The S&P 500 of course gapped higher to kick off the week, as word got out that the Americans would not increase tariffs against the Chinese. While this is a good turn of events, the price action since that announcement and that subsequent opening has been horrible. With that in mind, it’s very likely that the market is going to show itself to be unimpressed with the turn of events and will be looking for the next catalyst to start trading.

The gap looks like it is going to be filled, so the question then becomes whether or not we can hold that gap which is roughly 2950. If we can, that’s obviously a bullish sign but there are couple of variables this week that will make trading a bit more difficult and different than usual.

We have the Independence Day holiday in the United States on the fourth, and that will cause a lack of volume, but after that we have the jobs figure coming out on Friday, which is going to be crucial as to where we go next. The reality is that jobs figure tends to throw the market around into a lot of volatility but doesn’t necessarily settle anything. At this point I think we are starting to enter a “bad is good” phase, because if the jobs number comes out far too weak, people may be afraid that the Federal Reserve will be cutting interest rates in July. Let’s be honest here, the only thing that’s really lifting the stock markets right now it is the expectation of the Federal Reserve rate cut, and if that gets thrown into disarray that could throw this market into disarray as well.

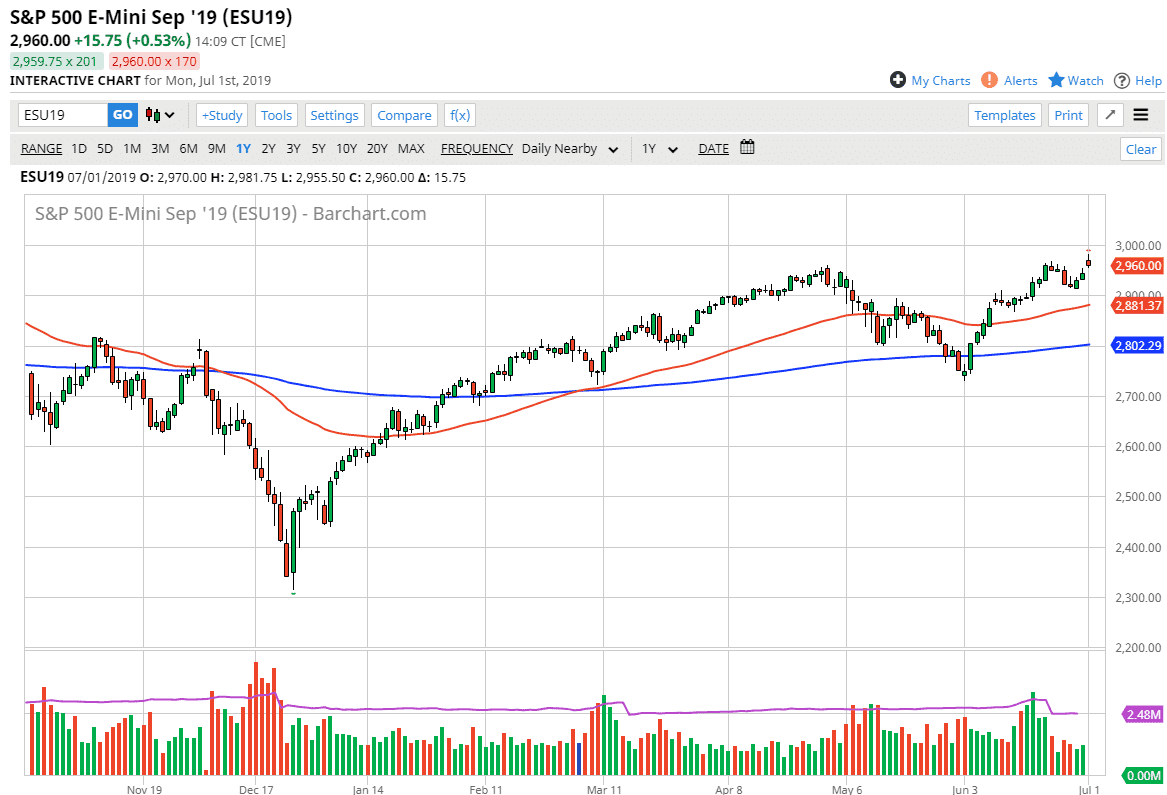

Above we see the 3000 level as a major psychological barrier that will more than likely be tested. I see the 2900 level as massive support that extends down to 2880, which should keep the market somewhat afloat. If we were to break down below that level I would be very concerned about the S&P 500 but we have recently made a “fresh new highs”, so that suggests that we are going to go higher and eventually tested that round figure. If we can get above there is a completely different question, but right now the odds are probably better than even it happens eventually. Short-term pullbacks should be thought of as potential buying opportunities in a market that has been extraordinarily bullish.