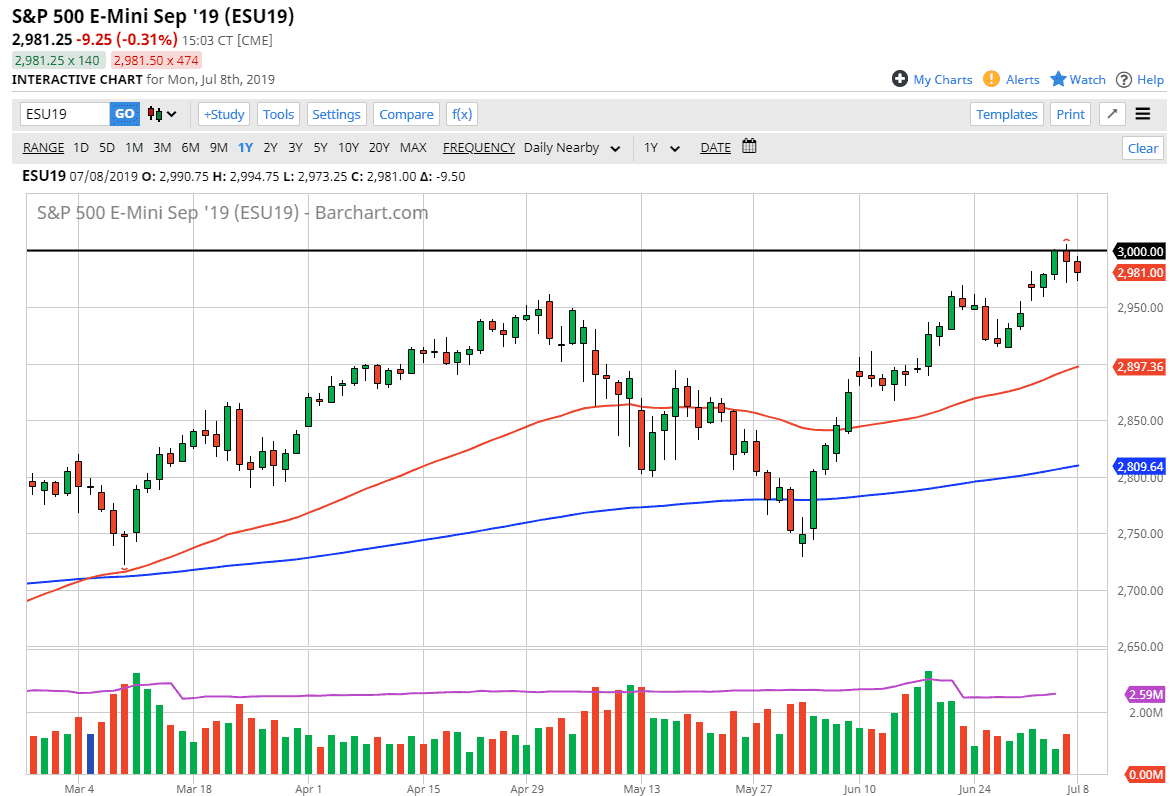

The stock market pulled back a bit to begin the week on Monday, and that of course includes the S&P 500 index. Looking at this candlestick, it shows that we are going to reach down towards the 2975 handle, and perhaps even the 2950 level after that. Ultimately, this gap at 2950 should be a bit of a “floor” at least in the short term.

The 3000 level of course did cause a bit of profit taking, which is usual market behavior considering that the number is an “even thousand” figure. With that being the case it’s likely that we will see some type of sluggish behavior, but eventually I do believe that we break above the 3000 handle. When we do, that should open up the floodgates of more trade orders, and at this point it’s only a matter of time.

Looking at the charts, it’s easy to see that we been in an uptrend, and we have of course made a “higher high” from a longer-term standpoint, it would Jerome Powell speaking in front of Congress in the next few days, that could be the fuel to send this market higher. I believe that once we close above the 3000 level on a daily chart, this market is probably going to raise at least another 50 points, possibly 100 without too many issues.

While many analysts argue about earnings and the like, the reality is the only thing the investment banks care about is interest rates in central banks, and whether or not they are rising or falling. The stock market has been divorced from the economy for at least 12 years, so at this point you are better off paying attention to what Jerome Powell says more than anything else. Earnings don’t matter, neither does GDP at the end of the day. In fact, we are in a situation where bad news is good news, and therefore we don’t like the idea of selling even if the negativity comes back into the news flow.

All things being equal I do think that we break out but you will probably be able to slowly nibble at a position, building it up as it works in your favor. I think the 2950 level is probably the optimal entry point if we get that opportunity. If not, that a daily close above 3000 works as well.