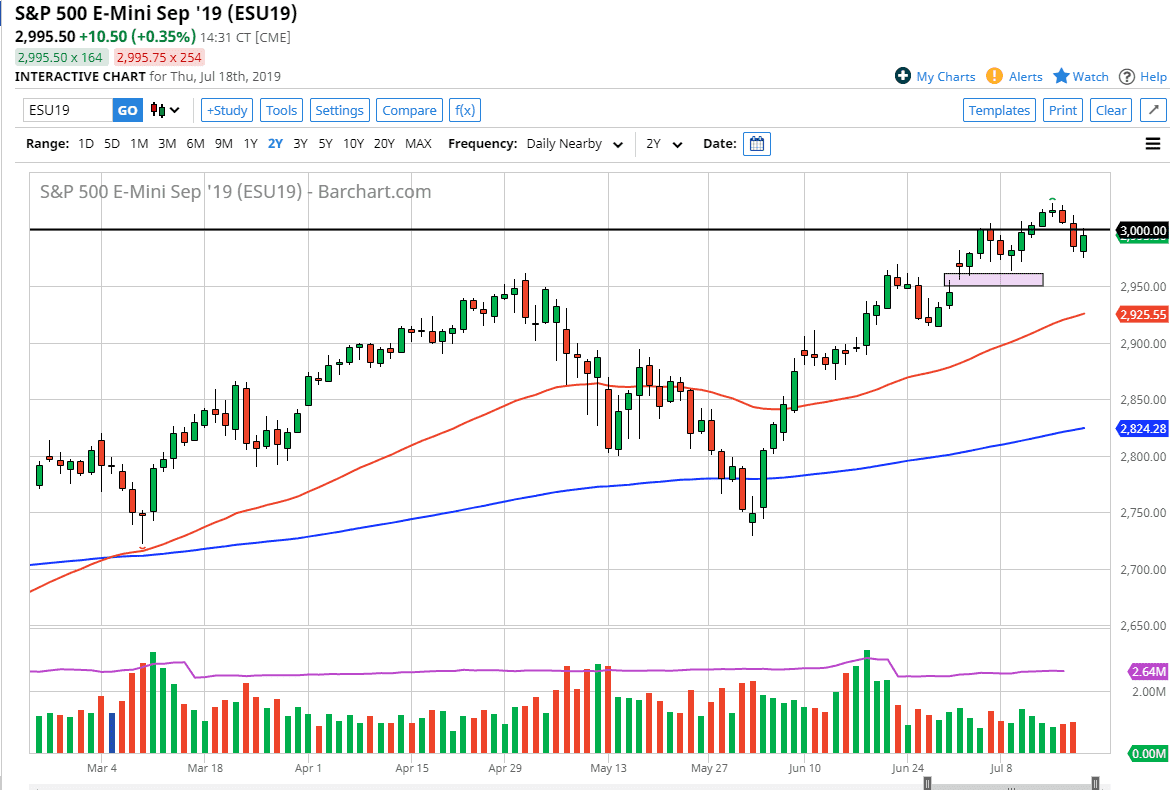

The S&P 500 had an adventurous day, initially pulling back during the trading session on Thursday, showing signs of exhaustion. At this point, it’s very likely that the volatility should continue, but the 3000 level of course will offer a little bit of short-term exhaustion. I think at this point in time, the market shows it’s upward proclivity, of course this was helped by the Iranian suggesting that they were more than willing to negotiate further on the nuclear talks. At this point in time it looks like we will eventually break above 3000 based upon this impulsive search, and at this point all we probably need are some good earnings reports.

Remember, we are in the middle of earnings season so it does suggest that we are going to go higher eventually. The 3020 level has offered a bit of resistance, but if we can break above there is very likely that we could go to the 3050 handle. Short-term pullbacks should continue to offer plenty of buying opportunities as we have a significant amount of support underneath. The 2950 level has been a major support level previously, as there is a massive gap. That of course should offer plenty of support and therefore a buying opportunity. The 50 day EMA underneath should continue to offer support as well, ultimately this is a market that does respect technicals, so I think one of those two areas will probably suffice.

You can expect volatility, but that wouldn’t be anything new, would it? Ultimately, I do think that we reached towards fresh, new highs, but this is a market that is hanging on every headline, and newsflash. The Iranian situation, which of course has absolutely nothing to do with earnings of companies in the S&P 500 was the catalyst during the trading session on Thursday. That being said, we don’t know what the next catalyst for either direction is. We live in a world where algorithms trade these indices, and they simply read headlines and place trades accordingly. This is why sometimes you see sudden moves that make no sense, and then reversals. This is because they are reading headlines but don’t have the ability to discern whether or not we are hearing good or bad news sometimes. With this, the market remains fragile and erratic, but the longer-term trend is most certainly to the upside, so that’s how I prefer to trade this market.