The S&P 500 is ready to rocket higher after the Federal Reserve has its interest rate announcement. Not only are they expected to cut rates, but I think at this point they will do whatever it is Wall Street wants them to do as we have seen for over a decade. They will cut rates, and beyond that they will probably look for any reason they can to suggest dovish and this going forward. I think at this point it’s very likely that we will see pullbacks in the run-up, but eventually we will see more buyers step in.

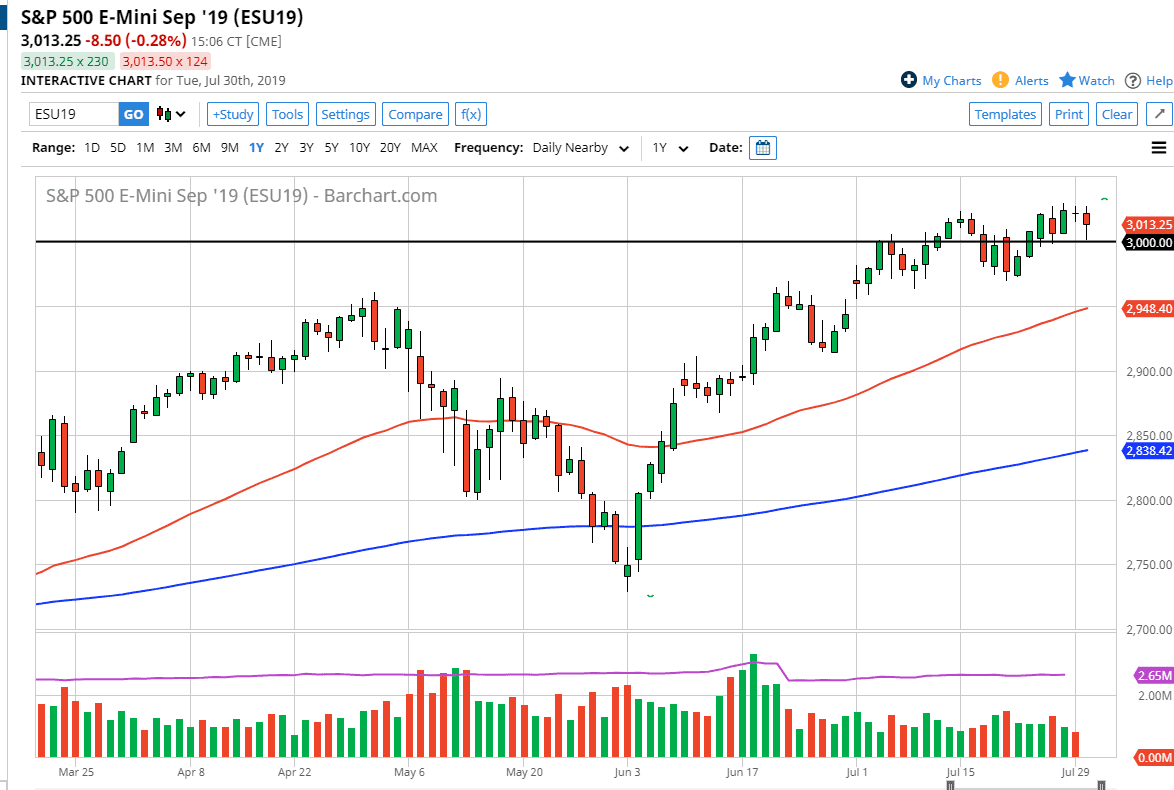

I believe that the 3000 level should offer plenty of support, as it is a large, round, psychologically significant figure and it did of course do the same thing during the trading session on Tuesday. By showing that support, it looks as if the market is ready to finally make its move to the upside. As soon as he gets the “sugar” that is looking for, market participants will continue to push towards the 3050 handle. Pullbacks are value, and I can’t imagine a scenario where the Federal Reserve will step out of line and send this market lower.

That being said, if we do see some type of shock to the system we need to start looking for support underneath. That support will be found at the gap sitting at roughly 2950, which now has the added protection of the 50 day EMA which of course offers quite a bit of psychological and technical support as well. We are certainly in an uptrend, and that should continue to be the case going forward. I believe that the market is one that is simply waiting to see if the Federal Reserve will cover its back, and if it does it’s very likely that we then see massive bullish pressure in a surge higher. This could be the beginning of the next leg to the upside, perhaps giving us an opportunity for a little bit more in the way of momentum. We are getting close to the end of summer, and traitors will need something to sink their teeth into.

All of that being said, if the Federal Reserve does not cut interest rates and shocks the market, a break down below the 50 day EMA could unwind this market quite rapidly. There are a lot of concerns out there, but cheap money wins out, we have seen that more than once.