The S&P 500 pulled back significantly during the trading session on Friday, as we have seen a very strong jobs number coming out. This of course had people start to worry about whether or not the Federal Reserve would still cut rates, which is the one thing that seems to be propping the markets up. Later on during the day, we had Jerome Powell come out and discuss how they were still going to do what the markets need.

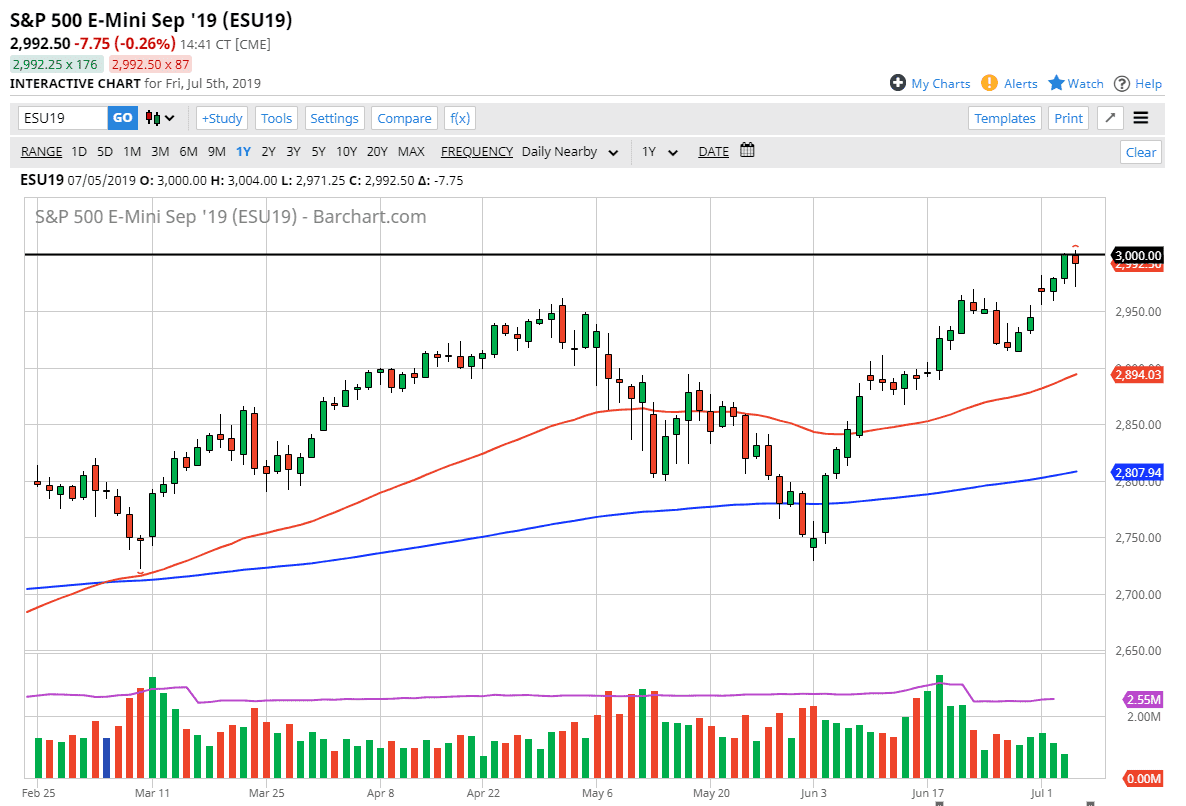

At this point, it looks as if we are going to form a bit of a hammer, which looks like a market that’s trying desperately to break through the 3000 level. Once we get a daily close above there, the market should continue to go much higher and I do think that it’s more or less only a matter of time before it happens. I like buying dips going forward, as the 2950 level should be massive support. At this point, value comes into play and people continue to go into the market looking to boost returns.

Ultimately, the Federal Reserve is going to cut interest rates and that makes bonds less interesting. That forces money into the stock market and we continue to go towards the 3100 level. If we were to break down below the 2950 level, then it’s likely that we could go looking towards the 2900 level which is currently supported by the 50 day EMA. I doubt that happens, but keep in mind it’s a possibility. This market certainly seems to have a lot of rocket fuel underneath it, and we have been in a massive uptrend since June. It’s very likely that although the trajectory will slow down, we will continue to rally because there’s nothing else to do.

Think of it this way: How many times have you heard that the market was getting ready to roll over and collapse? Yes, that is exactly what I’m talking about here, the fact that this market simply refuses to die. Yes, someday it will collapse but it’s not going to be today or anytime soon from everything I see. As long as we are above the 50 day EMA you simply have to hold your nose and continue to go long. This market continues to be one that simply waiting for opportunities is the best way to deal with this market, and patience will be a major influence as to whether or not you are profitable. Look for value.