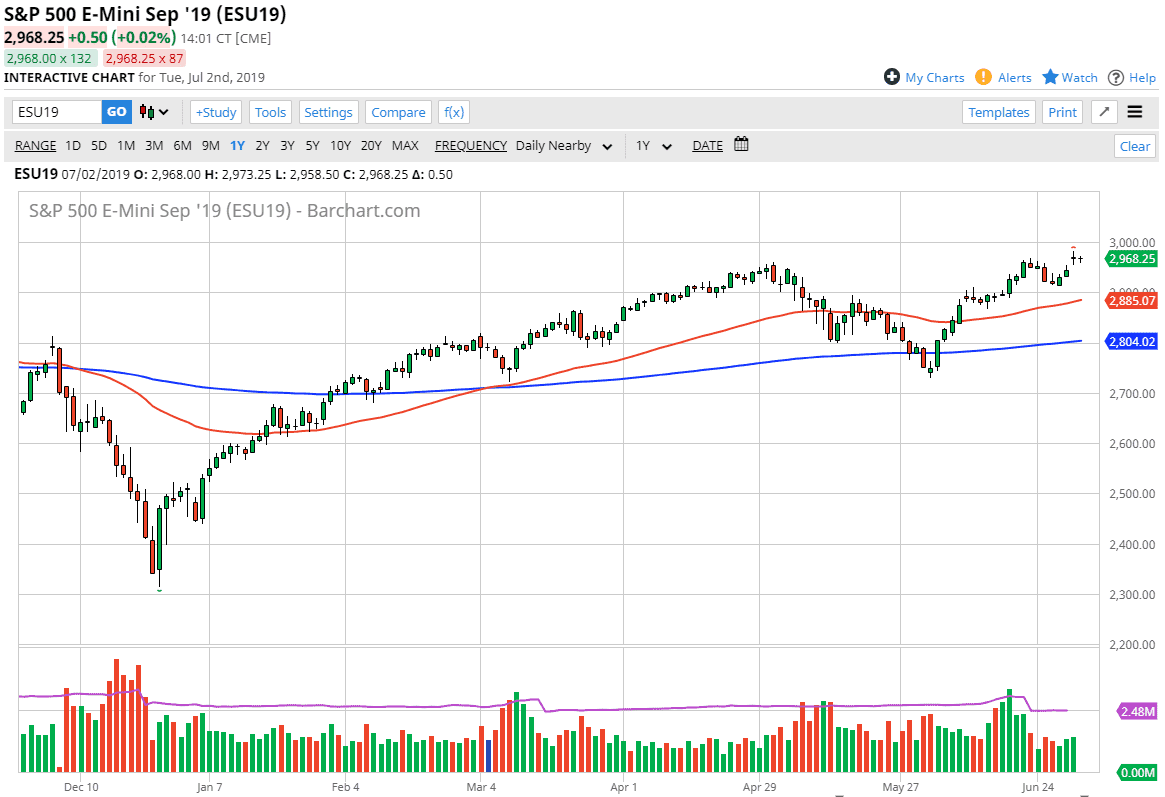

The S&P 500 went back and forth during the trading session on Tuesday, as we continue to try to figure out where we're going next. At this point, we still have a gap underneath that should offer plenty of support, so pullback should be buying opportunities. Just above, we also have the 3000 level which should be massive resistance, as it is a large, round, psychologically significant figure.

The neutral candle stick of course is something to pay attention to as well, as it shows the market doesn’t know where to go next. That makes sense, because the Wednesday session of course is going to be shortened in the cash markets, and of course we have the July 4 holiday on Thursday going forward. Beyond that, we also have the Friday jobs number coming, and that of course will move the markets as well. At this point, we are trading on whatever’s going on with the Federal Reserve and perceived interest rate hikes or cuts. Obviously, the market likes the idea of the Federal Reserve cutting interest rates in the future, and in fact some people would even guesstimate that they have priced into cuts.

Overall, this is a market that seems to be well supported underneath, not only buy the gap underneath, but also the 2900 level that extends down to the 2880 handle. I like the idea of buying dips, because I do think that we will eventually go looking towards the 3000 handle. If we can break above there, then the market could enter more of a “melt up phase”, but we need some type of catalyst going forward.

If we were to break down below the 2880 handle, that wipes out the uptrend as far as I can see, but right now I suspect that it’s going to be very difficult to do that, and although things are a bit difficult right now it’s obvious that were in and uptrend and that hasn’t changed regardless of how erratic the markets have been over the last 48 hours. Even though we aren't going anywhere in the short term, longer-term we still remain very bullish as far as sentiment is concerned, and taking a bit of a breather ahead of the holiday and the jobs number isn't a huge surprise so with that in the back of our minds we like the idea of buying short-term pullbacks.