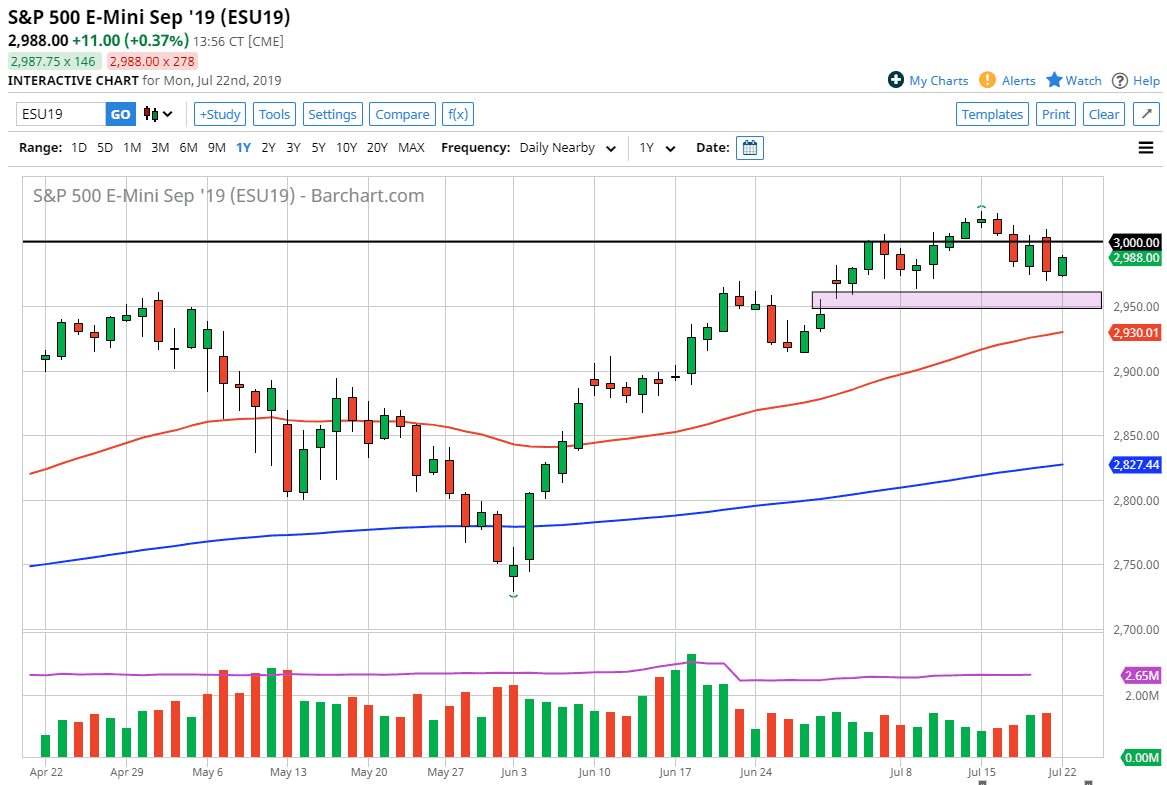

The S&P 500 has rallied a bit during the trading session on Monday, reaching towards the 3000 level above. That is a large, round, psychologically significant figure, and that of course will attract a lot of attention. If we can clear that level, and perhaps more importantly clear the all-time highs that were made recently, then we could go much higher. However, not all things are at that clear-cut.

Earnings season and the Federal Reserve

The earnings season is in full force, and that of course will move individual stocks. Given enough time that should affect the S&P 500 as well, but let’s be honest here: traders don’t care about profitability, they care about cheap money. Cheap money fuels stock buybacks by corporations, which has been a major driver of the S&P 500 for some time.

The Federal Reserve cutting interest rates of course does levitate the stock market, as money has to go looking for return somewhere. Fund managers can’t make that money through coupons in the bond market, as we have the Federal Reserve crushing yield. Looking at this chart, the market looks likely to continue to grind higher, but there is going to be a key phrase here: “grind.”

Technical analysis

The technical analysis in this market is relatively bullish, as the gap underneath is highlighted on the chart at the 2950 handle. As long as we can stay above there I think it’s likely that this market will continue to break to the upside. However, the 3000 level course attracts a lot of attention and is relatively bearish. If we can break above there, and perhaps even the all-time high, then I think the market has a real opportunity to go higher.

Underneath the gap, the 50 day EMA underneath could cause support as well. As long as we can stay above that level it’s very likely that we could continue to grind to the upside. If we break above the 3010 level, then we could be looking at a move towards 3050 above. I do believe that eventually the S&P 500 will break to the upside, because quite frankly the momentum is in favor of the buyers, and of course we have plenty of liquidity being added to the system to push this market to the upside.

Trading the S&P 500 E-mini contract

As far as I’m concerned, you should be buying dips in this market but also be very selective about that. As long as we can stay above the 2950 handle, I think there are plenty of opportunities to go long in this market and it simply comes down to your timeframe. The candle stick on the Monday session of course is a good sign, but it isn’t the be-all and end-all of buy signals. Expect a lot of choppiness and volatility on short-term charts but keep an eye on these major levels that I have mentioned in this article. I have no interest in shorting this market, at least not anytime soon.