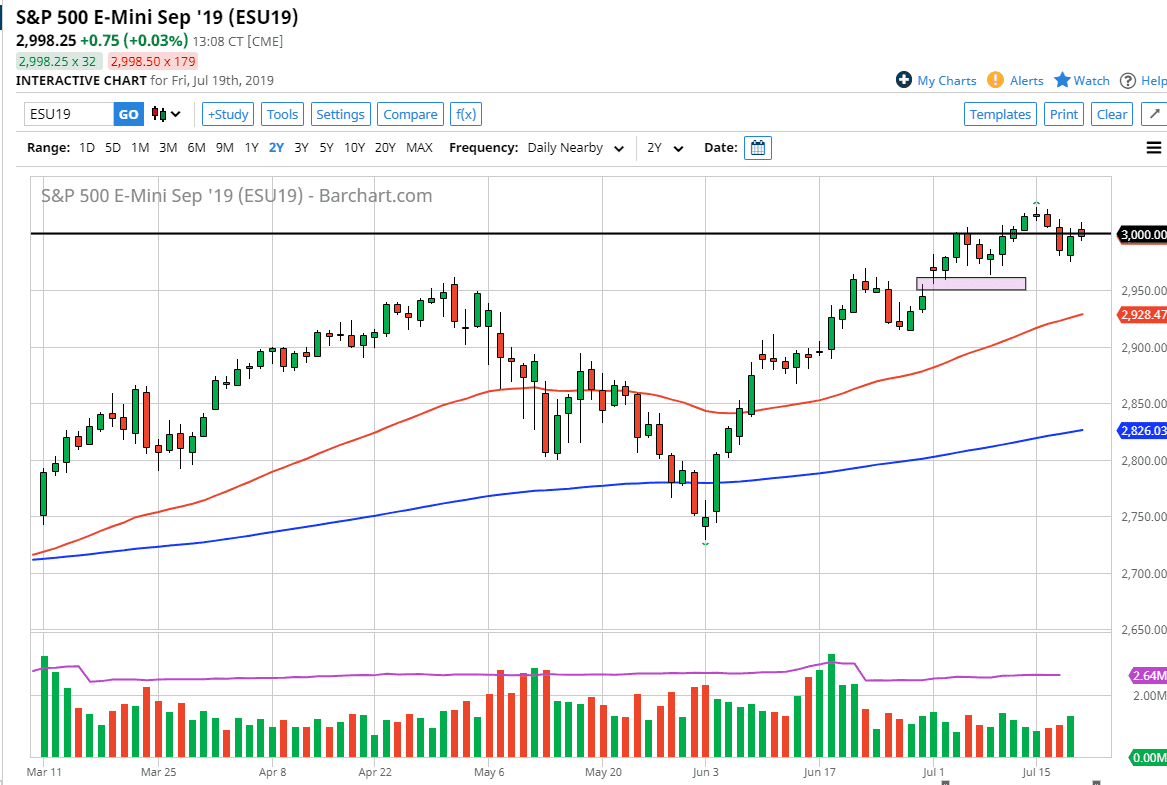

Looking at the stock market, you can see that we did try to rally a bit during the trading session on the S&P 500 for Friday, but then gave back the gains. By doing so, it shows that we still aren’t quite convinced as the way to go next. Ultimately, this is a market that continues to go back and forth around a large round figure in the form of 3000, and I don’t think that’s going to change in the short term. This is a market that is very bullish, mainly due to the Federal Reserve looking to cut interest rates. After all, as long as we have liquidity in the system, traders will be looking to take advantage of the S&P 500.

Looking at the chart, I also see a major gap underneath at the 2950 handle, and that is an area where I think the buyers could be found. As long as we stay above that area I remain rather bullish, and I do think that we probably will. Any short-term pullback will probably be buying opportunities and therefore I think we continue to bounce around in this area. Beyond that, we have the 50 day EMA underneath, and that should also offer support as well.

The stock markets of course are very sensitive to liquidity measures, and it does seem that’s all they are focusing right now. Granted, we have earnings season going on right now, but I don’t think earnings truly are what the market cares about these days. For the last 12 years or so, it’s all been about easy money. I don’t see that changing anytime soon, so I do think that value hunters will continue to come back into this market every time they get an opportunity to.

If we did break down, I believe that the 2900 level would be your “line in the sand” as far as the uptrend is concerned. Overall though, this is a market that shows quite a bit of noise, but that makes sense when you think about all of the geopolitical situations that we have going on right now. If we can ever get some type of negotiated settlement between the Americans and the Chinese, this could truly send this market straight to the moon as it’s one of the few things beyond the Federal Reserve that the market seems to care about.