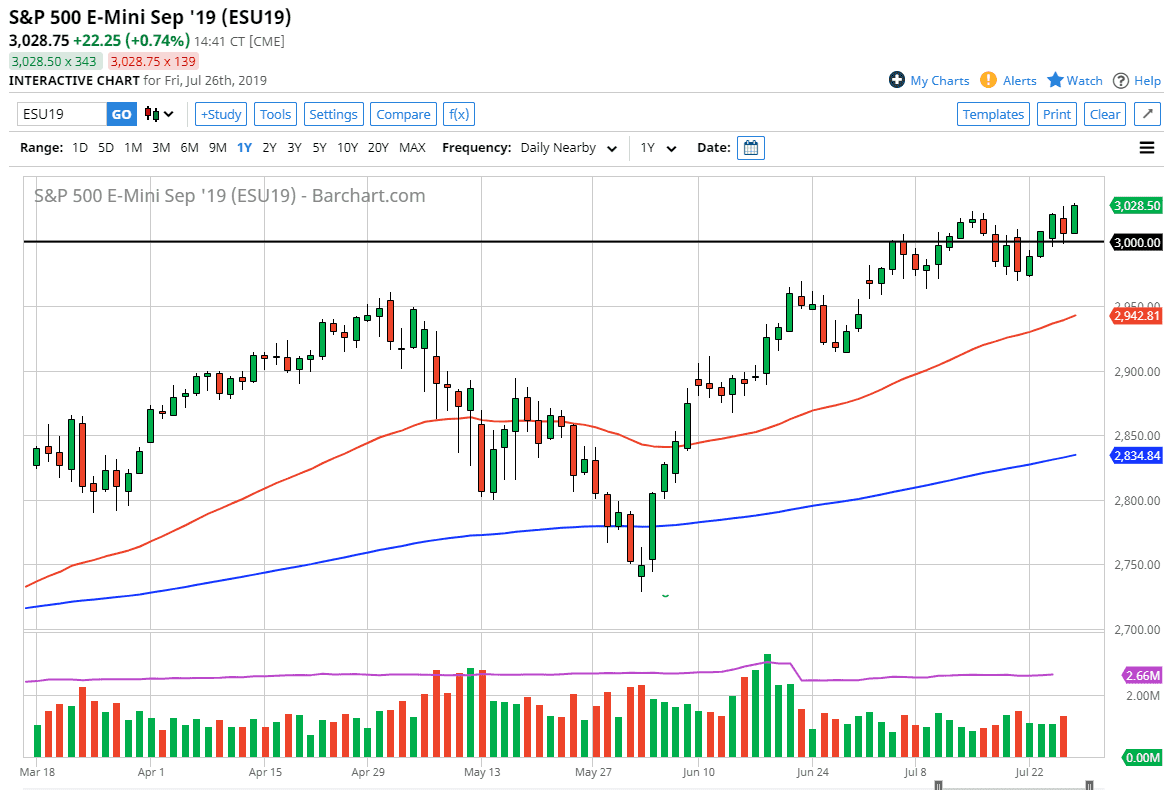

The S&P 500 rallied significantly during the trading session on Friday, reaching above the 3025 handle. As we are closing at the very top of the daily candle stick, this shows very good strength, and we have made a fresh, new high. That being the case though, we have barely done so and I think it’s very likely that we could see a little bit of a short-term pullback.

I think the 3000 level underneath should be supportive, as it is now in the rearview mirror. That is the bottom of the last three candlesticks, and now looks very likely to be an area where a lot of buyers would get involved. We have been grinding higher for some time, so I think that the market probably will continue to find plenty of reasons to go higher. Ultimately, the market is focusing on several things, not the least of which will be the Federal Reserve cutting interest rates. If they cut interest rates and then have a massive dovish statement come out, then we could see the markets continue to react in a positive manner, at least in the short term.

Ultimately, this is a market that I think has plenty of support at the 3000 handle, but perhaps even if we did reenter that consolidation area, it’s likely that the market will find even more support down at the gap underneath which currently resides at the 2950 handle. The 50 day EMA is just below there as well, so now it looks like there is at least a couple of reasons why the buyers would reenter on the type of pullback. Regardless though, this is a market that has been extraordinarily bullish, and the fact that we closed the way we did on Friday suggests that people are not worried about carrying risk into the weekend and that of course is a very bullish sign.

Short-term pullbacks I believe will be a nice opportunity that people will be looking towards, as we clearly are in an uptrend and it looks as if the earnings season isn’t going to change that anytime soon. I do like the idea of buying, but I also recognize that the market has made his decision for quite some time. All things been equal though, if we did break down below the 50 day EMA, the market would collapse and go much lower.