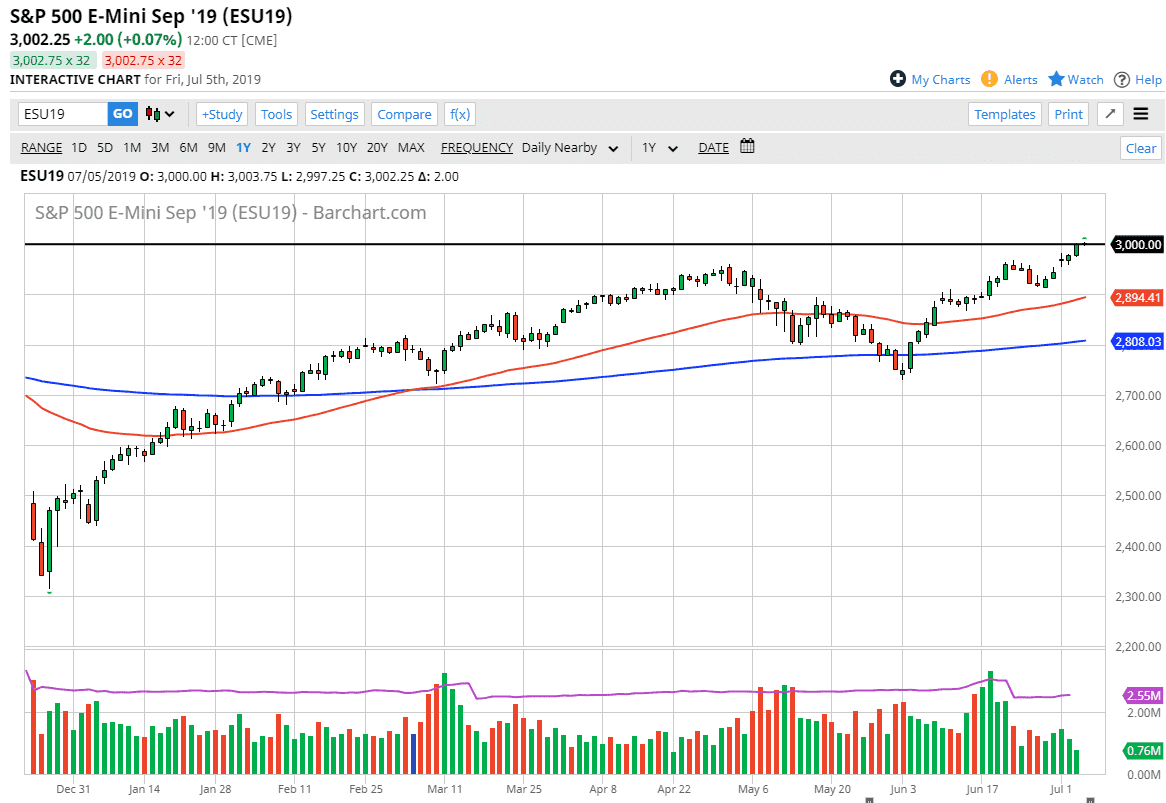

The S&P 500 of course was closed during the trading session on Thursday but the electronic E-mini contract has been trading. Looking at the chart you can see that we are currently hanging around the 3000 handle, and therefore I think that the market is setting up for a huge move higher. However, we have a couple of things to consider, not the least of which would be the Nonfarm Payroll figures coming out on Friday.

Looking at this chart, I see a lot of support underneath, especially near the 2900 level. I think that extends down to the 2880 handle, which I considered to be a floor in the market. Underneath we have the 50 day EMA which is pictured in red. That should continue to support this market and I do believe that longer-term traders will continue to look at this as a signal to hold on to this market. Selling is all but impossible as the S&P 500 has been in a bullish run and is at all-time highs.

The 3000 level course attracts a lot of attention so it’s possible that we pull back from here, and we may have people a bit concerned about holding onto the contract ahead of the jobs figure. That being said though, there are couple of thoughts that could go into the jobs announcement, which we can explore here.

The first possibility is that the jobs number is rather soft, making the likelihood of an interest rate cut even higher out of the Federal Reserve, which of course will drive money into stocks as interest rates go lower. There’s no money in bonds at this point, at least not much in the way of return, so stocks get a boost. All things being equal, this is a market that should continue to go higher, the question is whether or not we pull back in the process.

The second possibility is that the jobs number is stronger than anticipated, which could drive the stock market down a bit initially, but there is enough physical support underneath to keep this market higher. Beyond that, people will start to think about how the Federal Reserve is likely to cut rates anyway, as there has been a 100% possibility of an interest rate cut priced into the market already. The Federal Reserve does what Wall Street wants, it has proven that to be the case more than once in the past, and this won't be any different.