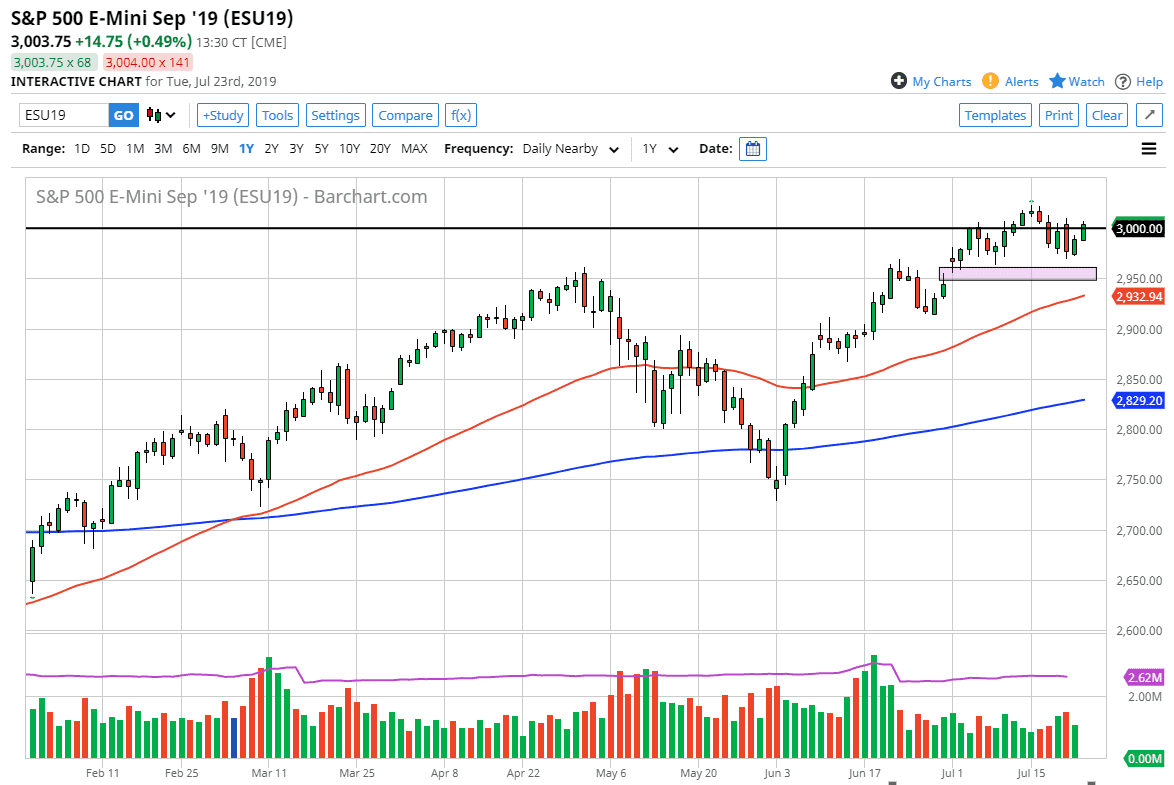

The S&P 500 rallied again during the trading session on Tuesday reaching towards the psychologically and structurally important 3000 handle. That’s an area that of course will attract a lot of attention as it is a century figure, but ultimately I think that what we are looking at is a scenario where we will eventually break out. Once we have that happen, this market can continue to go much higher, but I think there is a significant amount of resistance extending to at least the 3010 level. If we can break above there, then the market is very likely to continue to go much higher as it would be the last vestiges of resistance, at least in the short term.

Just below current trading conditions, there is a massive gap at the 2950 level that should continue to keep the market somewhat afloat. As long as we can stay above there I think the market is in a relatively good shape, and it should continue to attract momentum and more importantly money. The 50 day EMA is reaching towards that level so I think we are probably going to see enough interest in this market down at that level to be back any type of attempt to break the trend.

Keep in mind that it is earnings season and that can cause some volatility but at the end of the day nobody really cares about earnings, they care about the Federal Reserve and whether or not they cut interest rates. It appears that we are trying to form some type of basing pattern in order to build up momentum to the upside, which of course would be a simple continuation of what we have been seen for some time. If we did break down below the 50 day EMA, then that of course is a completely different scenario where we could go looking towards the 2900 level, but I don’t think that’s very likely.

All things being equal, we will continue to pay attention to whether or not the Federal Reserve is going to not only cut interest rates but perhaps go on another course of monetary easing, because if they do that should be good for stocks, at least in the short term. For 12 years stock market trading has been all about Federal Reserve monetary policy, and nothing to do with the underlying companies. I don’t see that changing in the next few days.